(Bloomberg) -- Oil bounced back on a stronger-than-expected US jobs report and plans to refill the Strategic Petroleum Reserve on Friday, but still closed out the longest weekly losing streak since late 2018 amid concern about an impending global glut.

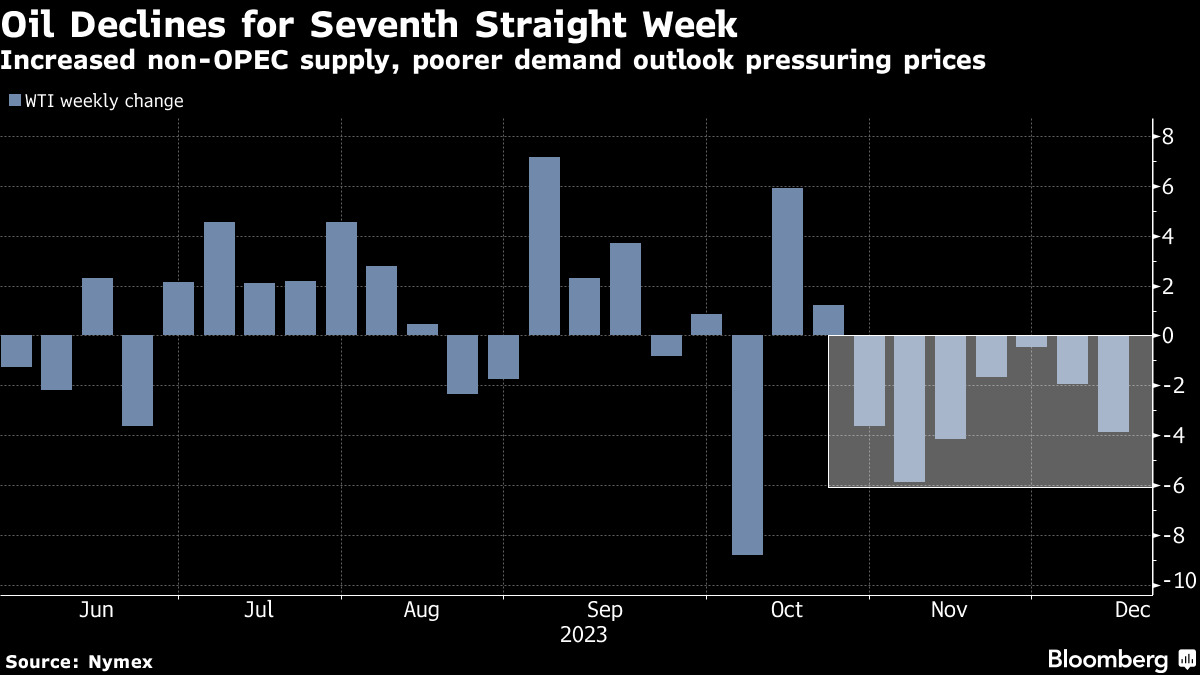

West Texas Intermediate climbed 2.7% to settle above $71 a barrel after hovering around five-month lows for the past four sessions. Crude notched its seventh straight weekly drop, and widely watched timespreads are mired in bearish contango structures to the middle of next year.

Oil found support on Friday from a US solicitation for 3 million barrels for the reserve and a plan to hold monthly tenders through at least May. The country's payrolls report also beat projections, adding to expectations that a decline in fuel demand may be bottoming out. Average retail motor fuel prices in the US have collapsed to the lowest in a year, according to data from the American Automobile Association.

Before Friday, crude had closed lower every session since last week's meeting of the Organization of Petroleum Exporting Countries and its allies. The group's plans for deeper production cuts were met with skepticism and seen as inadequate to counter supply booms elsewhere, notably in the US. The slump has persisted even amid comments by leading producer Saudi Arabia that the curbs could be extended beyond March, which were followed by similar remarks from Russia and Algeria.

“The market is providing clear signals that should check the conviction of bulls,” Macquarie analysts including Marcus Garvey and Vikas Dwivedi said in a note. “These signals include skepticism about OPEC+ policy effectiveness, perhaps finally and strangely, a reluctance to bet against US production growth after roughly a decade of outperformance by the US shale industry, and maybe a shelving of the structural underinvestment thesis.”

There are also concerns about the trajectory of demand. Chinese consumption is expected to grow by 500,000 barrels a day next year, according to a Bloomberg survey, less than a third of the increase seen in 2023. In the US, meanwhile, many economists see a recession starting next year.

But others see the market as currently experiencing a wide gap “between sentiment and reality,” Saad Rahim, Trafigura Group's chief economist, wrote in the group's 2023 annual report. “Demand for commodities might have been expected to wane. In fact, we have seen consumption climb to record highs across several markets.”

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.