(Bloomberg) -- Maybe only a recession will create an actual dip in the stock market, at this rate.

At least that's what it feels like on Wall Street right now, as the relentless market rally punishes investors who failed to go all-in on equities heading into 2024.

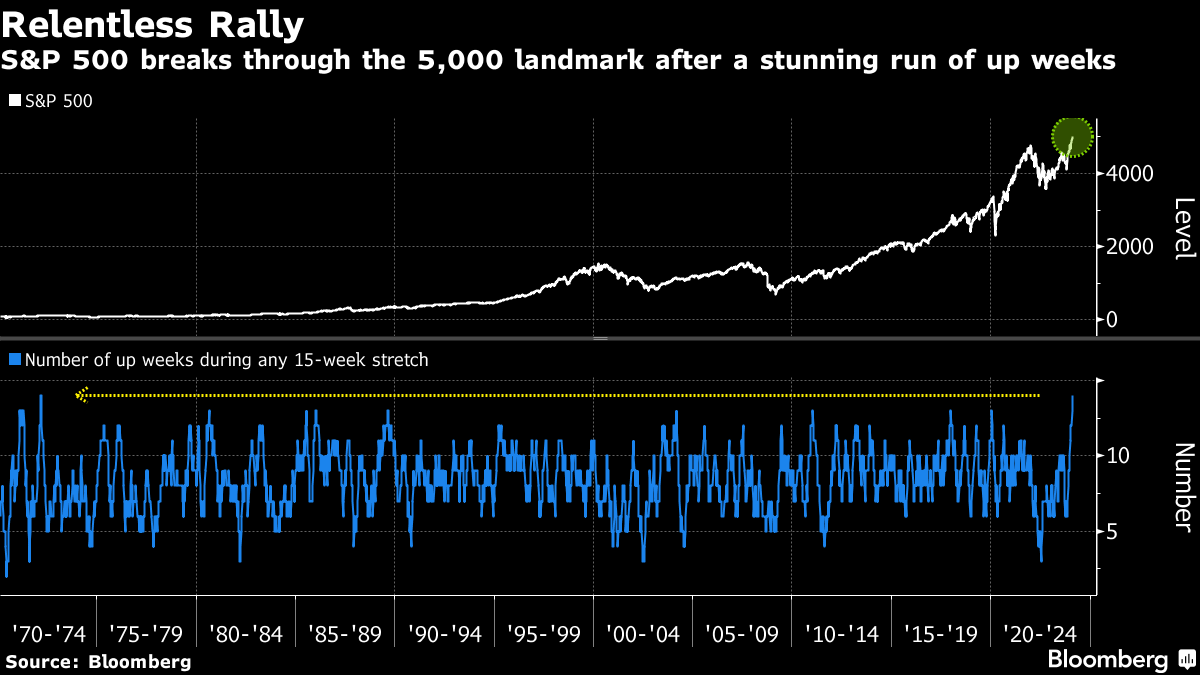

The advance in the S&P 500 is breathtaking across any measure, including gains in 14 of the last 15 weeks — the most since 1972. An exchange-traded fund chasing momentum is off to its best yearly start since at least 2013. Even the hour-by-hour data is impressive. In 28 sessions this year, 71% have seen the benchmark close above the midpoint of its daily range. That beats any full-year reading in four decades.

The powerful ascent, propelled by optimism over everything from accelerating corporate earnings to artificial intelligence, has been a gift for anyone prescient enough to be ultra-long. Yet with stocks getting more expensive by the day, it looks like dispiriting news for those money managers looking to dive into the market now or add to their positions.

Jeff Muhlenkamp is the furthest thing from a victim of the market's trajectory. His namesake fund has ridden the rally to a market-beating 12% annualized return in the past three years. But the 57-year-old Army officer turned money manager says even he considers prices too hot to touch in the current updraft.

“Big segments of the market are still very expensive,” said Muhlenkamp, whose fund now holds 12% of its money in cash. “It's possible that a recession gives me an opportunity to put it to work at better prices.”

