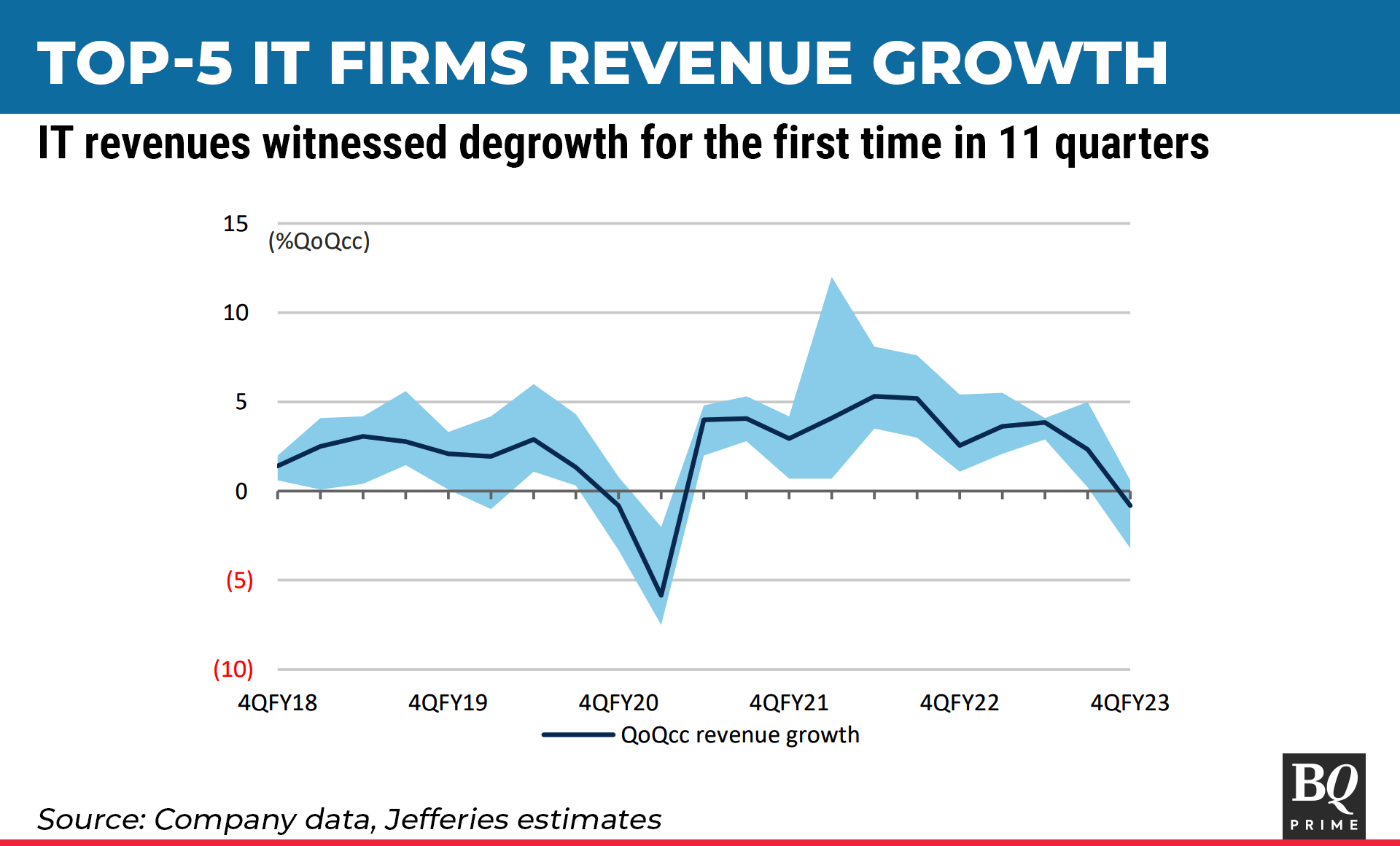

The information technology services sector in India has clocked its worst performance since the beginning of the pandemic as the spectre of a slowdown—stemming from a banking crisis in the US and the Russia-Ukraine war—roiled dealmaking in financial services to telecom and retail.

