(Bloomberg) -- Former Treasury Secretary Lawrence Summers said the economy's enduring strength in the face of vigorous Federal Reserve tightening makes it increasingly likely that neutral interest rates have risen.

“We've got an economy with a lot of underlying strength at interest rates where that would have looked unlikely some time ago,” Summers said on Bloomberg Television's with David Westin. Arguments in favor of neutral rates being higher thanks to fiscal deficits, and spending now being less sensitive to the level of borrowing costs, are “tending to be borne out,” he said.

Summers said he welcomed Treasury Secretary Janet Yellen's expression of doubt last week about whether interest rates will return to low, pre-Covid type levels — marking a shift in her commentary. He said he'll be watching to see the Biden administration's new projections, which are due with the annual spring budget proposal.

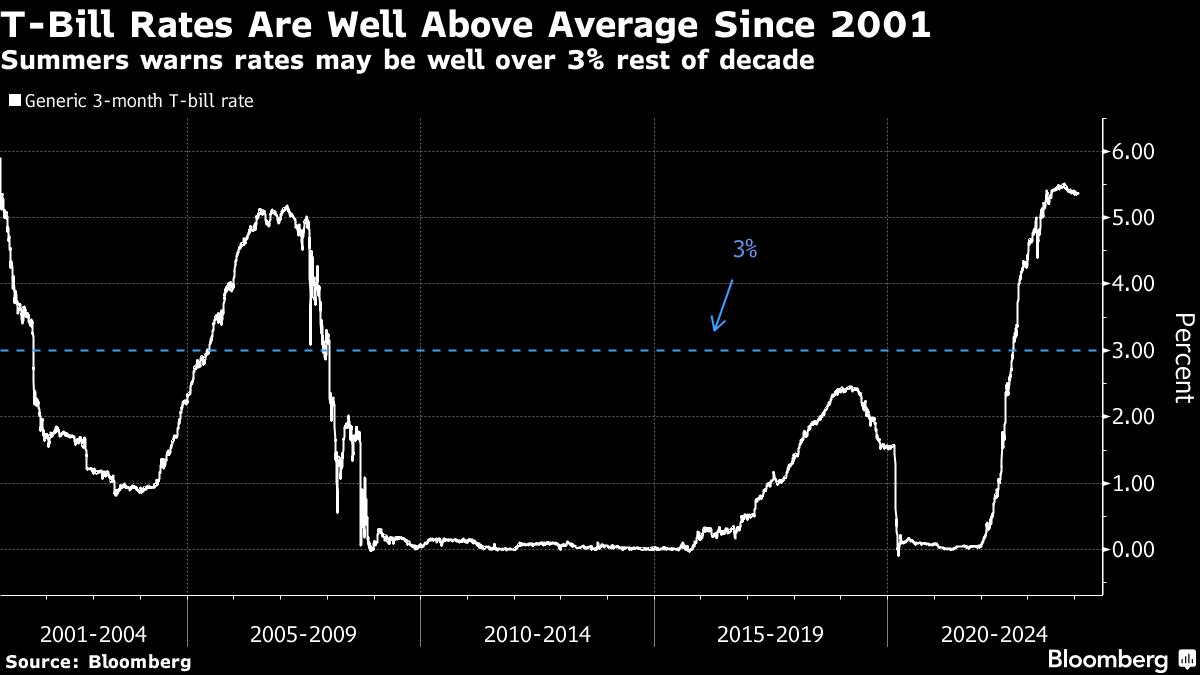

“One would want to be guessing that Treasury bill rates will be averaging well above 3% through the rest of this decade,” said Summers, a Harvard University professor and paid contributor to Bloomberg TV. Last year, the White House projection for bill rates in 2030 was 2.4%.

Such a level would be much higher than has been typical since the turn of the century. Three-month bill rates averaged around 1.5% over that period. Bill rates tend to closely track the Fed's overnight benchmark, and policymakers for years after the global financial crisis kept that near zero.

Summers spoke hours after the government reported a much bigger jobs gain than economists projected for January. He said it was a “very strong number” that suggests, despite the Fed's rate hikes over the past two years, “there's a lot of strength in the economy.”

Read More: Blockbuster US Jobs Report Turns Slowdown Narrative on Its Head

One reason why higher rates may not be having the impact that might have previously been expected is that housing — typically a more interest-sensitive sector — makes up a smaller part of gross domestic product than it once did, Summers said. It may also be the case that “durable goods are less durable,” and their shorter useful lives mean they need replacing more often, he indicated.

Another factor behind the economy's resilience may be the bigger federal debt load, along with higher rates, has generated “more flow of income to add to the rest of the economy,” Summers said.

The former Treasury chief also cautioned against dismissing the risk of a re-acceleration in inflation, given the economy's strength. Fed Chair Jerome Powell earlier on Wednesday said that “the greater risk” than re-acceleration is that price gains “would stabilize at a level meaningfully above 2%.”

Summers applauded Powell for his comment that the Fed is unlikely to be in a position to cut rates as of the March meeting. He also said that after Friday's jobs report, he would assume “March is completely off the table.”

While Summers has come under criticism for past predictions that inflation wouldn't come back down without a major downturn in the job market, he's “much less prepared to declare that it's all over.” After all, “we have not yet landed this plane,” he said.

“But yes, the outcome has been more benign than those of us who drew the implications from standard models predicted,” he said.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.