ICICI Bank Ltd.'s shareholder wealth has eroded by nearly 12 percent, or Rs 27,000 crore, since the middle of March. The reason: allegations of nepotism surrounding loans worth over Rs 3,250 crore given to the Videocon Group in 2012, which have since been classified as a non-performing asset.

The allegations stem from a whistleblower blog that questions investments made by Videocon Group Founder Venugopal Dhoot in NuPower Renewables Pvt., a company founded by Deepak Kochhar, the husband of ICICI Bank's Managing Director and Chief Executive Officer Chanda Kochhar.

While the bank's board and Chairman MK Sharma last week denied the allegations vigorously, the ICICI Bank stock has lost over 12 percent since the controversy first grabbed headlines.

Dhoot also denied all allegations of impropriety in the loans received by his company. There was no quid pro quo from ICICI Bank to Videocon, he said to newswire agency PTI. NuPower and Deepak Kochhar have made no comment so far but are being investigated by the Central Bureau of Investigation and are also under scrutiny of the Income Tax Department.

What is NuPower?

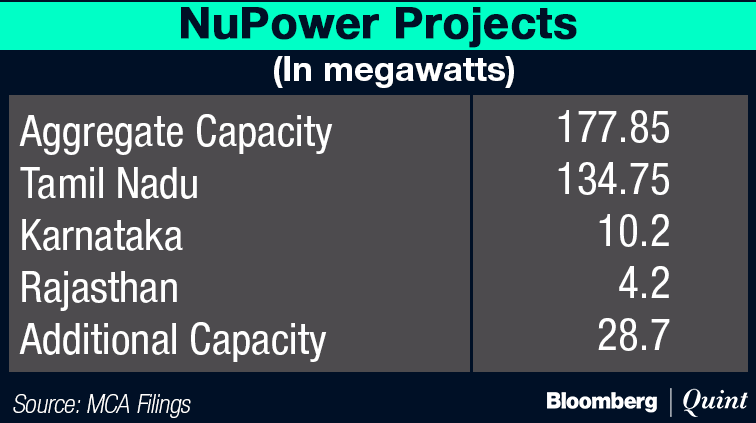

Incorporated on Dec. 24, 2008, the renewable energy company has nearly 700 megawatt in wind power generation capacity, current and under production, across six states, as per its website. But, according to data available from its filings with the Registrar of Companies and documents available on the Ministry of Corporate Affairs website, it has just under 180 MW of power projects.

Deepak Kochhar served as the first director on the board of the company. He was then appointed managing director for five years starting April 1, 2012, but resigned on April 1, 2016, and continued as a director on the board, according to the filings.

Along with Kochhar, Dhoot and Saurabh Dhoot were also appointed among the first directors of the company but resigned on Jan. 15, 2009. In their place, Karunchandra Adityaprasad Srivastava and Mahesh Chandra Punglia were appointed as directors on the board, as per filings.

Capital History

The company was incorporated with Rs 5 lakh as capital, according to its filings.

- In early January 2009, it issued 19.97 lakh warrants which were converted into equity shares in March 2012.

- The company issued cumulative convertible preference shares six times starting Dec. 31, 2010—these 39.77 lakh CCPS were converted into 32.45 lakh shares on Jan. 18, 2017.

- In March 2016, it also converted 71 lakh fully convertible debentures worth Rs 71 crore into 6.08 lakh equity shares in favour of Deepak Kochhar and Supreme Energy, a promoter entity that holds stake in NuPower. The filings don't provide clarity on when these FCDs were originally issued.

Operations

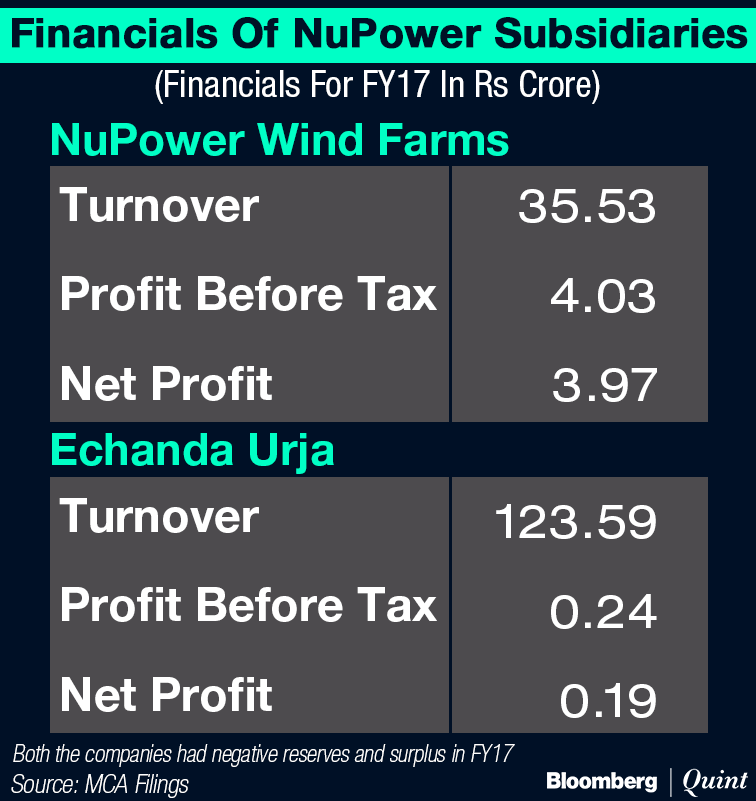

NuPower operates via two main subsidiaries — Echanda Urja Private Ltd. and NuPower Wind Farms Ltd. — with a current cumulative operational capacity of 176 MW across Tamil Nadu, Karnataka, Rajasthan, Maharashtra, Andhra Pradesh and Madhya Pradesh. It owns 70.95 percent in Echanda Urja and 73.28 percent in NuPower Wind Farms.