Still, a segment of the $245-billion industry was immune to the contagion.

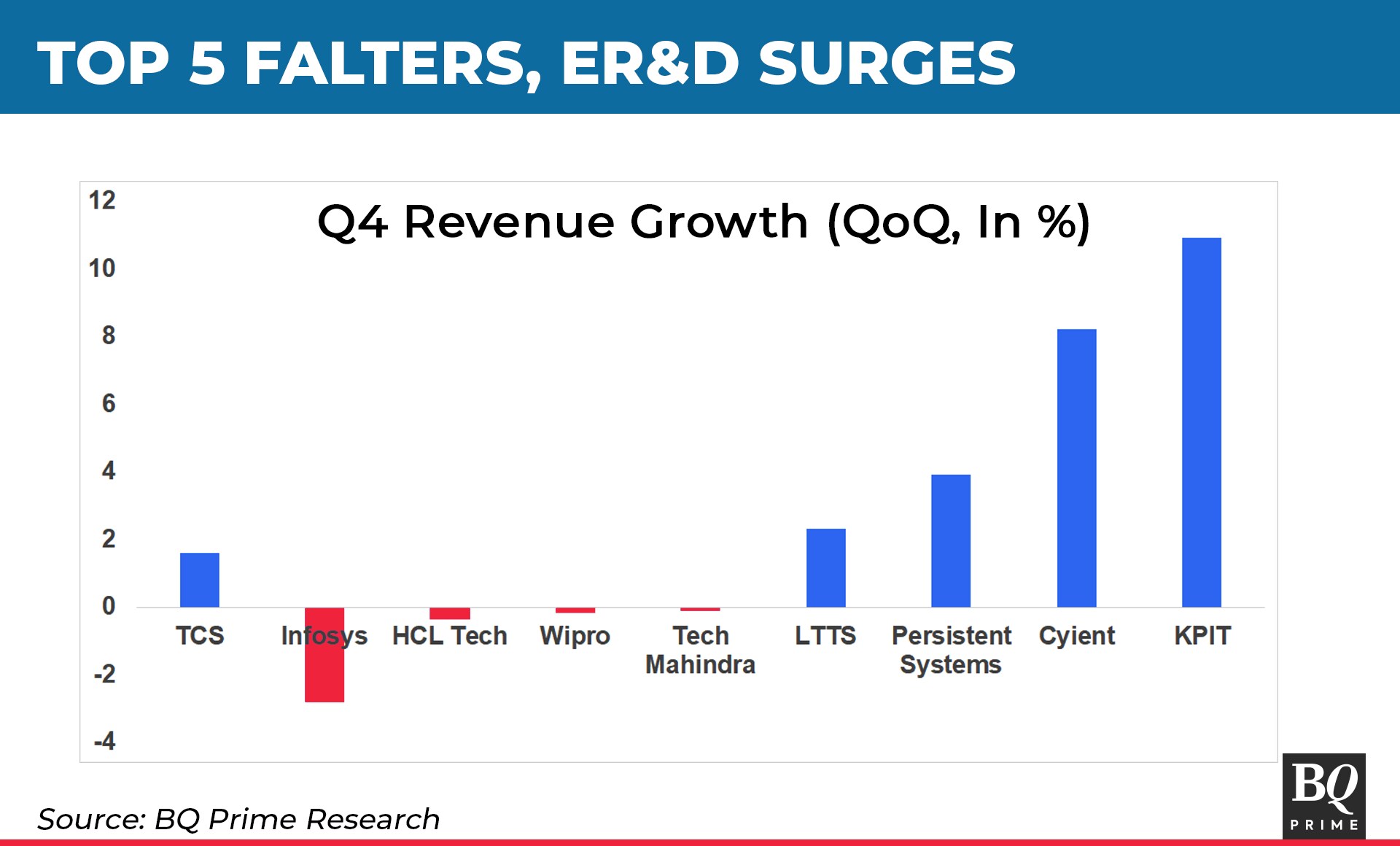

Pure-play engineering R&D companies in India—KPIT Technologies Ltd., Cyient Ltd. and L&T Technology Services Ltd.—clocked high single-digit sequential revenue growth in the January-March quarter. In comparison, India's top five IT services firms—led by bellwethers Tata Consultancy Services Ltd. and Infosys Ltd.—delivered earnings that can be best described as a disappointment and a shocker at its worst.

The divergence in performance is likely to get only starker hereon.

Trouble At Top

Brokerages as well as management commentary have indicated that the first half of the 2024 financial year is likely to be a washout. Growth is unlikely to return in a hurry, at least not until the geopolitical headwinds ease in the second half of the fiscal.

That's reflecting in the revenue guidance as well.

Infosys has forecast its revenue growth at 4–7% in constant currency terms in the fiscal ending March 31, 2024.

HCL Technologies Ltd. has pegged its growth at 6–8%, with peak growth arriving in the third quarter of the 2024 fiscal.

Wipro Ltd. expects its revenue to decline 1-3% in constant currency in the first quarter of 2023-24.

LTIMindtree is seeing "a bit of a lull" in the April-June quarter due to client freeze.

Tech Mahindra Ltd. expects a positive upswing in the second half of 2023-24 as delayed deals fructify.

Decline in aggregate revenues, led by broad-based weakness across verticals and regions in the fourth quarter, suggests that cracks are beginning to emerge.

"The demand uncertainty is unlikely to reverse in H1 FY24," Jefferies Financial Group Inc. said in a research report on May 9. "Consensus dollar revenue growth expectations of 7% in FY24 needs a sharp growth recovery in H2 FY24…which seems optimistic."