Finding fresh buyers for the rally may be an obstacle to its sustainability after three straight months of gains pushes positioning to elevated levels. Trend-following traders and active managers are already heavily overweight equities, a signal that people who were under-invested have begun to catch up.

Trying to time pullbacks has been a losing battle for over a year, as anyone who has heeded the inverted yield curve in Treasuries as a reliable recession signal can attest. After slashing positions in anticipation of a downturn at the start of 2023, many investors were then forced to chase gains as the economy chugged along and stocks defied gloom calls.

Equity investors have appeared to be noticeably more optimistic about the economy than their bond-market counterparts. Some $9 trillion has been added to US stock values since October, wealth creation that surpasses the entire Chinese market in size.

Credit the buoyancy to technology megacaps such as Meta Platforms Inc. and Microsoft Corp., whose enormous cash piles and profits have combined with the AI boom to draw investors of all stripes. The cohort known as Magnificent Seven — also including Apple, Amazon.com, Alphabet, Nvidia and Tesla — reigned the market in 2023 and has since continued to shine.

Big Tech's ascent is fueling gains in strategies like the iShares MSCI USA Momentum Factor ETF (ticker MTUM). Up 14% since January, the fund just notched two weeks of inflows, the longest streak in a year.

“A lot of people thought that tech will roll over. It didn't happen, so what do you do now?” said Joseph Saluzzi, co-head of equity trading at Themis Trading LLC. “It's performance chasing, full speed ahead. You don't want to get in front of the train when the train is moving so fast.”

Stocks rose over the week as firms like Walt Disney Co. and Arm Holdings Plc provided upbeat outlooks. The S&P 500 eclipsed the 5,000 mark for the first time, while the Nasdaq 100 closed Friday for its 11th all-time high this year.

Cheerful as it all is, the persistent love for quality stocks such as tech giants can also be framed as a sign of caution among investors fretting over the negative impact on the economy from the Federal Reserve's most aggressive monetary tightening in decades.

Take small-cap stocks, whose fate is most sensitive to domestic growth. The Russell 2000 Index of smaller firms is down roughly 1% this year, hovering 20% below its 2021 peak. The gauge is behind the tech-heavy Nasdaq measure by 8 percentage points since January, marking the worst relative return this far into a year since the 2020 pandemic recession.

Meanwhile, credit concern is creeping back as Fed Chair Jerome Powell threw cold water on hopes that policy makers would cut interest rates as early as March. A Goldman Sachs Group Inc. index tracking stocks with weak balance sheets has trailed that with strong finances in four of the five weeks.

In other words, there have been dips in areas of the market that few have stood up to buy.

“On one hand, the Magnificent Seven party is in extra innings, while on the other, you have small caps that can't catch a break,” said Michael Bailey, director of research at FBB Capital Partners. “A final nail in the coffin for small caps may have come from Jay Powell when he pushed back the rate cuts. Small caps need some rate relief and investors now have to sit and wait a bit long.”

The S&P 500 has gone without posting a daily decline of 2% for almost a year, the longest stretch of resilience since before the 2018 volatility blowup known as “Volmageddon.”

At 24 times reported earnings, the index's multiple already eclipses pre-pandemic highs, approaching levels seen at the last bull market's peak. The Magnificent Seven is twice as expensive.

For now, not owning enough of these tech darlings due to valuation concerns is hurting Muhlenkamp's returns. His fund, whose three-year performance beats 94% of its peers according to Bloomberg data, has slipped to bottom decile in the past three months.

While admitting he may have under-estimated AI's potential, Muhlenkamp is sticking to a value approach, favoring energy companies given their ability to generate robust cash flows and work as a hedge against inflation should pricing pressures resurface. To him, it's too early to call all-clear for the economy because recessions usually aren't declared until well after the Fed starts cutting rates.

Stock investing is a mix of skills and luck, according to the former US army lieutenant colonel, whose fund managed to deliver gains during the 2022 bear market.

“You can do everything right and still be unlucky and it makes you look stupid. You can do everything wrong and still be lucky and look brilliant,” he said. “Everybody that invested in tech in 1998, 1999 was a hero until they were not.”

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.