(Bloomberg) -- US bonds fell after Federal Reserve Chair Jerome Powell pushed back again the prospect of an interest-rate cut in March, further dashing hopes of a speedy pivot toward easier monetary policy.

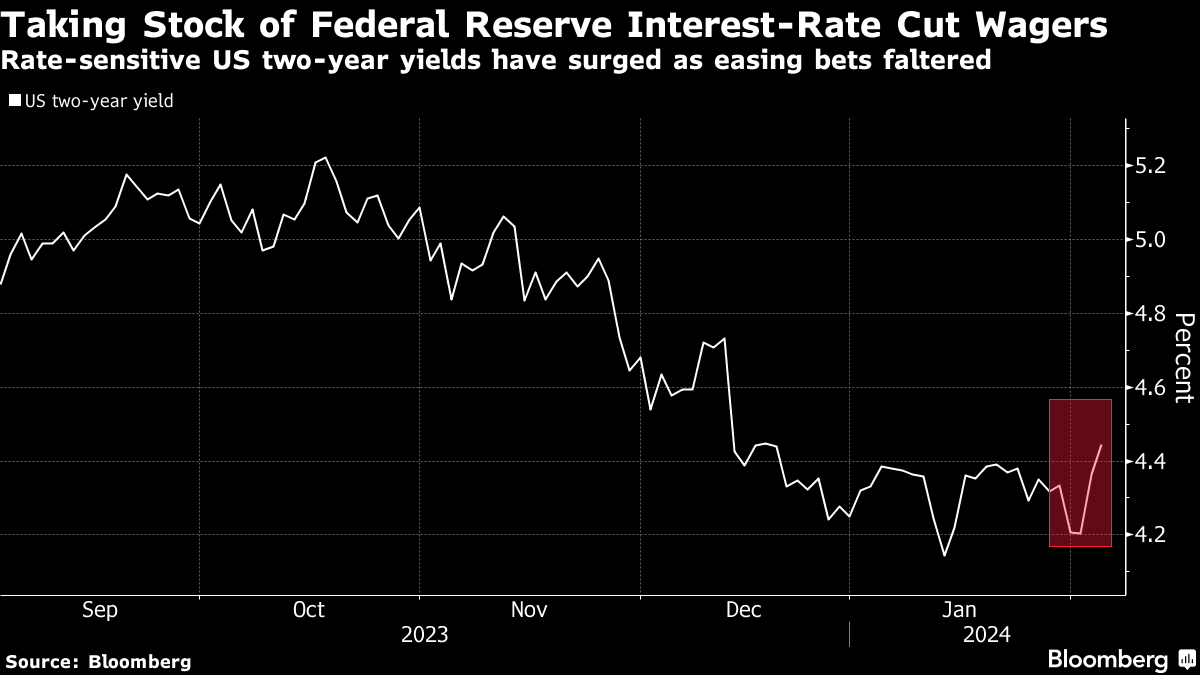

Short-dated Treasuries, which move in tandem with the outlook for rates, led losses, with two-year yields rising as much as 10 basis points to a one-month high of 4.46%. The chance of a quarter-point cut in March fell to almost 10% after Powell said in an interview with CBS's aired Sunday that Americans may have to wait beyond the Fed's next meeting to cut interest rates.

Just four weeks ago, a move by then was considered a near certainty by investors, but Powell said officials are looking for more economic data to confirm that inflation is headed down to their 2% target. Annual consumer price growth accelerated slightly to 3.4% in December.

Monday's move extend a rout that kicked off last week after data showed the US labor market was holding up far better than economists expected. It's the latest tussle between makers betting the central bank is poised to unwind its aggressive string of interest-rate hikes, and policymakers wary of declaring victory over inflation, even as it slows from a four-decade high of 9.1%.

Goldman Sachs Group Inc., Bank of America Corp. and Barclays Plc are among Wall Street banks who last week pushed back their calls for the timing of the first Fed rate cut from March.

“There is no reason for US Treasuries to rally,” said Althea Spinozzi, a senior fixed-income strategist at Saxo Bank A/S. “If inflation stays stubbornly above the Fed's 2% target, there is a chance that the Fed will disappoint markets on rate cuts.”

Bonds in Europe also traded lower though the moves were less pronounced than in the US. The yield on 10-year German bonds rose four basis points while the one on similar-dated gilts was up five basis points.

Traders are betting on five quarter-point reductions from the European Central Bank this year, down from nearly seven expected a couple of months ago. The Bank of England is only expected to lower policy rates three times compared to as many as six late last year.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.