IT firms have turned cautious on the demand environment as the likelihood of a recession in the US weighed on discretionary spending. While bookings are still supported by cost takeout and efficiency deals, revenue growth is impacted by project deferrals, delayed ramp-ups and cancellations. The outsourcers are even more wary of the pricing environment.

The Flip Side

The guidance from ER&D firms couldn't be starker, both on financials and incoming demand.

Automobile-focused KPIT Technologies, which clocked a constant-currency revenue growth of 36.7% in the 2023 fiscal, expects to grow at 27–30% in the 2024 fiscal while maintaining an operational profitability of 19–20%.

Aerospace-focused Cyient, which clocked a constant-currency revenue growth of 39.1% in the 2023 fiscal, is likely to grow at 25% in the current fiscal, while improving margin by 100–200 basis points over the 13.7% clocked in 2022–23.

Digital engineering-focused L&T Technology Services Ltd., which clocked a constant-currency growth of 16% in the last fiscal, now expects to grow in excess of 20% in the current fiscal, but margin is seen easing to 17% from 18.5% in 2022–23.

The demand scenario is seen as equally robust, unlike the dim dealmaking forecast by India's leading IT firms.

"There won't be a letup in this R&D spend," Ravi Pandit, chairperson at KPIT Technologies, told BQ Prime in a post-earnings interaction. The nature of client spending (in engineering services) is different from what is seen at traditional IT firms."

Over the next 10 years, there's "ample scope for growth" as the global automobile industry is in the midst of a once-in-a-century epochal shift driven by software, according to Pandit.

Pandit said the overall auto industry is sluggish, "but to even stay where they are, they need to make these (software) investments because that's the future of the industry".

The first two quarters of the current fiscal will be stronger and the next two will be slower, but that's not to say that demand is going away, he said. "We have to look at what would be the quantum of software R&D spends by OEMs (original equipment manufacturers) and over what period it'll happen."

