Vodafone India-Idea Cellular Merger To Create India’s Largest Telecom Operator

Vodafone-Idea merged entity to be the largest telecom player in India.

Idea Cellular Ltd. agreed to merge Vodafone Plc’s Indian unit with itself to create the country’s largest mobile services operator in a competitive market disrupted by Mukesh Ambani-led Reliance Jio Infocomm Ltd.’s free services.

Vodafone will hold 45.1 percent of the merged entity, while Idea Cellular’s promoter, Kumar Mangalam Birla-led Aditya Birla Group, will hold 26 percent, according to a filing to stock exchanges.

Both Vodafone and Idea Cellular brands will continue, Vodafone Group Chief Executive Officer Vittorio Colao said in a press conference.

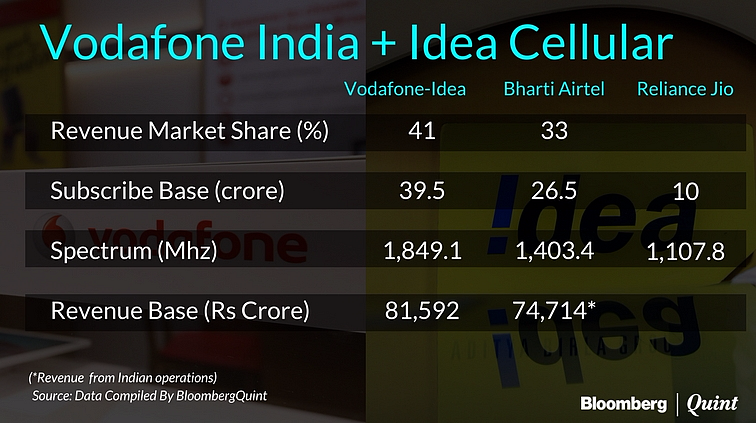

The combined entity will have a revenue market share of 41 percent, ahead of Bharti Airtel Ltd. (33 percent), and an annual revenue of over Rs 81,500 crore, according to data compiled by BloombergQuint.

The deal excludes Vodafone’s stake in Indus Towers but includes Idea Cellular’s holding in the telecom infrastructure provider. Vodafone and Idea own Indus along with Bharti Airtel.

Transaction Fineprint

Idea Cellular will issue shares representing 50 percent of the merged entity to Vodafone. The promoters of Idea Cellular will then have to pay Rs 3,874 crore to buy out 4.9 percent stake in the merged entity.

Three years after closing of the deal, Aditya Birla Group will have the right to purchase up to 9.5 percent from Vodafone at Rs 130 per share, which translates into a valuation of Rs 94,600 crore for the merged entity. If the two companies fail to bring their stakes to the same level, the Aditya Birla Group will have the option of buying more shares from Vodafone at the prevailing market price.

If the two companies still do not have an equal shareholding over the next two years, Vodafone will sell shares in the open market during the following five-year period to bring its stake to the level of Idea Cellular’s holding.

Vodafone To Transfer Debt

Vodafone will transfer debt worth Rs 55,200 crore to the merged entity, bringing down its net-debt-to-earnings before interest, tax and depreciation and amortisation (EBITDA) to 0.3 times, the company said in a presentation. For the financial year 2016, the company’s net debt to EBITDA was 2.85 times, according to Bloomberg.

Vodafone expects to save as much as Rs 14,000 crore annually by the fourth full year after completing the merger, the company said.

The deal, expected to be completed in 2018, is subject to the approval of regulators and Idea Cellular shareholders.

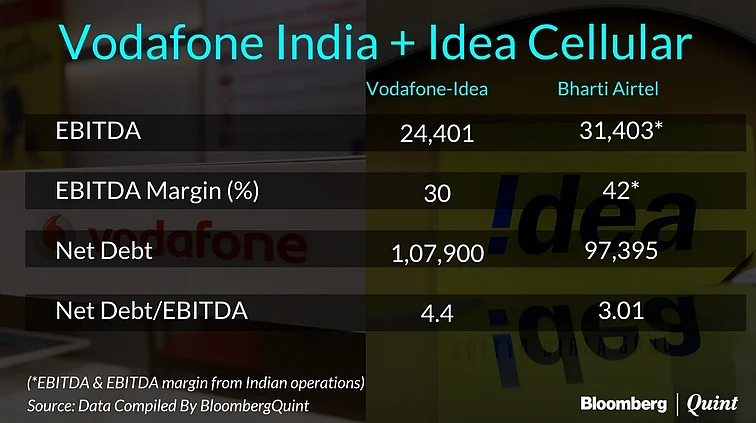

The merged entity’s EBITDA and EBITDA margin for 12 months ended December last year was below that of Bharti Airtel. It’s net debt and net debt to EBITDA is higher than Bharti Airtel’s.

