(Bloomberg) -- SpaceX's prized Starlink satellite business is still burning through more cash than it brings in.

People familiar with the finances of one of the world's most valuable private companies say Starlink has — at times — lost hundreds of dollars on each of the millions of ground terminals it ships, casting doubt on claims by Chief Executive Officer Elon Musk and the company's top brass that the business is in “profitable territory.”

Starlink, which provides space-based internet service to more than 2.6 million customers, often strips out the hefty cost of sending its satellites into space to make the non-public numbers look better to investors, these people said, asking not to be identified discussing private information. They describe the company's accounting as “more of an art than a science” and say it's not actually profitable based on an operational and ongoing basis.

Closely held companies don't have to publicly release their financials and often massage their numbers while fundraising. Many operate for years by subsisting on financing while burning through cash. But people with knowledge of Starlink's balance sheet say money-making quarters have been less consistent than Musk suggested to investors when he celebrated having achieved “breakeven cash flow” in a post last year on his social media platform, X.

When pressed further about Musk's comments at a Washington conference last month, SpaceX Chief Financial Officer Bret Johnsen said, “I don't know that I want to quantify those numbers, but we are in positive cash flow and profitable territory for our satellite business now.”

Much as Musk's electric car manufacturer, Tesla Inc., upended the global auto industry, SpaceX is remaking the market for rockets and satellites. It has slashed rocket launch costs with its reusable boosters — largely made in-house. And with Starlink now accounting for a majority of all active satellites around the world, the company's global profile is rising.

Read More: Elon Musk's Starlink Terminals Are Falling Into the Wrong Hands

Space Exploration Technologies Corp. in December was valued near $180 billion, putting it on par with corporate behemoths like Verizon Communications Inc. and General Electric Co. It's now integral to the US government space program and has become a major player in national security. But the company is relying, in part, on Starlink to pay the bills.

As SpaceX tells it, there's a limit to how much money rocket launches can make. Musk is counting on the rapidly growing satellite business to bankroll the billionaire's lifelong ambition to reach Mars. According to some investors, Starlink accounts for more than half of SpaceX's 2024 revenue.

“There are probably 150 rocket customers on this planet, but there's eight billion potential customers for Starlink,” SpaceX President Gwynne Shotwell said in an interview with Goldman Sachs partner Susie Scher posted last month on the bank's website. SpaceX didn't respond to requests for further comment.