Industry watchers echoed Pandit's views.

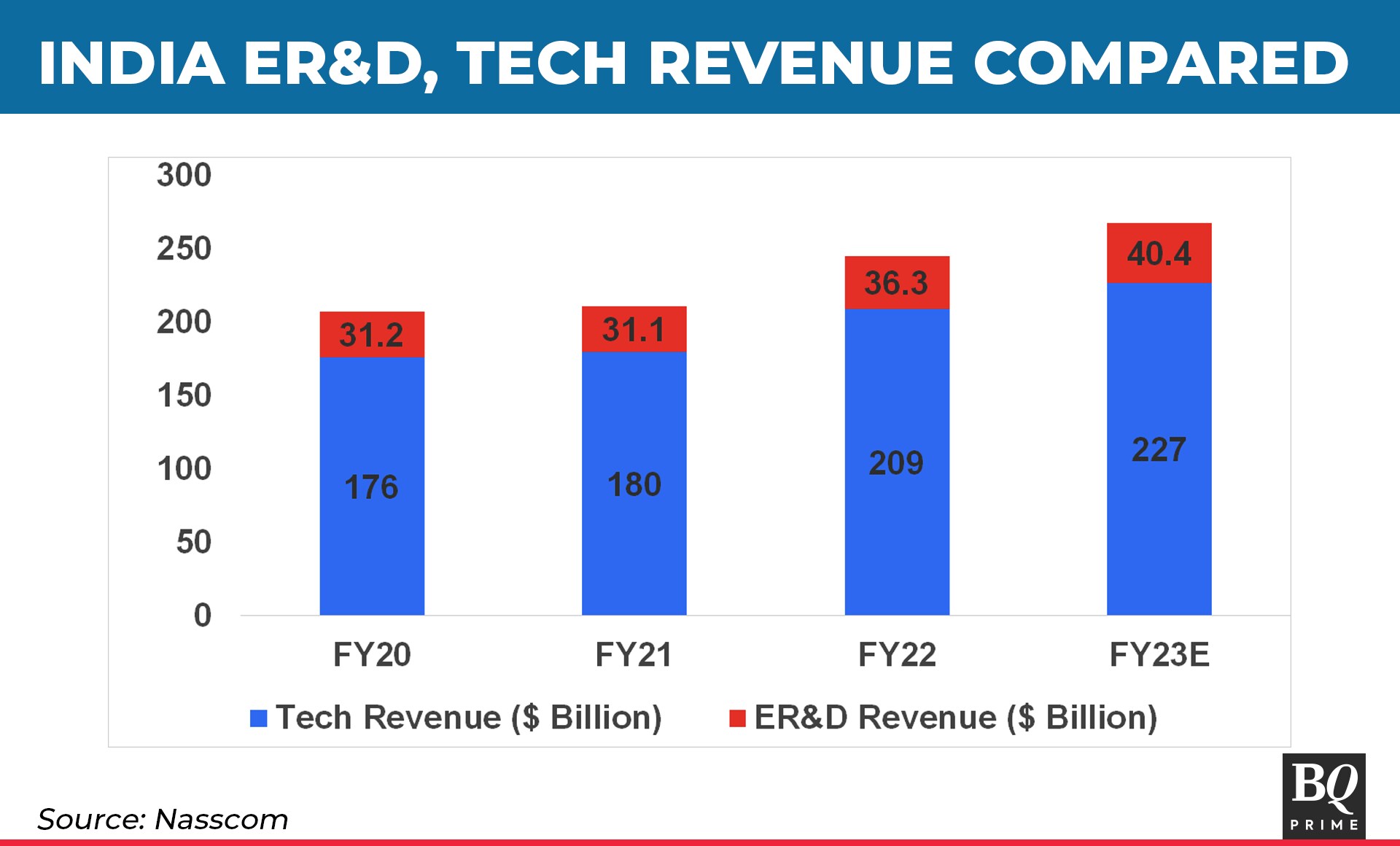

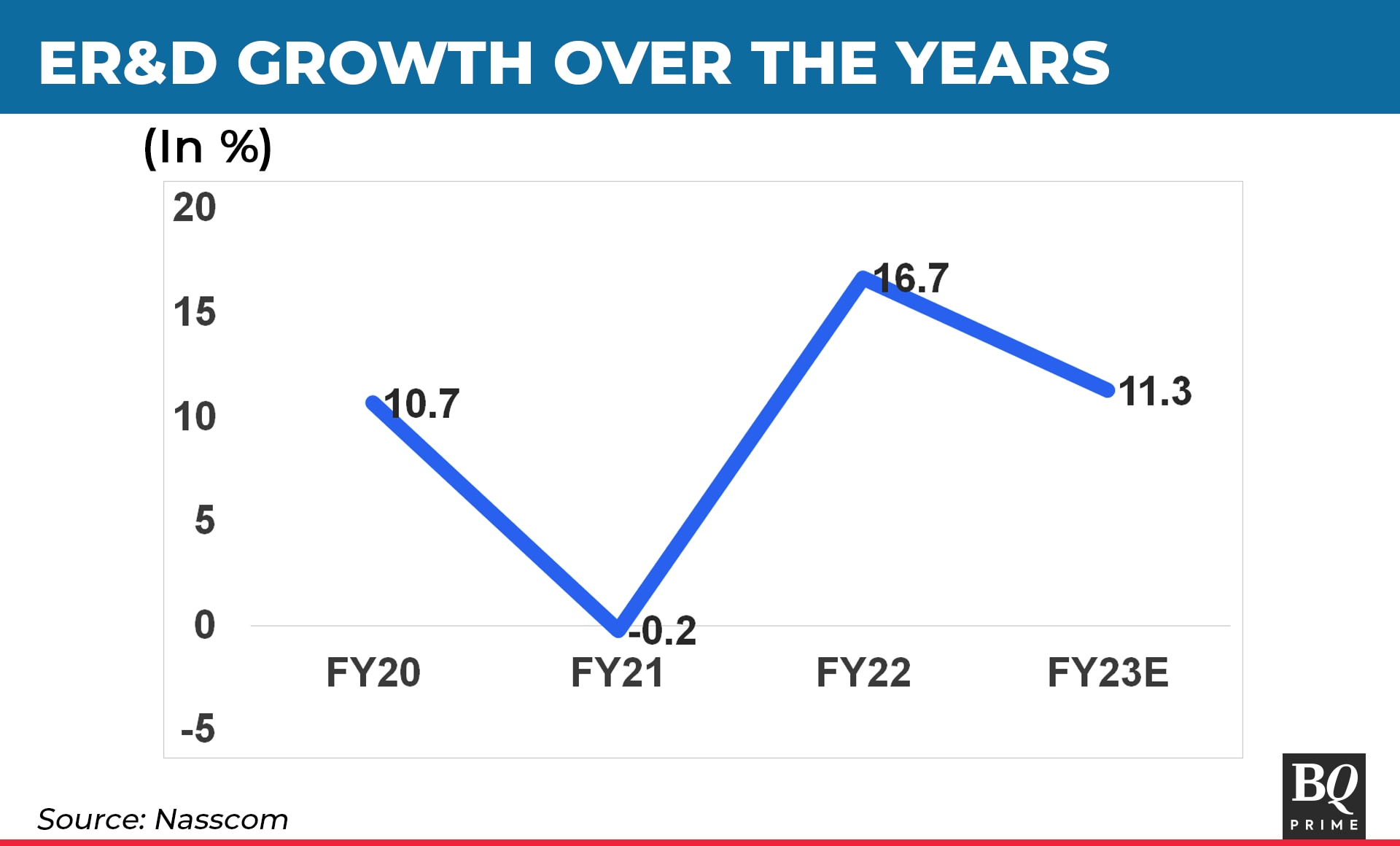

"The ER&D world has grown significantly...double-digit growth in FY23 to about $41 billion," said Anant Maheshwari, chairperson at industry body Nasscom. "That's a very good indicator that India is not being seen just as the source of the entry-level part of the value stream, but as a destination for core engineering R&D."