Also Read: Vodafone In Merger Talks With Idea Cellular

Board Composition

Vodafone and Aditya Birla Group will have the right to appoint three directors each to the 12-member board of the combined entity. Kumar Mangalam Birla will be the chairman of the entity, while Vodafone and the Birlas will jointly appoint the chief executive officer and the chief operating officer. Vodafone will have the right to appoint the chief financial officer.

Reliance Jio Effect

The entry of Mukesh Ambani’s Reliance Jio spurred consolidation in the Indian telecom market. Apart from Idea and Vodafone, Reliance Communications Ltd. and Aircel Ltd. have announced plans to merge their operations, while Bharti Airtel Ltd. acquired the assets of Telenor (India) Communications Pvt. in February.

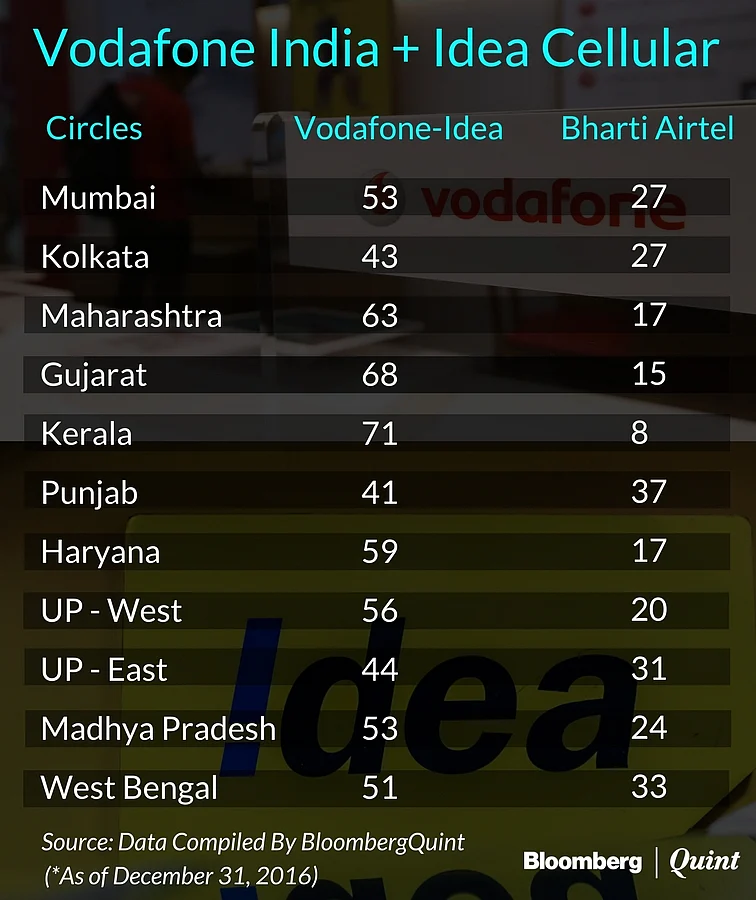

The Idea-Vodafone combine will have 1,849.1 MHz (megahertz) of spectrum across five different bands in its disposal. It will emerge as a market leader in 11 circles of the 22 telecom circles on the basis of its market share.

According to the merger & acquisition guidelines, a combined entity cannot hold more than 50 percent of the spectrum in each band individually and should have less than 25 percent of the airwaves allocated to all operators across bands and circles.

The Vodafone-Idea merged entity will have excessive spectrum in five circles – Maharashtra, Gujarat, Kerala, Haryana, and Uttar Pradesh (West). Which means, for the deal to go through, it will either have to sell the airwaves to another telecom player or surrender them to the government for free.