RBI Lays Down New Triggers To Invoke Corrective Action In Weak Banks

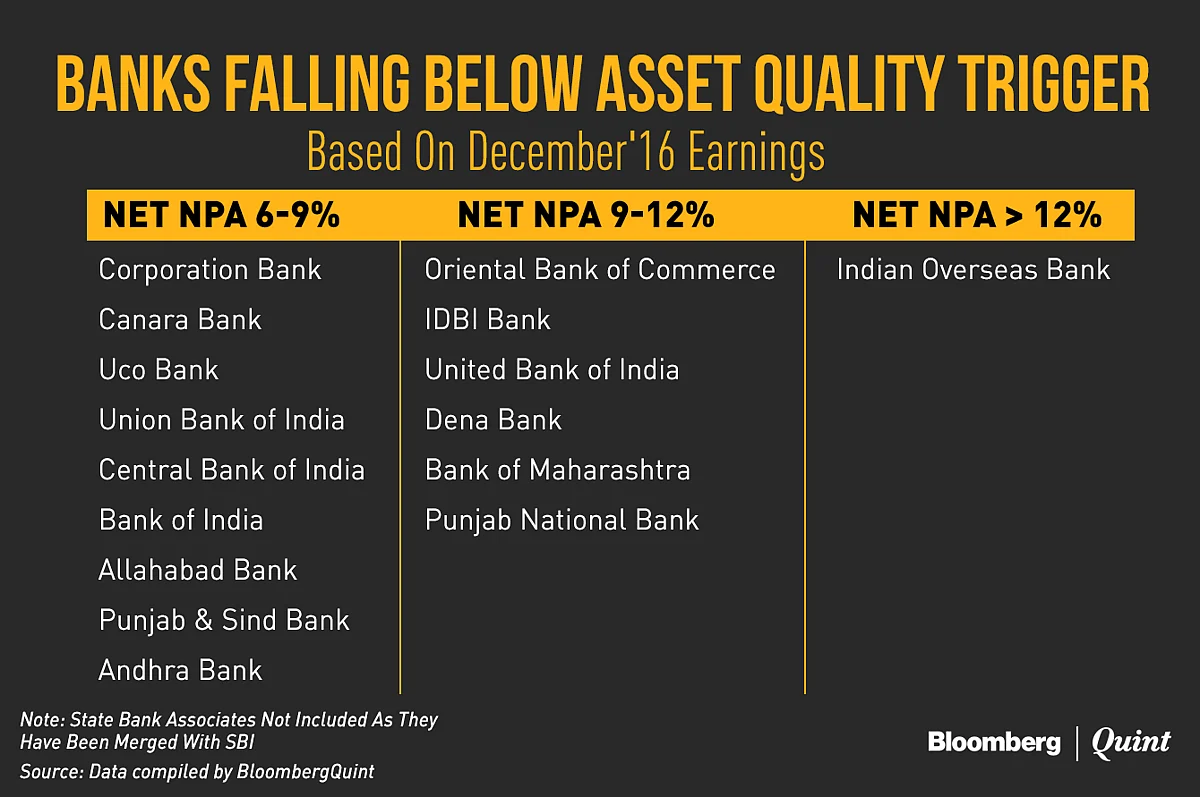

As many as 16 public sector banks may be forced to take corrective measures under the new framework.

The Reserve Bank of India (RBI) on Thursday put out a new set of triggers which will be used to invoke corrective action in weak banks starting the current fiscal year. The new benchmarks could mean that at least 16 public sector banks will be forced to take specific measures in the current fiscal to correct their performance, according to data compiled by BloombergQuint.

Apart from tracking indicators like capital, asset quality, and profitability, the RBI will also keep an eye on banks’ leverage ratios, it said in the revised rules. The thresholds at which corrective action will kick in have also been adjusted.

The revision in prompt corrective action (PCA) rules comes at a time when several banks have reported a surge in stressed assets after the RBI’s asset quality review. Banks are also strapped for capital as they need more funds to provision against bad loans. The PCA rules will provide a template using which weak banks can slowly strengthen their balancesheets and their operations.

As part of its rules, the RBI has defined three risk thresholds for each indicator and linked specific corrective measures to each threshold. The higher the risk, the tougher the corrective measures. “Breach of any risk threshold would result in invocation of PCA,” said the RBI.

.png)

Bad Loan Thresholds

Among the indicators being tracked by the RBI, the level of bad loans will be among the most crucial at this stage.

Banks with a net non-performing asset (NPA) ratio of 6-9 percent will fall under risk category 1. Under the earlier rules, a bank would come under prompt corrective action if net NPAs were over 10 percent but less than 15 percent of total assets.

The second threshold, which was earlier a net NPA ratio of 15 percent or above, has now been set at 9-12 percent. The RBI has also introduced a third threshold of a net NPA ratio of 12 percent and above.

“More than anything else, the new guidelines on prompt corrective action gives absolute clarity on which banks will be brought under strict scrutiny by the RBI. This has made it black and white,” said Abhishek Bhattacharya, head of banks and financial institutions at India Ratings.

Data compiled by BloombergQuint shows that, based on the thresholds for the net NPA ratio, as many as nine banks will fall under in first risk category; six will fall under the second category and one will move into the highest risk category. The analysis takes into account net NPAs as of the December 2016 ended quarter since March quarter earnings are yet to be released. The RBI will make its final analysis based on March data, it said in the release.

Capital Adequacy Triggers

Changes have also been made to another trigger, the capital adequacy ratio of banks. The thresholds that will result in the invocation of PCA have been updated to conform with the changing needs of meeting Basel-III regulations, said Bhattacharya.

Under the new norms, banks’ common equity Tier-1 capital will be closely monitored. The RBI has stipulated that the first risk threshold will be breached if a bank’s Tier-1 capital falls to between 5.125 and 6.75 percent. The second threshold has been set at 3.625 and 5.125 percent, while the final threshold has been set at below 3.625 percent.

“We have, for some time been talking about the requirement for bail out capital for some banks. Till now, there has been no clear level that could be looked at as a point of non-viability. With the introduction of the threshold on Tier-1 capital, the third threshold can be interpreted as this point,” said Bhattacharya.

In its release, the RBI said that if the common equity of a bank falls below 3.625 percent, it is likely to become a candidate for resolution through tools like “amalgamation, reconstruction, winding up etc.”

The thresholds on the headline capital adequacy ratio (CRAR) have also been revised under the new guidelines. The first threshold will be breached if CRAR falls to between 7.75 and 10.25 percent; the second if it falls to between 6.25 and 7.75 percent, the RBI said.

Other Risk Thresholds

Apart from asset quality and capital, the RBI will continue to monitor profitability. This will be monitored on the basis of Return on Assets (RoA). The first threshold on prompt corrective action will be triggered if a bank has a negative return on assets for two consecutive years. The next two triggers will be breached if the bank continues to underperform, first for three years in a row, and then for four consecutive years.

The last trigger, and the newest addition to the list, is leverage ratio. The leverage ratio of a bank is a measure of the degree to which it has leveraged its capital base. Under the new framework, a bank will come under prompt corrective action if its Tier-1 leverage ratio is between 3.5 to 4.0 percent, that is if its leverage is over 25 times its Tier-1 capital.

The second threshold is breached if the bank’s leverage rises to over 28.6 percent of its Tier-1 capital.

While the RBI has linked specific actions to the breach of specific triggers, it has also spelt out the discretionary actions that it can take in such a situation.

The discretionary actions range from conducting supervisory meetings, conducting reviews, altering business strategy, planning capital infusion, and restrictions on staff expansion.