"We also see deal volumes going up from where they were in FY21," the Microsoft India president told BQ Prime. "That's a very good indicator that India is being recognised for higher-end tech skills."

According to a 2021 Nasscom report, India's global research and development market is expected to grow at a compounded annual growth rate of 12–13% to $63 billion by 2025. The industry, at present, is valued at $40.4 billion—about 17% of the overall industry

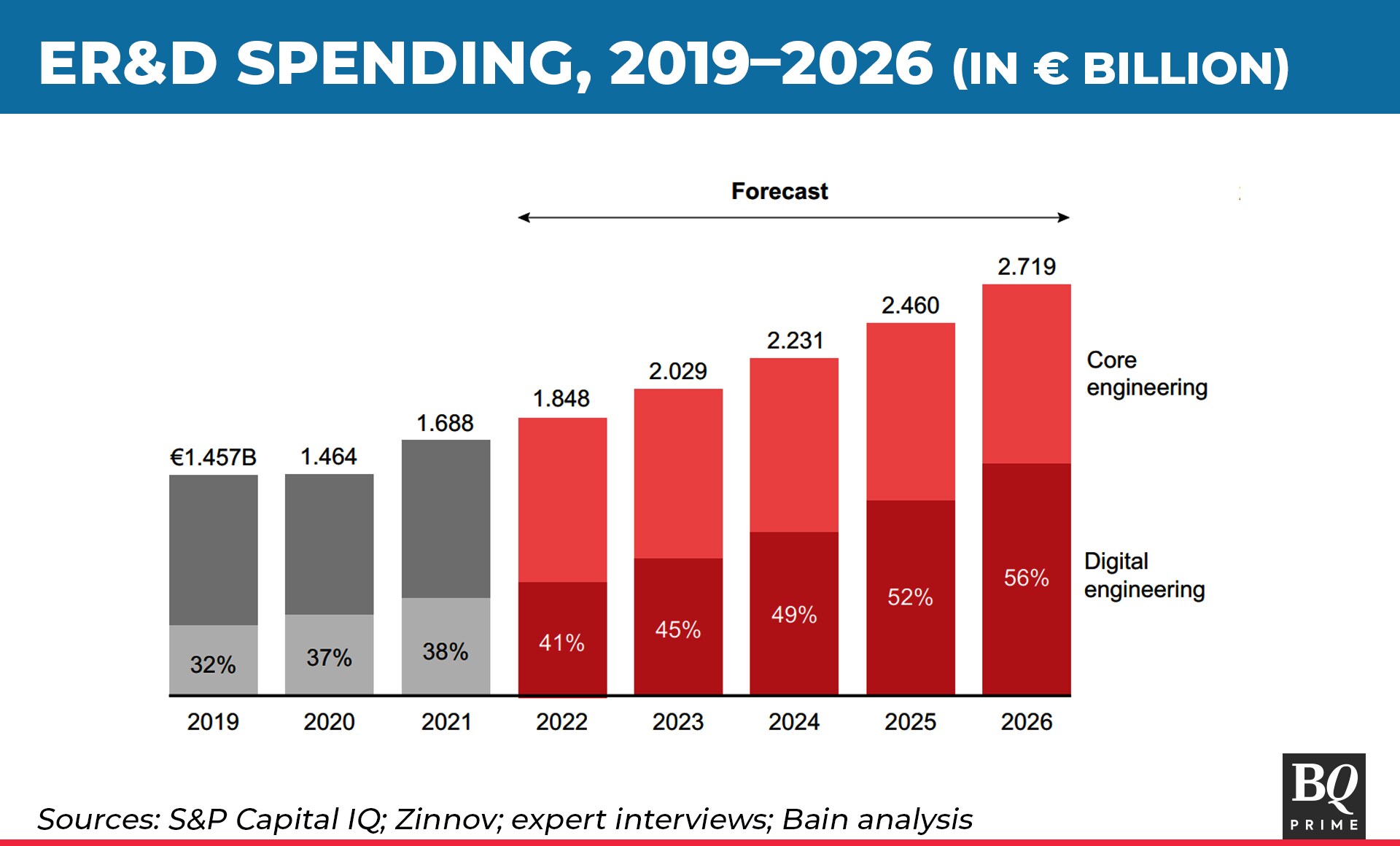

According to Bain & Co.'s Engineering and R&D Report 2023, which was released in April, global ER&D investments are set to grow at 10% CAGR over the next five years despite current uncertain economic conditions. That growth will be fuelled by investments in digital engineering.

Investing in ER&D during a recession can help companies pull ahead in the innovation race, the report said. That is evidenced in past downturns when growth in ER&D spending was more resilient than the growth in the gross domestic product.

"Companies today view ER&D as a strategic capability that will determine future success and shape new business models," Bain's Zurich-based partner, Daniel Suter, said in the report. "Investments in ER&D not only improve products, but also increasingly reinvent or disrupt parts of the business."

According to Omkar Tanksale, research analyst at Axis Securities, the ER&D space within India's IT ecosystem is underpenetrated, unlike financial services that's saturated. That also prevents industry heavyweights like TCS and Infosys, which derive more than a third of their revenues from banking, financial services and insurance clients, from delving deeper into engineering services.

The ER&D firms do not have exposure to BFSI. The US clients are delaying projects after the collapse of the Silicon Valley Bank, Tanksale said.

Traditional IT services firms are focused on digital transformation and automation, which suffer during a slowdown/recession. The ER&D firms are focused on operations, product and product optimisation, and that's tamper-proof, according to Tanksale.

