Union Finance Minister Nirmala Sitharaman has tipped the scales for price-hit jewellery buyers in India in the Union Budget 2024. She reduced duties on gold, silver and platinum imports, which could make them cheaper by around 9%.

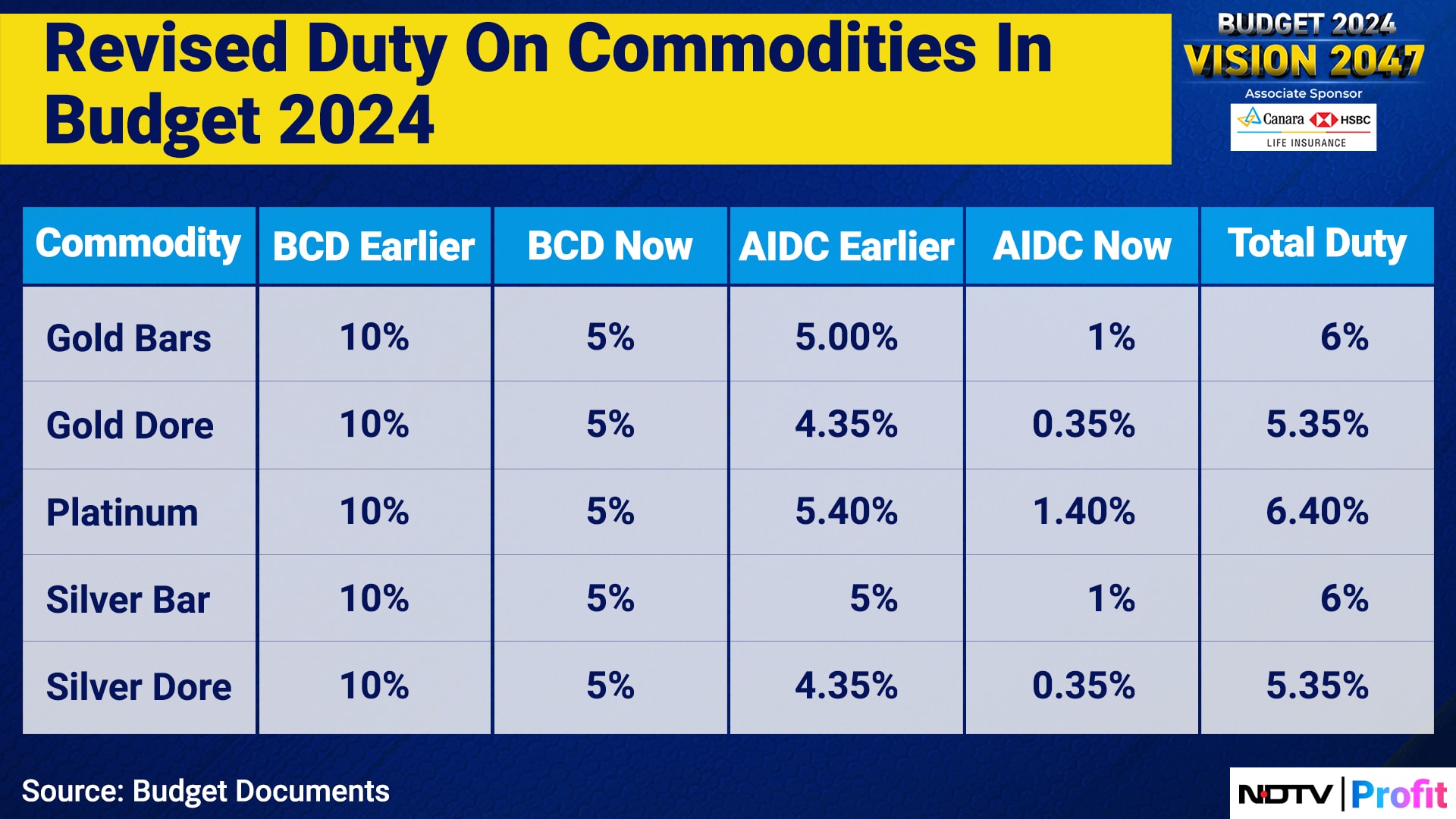

“To enhance domestic value addition in gold and precious metal jewellery in the country, I propose to reduce customs duties on gold and silver to 6% and that on platinum to 6.4%,” Sitharaman said in her budget speech.

Earlier, the basic customs duty (BCD) on gold and silver was 10%. Also, Agriculture Infrastructure and Development Cess (AIDC) is reduced to 1% from 5%, as per sector experts.

This announcement is significant as India is the second-largest consumer of physical gold, and most of it is imported. It's a positive surprise for jewellers and associations that have been expecting it for a long time.

“Bullion market participants were expecting a 5% cut in duties, but FM has announced a 9% cut, which is a commendable step from the government. Indian consumers would be able to buy now at a 9% cheaper rate from today, so it will boost physical demand,” says Prithviraj Kothari, managing director of RiddiSiddhi Bullions.

(Source: NDTV Profit)

Bullion Prices Crash

The domestic intraday gold price started falling immediately after the announcement. “The price of gold reacted lower in MCX by more than Rs 2,000 to Rs 70,350 (for 10 gm) and silver by Rs 2,500 to Rs 86,600 (for 1 kilo) as the market prices in the lower import duty gap of 4%,” Jateen Trivedi, VP research analyst of commodity and currency, LKP Securities, told NDTV Profit.

From 2024 until now, retail sales of fresh gold have been dull, especially after prices hit a new high of Rs 74,000 per 10 gm. Since then, gold prices have been volatile, further keeping consumers away from physical gold sales. A depressed rupee also didn't help matters.

Most of the sales in the first half were dependent on recycling, where consumers exchanged old gold for new, slashing the margin for jewellers. As per a World Gold Council report, in the January–March quarter of 2024, gold recycling went up by 10%.

Come November, the fortunes of jewellery retailers might change. After the Akshaya Tritiya season in summer, jewellery sales see its best season during Dusshera-Deepawali and the winter wedding season right after.

“Gold jewellery saw sluggish consumer demand due to skyrocketing prices. This move will help plain gold sales as well as studded gold jewellery,” Vipul Shah, chairman of the Gem and Jewellery Export Promotion Council, said.

Gold prices have been volatile in the last few months, amid fast-changing geopolitical scenarios and reduced purchases from central banks around the world. The much-expected rate cuts from the US Federal Reserve have been dragging, keeping safe haven asset investors guessing. Even after the domestic changes, the prices of gold might remain volatile internationally.

“The broad view remains volatile and weak as Comex gold stays below $2,415 (per ounce),” Trivedi said.

While jewellery buyers might see green, the Finance Minister also tinkered with the long-term capital gains tax on the yellow metal. It reduced the holding period for gold to qualify as long-term capital gains from 36 months to 24 months. It also cut the LTCG tax rate on gold to 12.5%. Moreover, indexation available for LTCG calculation for gold has been removed—impacting gold buyers who view it purely as an investment.

Diamonds In The Rough

As part of budget announcements, Sitharaman also eased the process of selling raw diamonds.

“India is a world leader in the diamond cutting and polishing industry, which employs a large number of skilled workers," she said in her speech. "To further promote the development of this sector, we would provide safe harbour rates for foreign mining companies selling raw diamonds in the country."

The move will help foreign players like De Beers and more who sell rough diamonds to Indian jewellers, who buy directly from the zones.

“This move will help us save on logistics costs,” Shah said.

Katya Naidu is a senior business journalist who writes about equity markets, startups, energy, infrastructure, real estate and healthcare.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.