Capacity Constraints

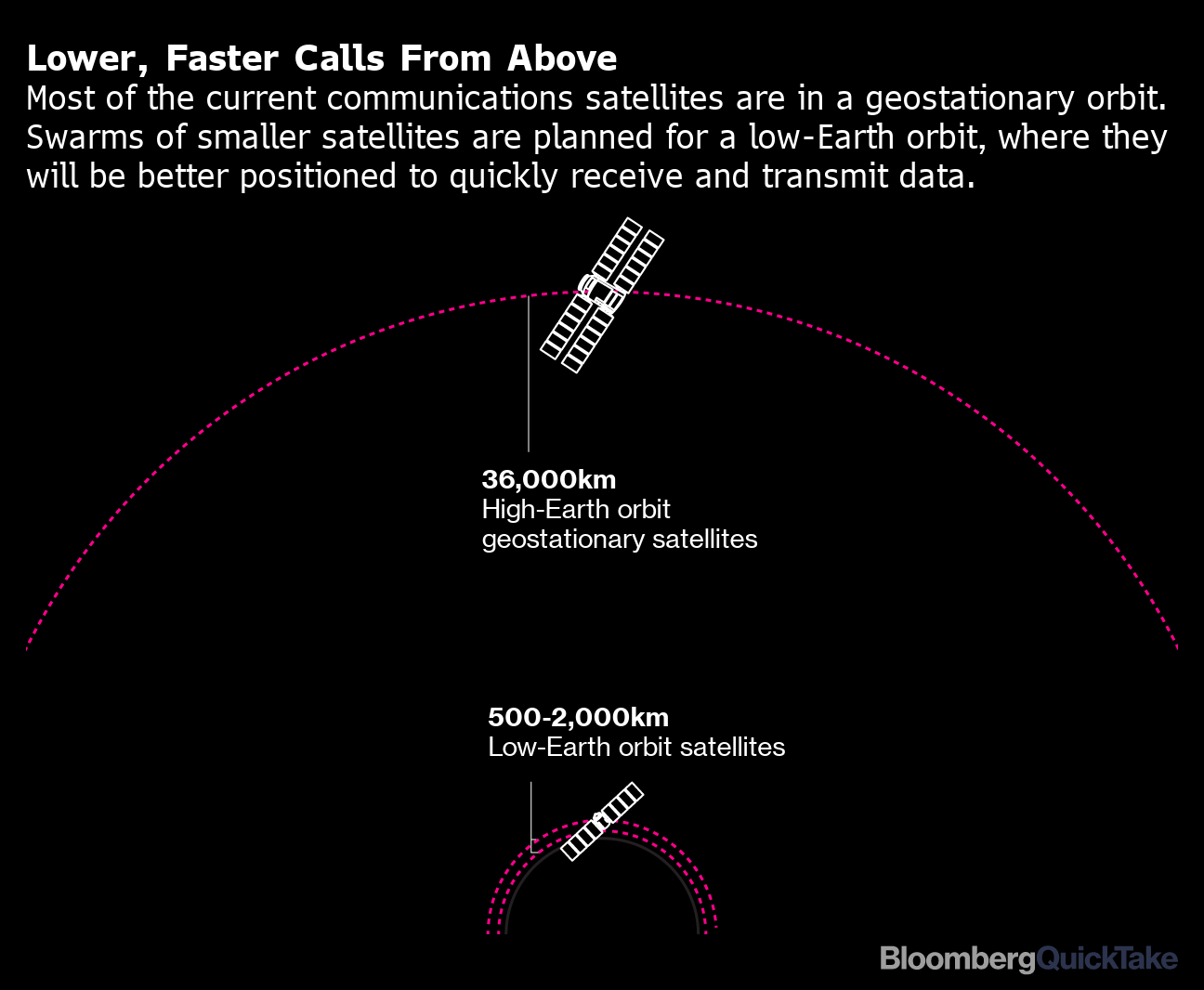

To reach those customers, Starlink is building a larger network of powerful satellites that zip around Earth at relatively low altitudes to reduce so-called latency, the time it takes for data to travel from satellites to terminals.

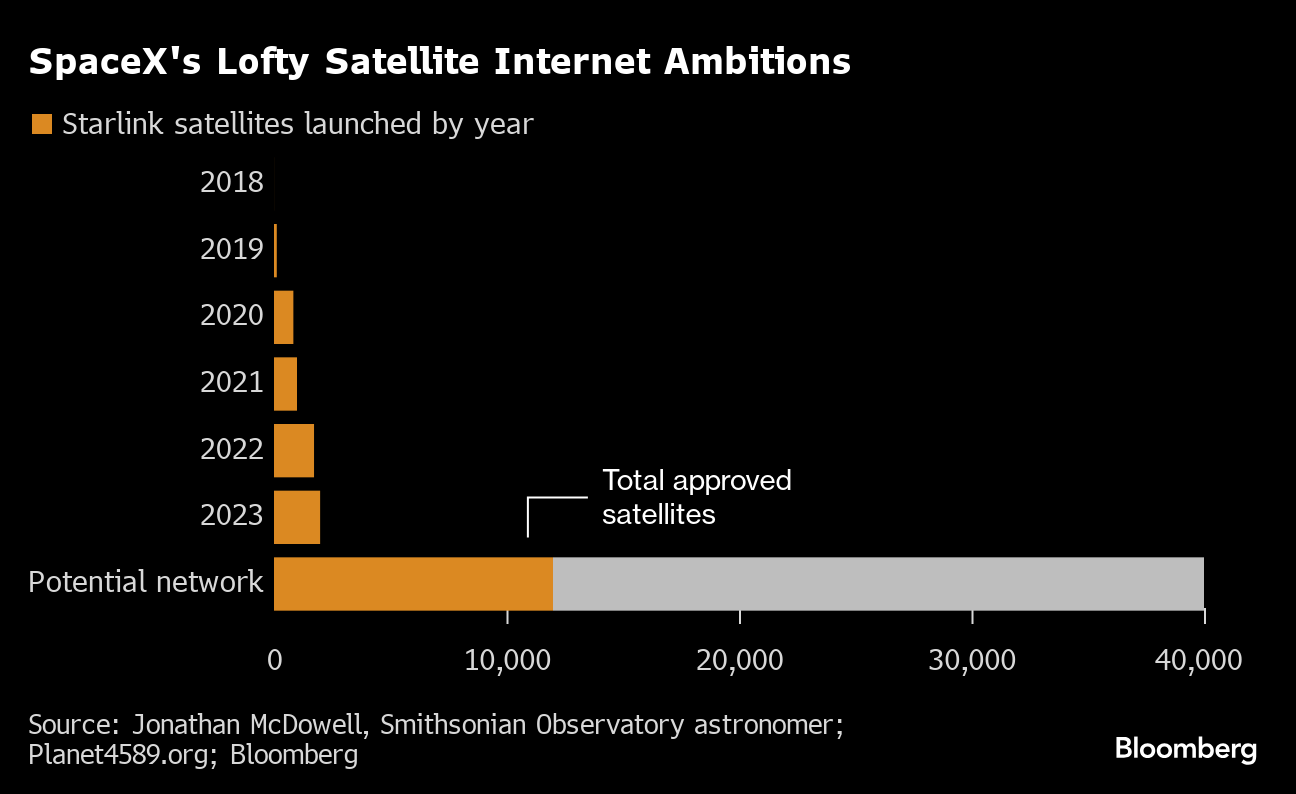

Right now, Starlink has 5,600 active satellites deployed, but plans to add tens of thousands more to reduce transmission times and boost its internet capabilities around the world. Once fully deployed, the network aims to rival telecom providers that use larger and higher orbit satellites that hover over one location.