Secondly, the US economy is worse off than Europe's. And all the ER&D have bigger exposure across the pond. That reduces the risks even further, Tanksale said, maintaining that he has a bullish outlook on the ER&D space for the next three to four years.

But not all are gung-ho on the sector. In fact, Kotak Securities' Sumit Pokharna said growth within the ER&D space isn't homogeneous.

"Even within engineering, growth will differ depending on sectoral exposure: for instance, strength in auto, and weakness in telecom, hi-tech and semiconductors," the vice president of the brokerage said in an email to BQ Prime. "Hence, trying to draw parallels for IT companies from engineering results is not optimal."

"We also believe most ER&D companies are trading at rich valuations," Pokharna said.

Mahantesh Sabarad, an independent market expert, concurred.

"The ER&D space is not sustainable and very project-driven," Sabarad said. "Once the project is over, they have to look for new clients."

Beyond building for electric mobility, the scope for growth is very limited in the vertical, he said.

Joker In The Pack

Against that backdrop, the ER&D incumbents have to contend with a new entrant in their club. Tata Technologies, a unit of Tata Motors Ltd., is lining up an initial public offering and vying for investor mindspace at the same time.

"We welcome the competition," Kishor Patil, chief executive officer at KPIT Technologies said during a post-earnings press conference on April 26. "This will bring in much-needed transparency."

It's worth noting here that JPMorgan sees an erosion in KPIT's "scarcity premium" after the listing of Tata Technologies and a key catalyst for derating of the stock.

Tanksale of Axis Securities sees Tata Technologies as the dark horse in the mix, saying they are already established, with Jaguar Land Rover and Tata Motors in their client mix. The group companies bring in one-third of Tata Technologies' revenue.

They have the expertise, resources and dedicated target market, as well as "trust" that comes with the Tata name, he said.

"I'd buy into the IPO if I can."

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.