Financials

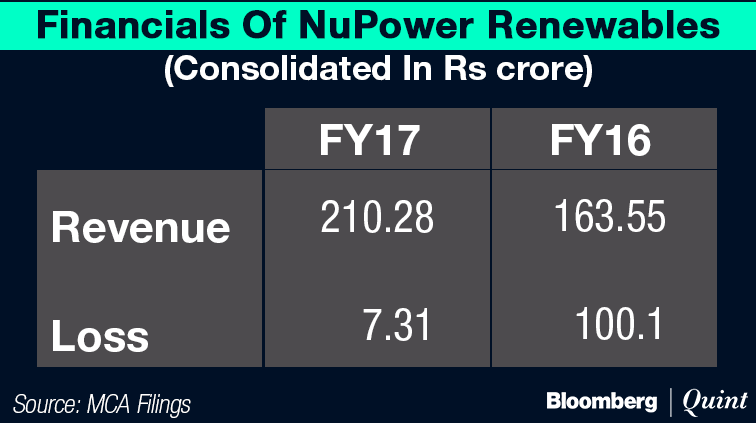

On a consolidated basis, NuPower's revenue for the last available financial year 2016-17 stood at Rs 210.28 crore. That year it recorded a loss of Rs 7.31 crore, a substantial improvement on a year-on-year basis. Both its subsidiaries ended the year through March 2017 with negative reserves, as per the filings.

Debt

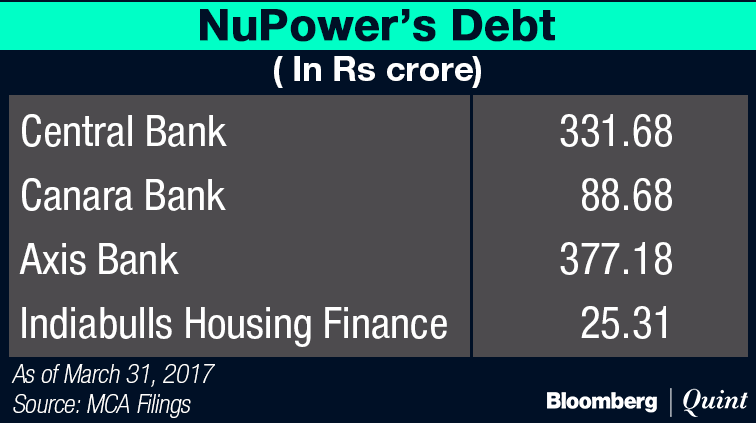

NuPower's long-term consolidated borrowings stood at Rs 822.9 crore as of March 2017, while short-term borrowings totalled Rs 15 crore. Axis Bank is its largest lender with a loan of Rs 389 crore extended to Echanda for a 100.5 MW wind power project in Tamil Nadu, as per the annual report filed with the Registrar of Companies.

On a standalone basis, the total secured and unsecured (NCDs) debt at the end of financial year ended March 2017 stood at Rs 279.5 crore, according to its filings. These funds were further invested in the subsidiaries via preference shares worth Rs 253 crore.

Valuation

NuPower's equity was valued at Rs 685.2 crore at the end of March 2017, giving the company an enterprise value of Rs 1,508 crore, according to data compiled by BloombergQuint.

A valuation report of Dec. 23, 2016 by accounting firm Price Waterhouse valued the company's shares at Rs 1,161 apiece. This was undertaken after Mauritius-based private equity player DH Renewable Holdings Ltd. opted to convert its 0.1 percent compulsorily convertible preference shares into equity shares.

DH Renewable converted two tranches of CCPS, the first at a pre-agreed price of Rs 2,000 apiece and the second at Rs 1,161 apiece in March 2017. In total, it converted 39.77 lakh CCPS into 32.45 lakh equity shares, bringing in Rs 397.71 crore and acquiring control with a 54.99 percent shareholding in the company. The private equity firm nominated Lee Chin Wee as its director on NuPower's board. Wee is also the managing director of Singapore-based investor CO2 Capital Pte Ltd.

Emailed queries to Sin Wee and Deepak Kochhar seeking confirmation remained unanswered.

The Buyback

The CCPS conversion shored up NuPower's reserves. Interestingly, barely a month after the conversion, in February 2017, the company decided on a buyback of shares to offer a partial exit to shareholders.

The board approved to repurchase 8.87 lakh shares, or about 15.03 percent of its paid-up equity, at Rs 1,161 apiece—the valuation arrived at by PW for the CCPS conversion.

The buyback cost the company 24.97 percent of its share capital and reserves. Promoters indicated they wouldn't participate and the offer would have provided an exit to DH Renewable. It is not clear whether the buyback was implemented.

Emailed queries to Deepak Kochhar seeking details of the buyback remained unanswered.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.