Unlike with cell service providers, Starlink can't strategically pinpoint areas that need greater capacity by adding static towers. It has to keep adding more satellites to its system, said space researcher Caleb Henry of Quilty Analytics.

“It's like trying to raise the sea level. It's spread all over and the only way to increase the amount is to spread it out everywhere,” Henry said.

Too many people tapping into a satellite at one time can overwhelm the system and cause disruptions for people on the ground. The increase in users in urban and suburban locations has been “dragging down the performance,” said Mark Giles, a lead analyst at Ookla,which tracks Starlink speeds and analyzes internet performance.

Starlink speeds began to decrease in 2022, coinciding with an increase in users, Ookla found. Speeds have trended upward again, particularly in less-populated regions, as SpaceX started launching upgraded satellites aimed at boosting capacity.

The company says it hopes to ramp up even faster later this year when it starts commercial launches of Starship, a larger rocket than the Falcon 9 currently in use. The costly spacecraft is still undergoing testing and aims to allow SpaceX to launch larger satellites.

“Starlink should accelerate the deployment of its satellites per launch and focus on the reliability of its existing satellites and internet service,” said Andrea Lamari, a Managing Partner at Cuatro Capital, and a transitioning General Partner at Manhattan Venture Partners, a venture firm that has invested in SpaceX across multiple funds under their management.

“Starlink has always been able to prominently expand coverage where traditional internet options are limited or non-existent. They must also continue to increase bandwidth capacity and reduce latency at every chance possible,” she said.

30,000 Feet

Capacity issues may be one reason why Starlink is struggling to woo some lucrative corporate contracts.

All the major airlines — Delta, Southwest Airlines, American and United — have spurned the Musk-led service in favor of sticking with established Wi-Fi providers like Viasat Inc. Analysts say SpaceX doesn't provide the long-term contracts and exclusivity that corporate clients often want and that it's cost prohibitive to rip out existing Wi-Fi for a service that doesn't yet stand out from competitors.

Viasat, for example, has a sales staff that numbers in the hundreds, compared to the dozens that Starlink has, people familiar with the business say. Viasat declined to comment.

“We'll continue to look at emerging technologies like Starlink. But right now our focus is on getting the Wi-Fi that we have to the right level of performance,” said Southwest CEO Bob Jordan during a Bloomberg interview last year.

For Delta, the memory of a failed 2022 demonstration still hasn't faded, according to people familiar with Starlink's efforts to win over the airline.

Delta executives were eager to test Starlink internet but as its jetliner flew upwards of 30,000 feet over Chicago, the plane wasn't connecting to the service. As a quick fix, SpaceX turned off internet for some paying customers in the city below, these people said. The move got Wi-Fi working in the plane's cabin but it wasn't enough to win a Delta contract, the people said. Delta, American and United declined to comment.

Starlink has had more success signing up corporate clients in rural and maritime areas where capacity issues don't overwhelm the system. They've signed up clients like Carnival Cruise Lines, Deere & Co. and shipper Anglo-Eastern Ship Management Ltd.

At Anglo-Eastern, Chief Information Officer Torbjorn Dimblad said Starlink access has become a necessity and has drastically reduced costs. “It's like suddenly getting running water,” he said.

Anglo-Eastern, which already has the service on about 300 of the 650 ships it fully manages, spends about $2,700 per vessel for Starlink hardware and $1,000 a month for internet service. That compares with $20,000 for equipment and $2,000 per month in subscription fees the company pays per ship for slower download speeds from incumbent satellite providers like Eutelsat and Viasat's Inmarsat Global Ltd.

To be sure, profitability is increasing as Starlink reduces the money it spends on manufacturing satellites and ground terminals. One person familiar with the company's financials said Starlink's cash generation improved toward the end of 2023 and that its now more consistently profitable.

SpaceX has met or exceeded revenue projections over the past three years, other people familiar with the company's balance sheet say. The company forecasts sales to grow to $15 billion this year from $4.7 billion a year ago, these people said.

To keep up with that growth, investors say they expect SpaceX to have to raise more money or get a cash infusion from Musk himself.

SpaceX has weighed a Starlink spinoff and potential IPO, which would allow the standalone entity to raise debt or equity separately from the parent company, Bloomberg News has reported. SpaceX has already hived off Starlink's data, storing it on dedicated servers, people familiar with the plans said.

At the moment, the company says it isn't in a rush to IPO. “It'd be more in the years to come,” Johnsen, the CFO, said last month.

--With assistance from Eric Johnson, Gillian Tan and Bruce Einhorn.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.