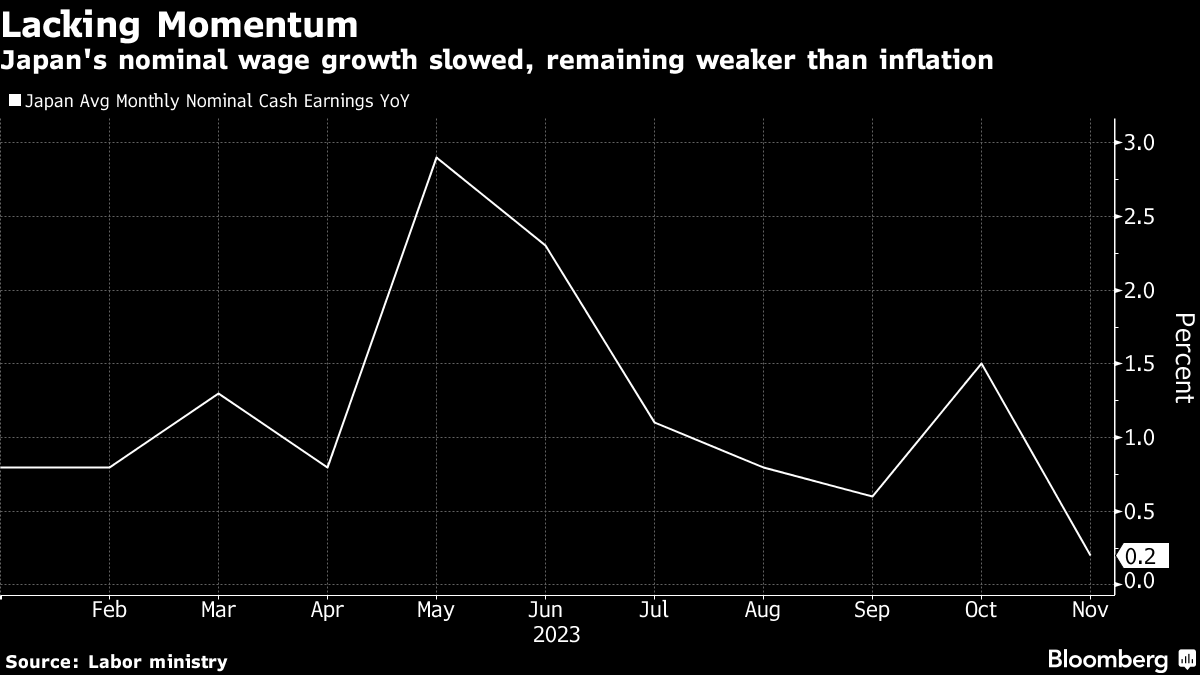

(Bloomberg) -- Headline wage growth for Japanese workers slowed sharply in November, an unwelcome development for the Bank of Japan as it seeks evidence of a virtuous cycle linking pay hikes to price increases as a prerequisite for normalizing monetary policy.

Nominal cash earnings for workers rose 0.2% from the previous year, decelerating sharply from a 1.5% increase in October, the labor ministry said Wednesday. Economists had expected the pace to hold steady. Real wages declined 3%, much deeper than the consensus call for a 2% drop.

Still, a key subset of the figures that avoids some sampling issues showed signs of resilience.

BOJ Governor Kazuo Ueda is monitoring wage trends for signs there will be enough momentum for the bank to achieve its goal of 2% inflation on a sustainable basis. While Wednesday's figures will back the rationale for keeping policy settings ultra-easy this month, they aren't likely to deter economists from predicting a rate hike in coming months.

The BOJ is already looking ahead to the state of play in annual wage negotiations expected to culminate in March. Japan's largest labor union federation is urging companies to raise wages by at least 5% in principle. Ueda told NHK late last month that it would be possible for authorities to make some decisions even if they don't have the full results of pay discussions from smaller firms, which may not be available until summer.

That remark spurred speculation that the likely timing of a BOJ hike would be the April monetary policy meeting. BOJ authorities next convene in two weeks at a gathering that concludes on Jan. 23, where in addition to setting policy they'll release updated outlooks for prices and growth.

“The current situation is that wages haven't caught up with prices,” said Harumi Taguchi, principal economist at S&P Global Market Intelligence. “Given the strong impacts of the base effect from the previous year and the weakness in some sectors, I don't believe we are in a virtuous cycle yet.” She added that she still foresees an exit from negative rates in April at the earliest.

Wednesday's report included data that avoid sampling issues and strip out bonus and overtime payments, which indicated that the underlying trend for compensation is more or less holding up. Growth in regular workers' core pay slowed by 0.1 percentage point to 1.9%. Ueda has signaled in the past that he's watching that data point.

What Bloomberg Economics Says...

“Hidden behind a surprisingly weak reading on Japan's November labor cash earnings, there was good news for the Bank of Japan — base pay for regular workers rose 1.9% from a year earlier, a pace registered in the early 1990s before Japan fell into a quagmire of low growth.”

— Taro Kimura, economist

For the full report, click here

“Regular workers' salaries have grown steadily at roughly around 2% since the summer,” said Saisuke Sakai, senior economist at Mizuho Research & Technologies. “The underlying tone of wages is growing to some extent.”

Prime Minister Fumio Kishida amplified his call for robust wage increases in a series of speaking engagements at business association events to mark the new year. The draft budget for the fiscal year from April includes a ¥1 trillion ($6.9 billion) fund to spur pay hikes and mitigate the impact of inflation.

Several firms have already signaled their plans to implement ambitious wage hikes as continuing tightness in the labor market forces them to compete for staff.

Nomura Holdings Inc. announced a 16% pay increase for younger employees in its brokerage subsidiary, and supermarket and convenience store operator Aeon Co. plans to lift hourly wages for 400,000 part-time workers by 7% by summer, according to the Nikkei. Tokyo Electron will raise its starting salary by about 40% on average, the Nikkei reported.

(Adds economists' comments)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.