(Bloomberg) -- The European Central Bank will soon need to start cutting interest rates, according to Governing Council member Fabio Panetta.

“Macroeconomic conditions suggest that disinflation is at an advanced stage, and progress toward the 2% target continues to be rapid,” he said on Saturday at the annual Assiom Forex event in Genoa. “The time for reversal of the monetary policy stance is fast approaching.”

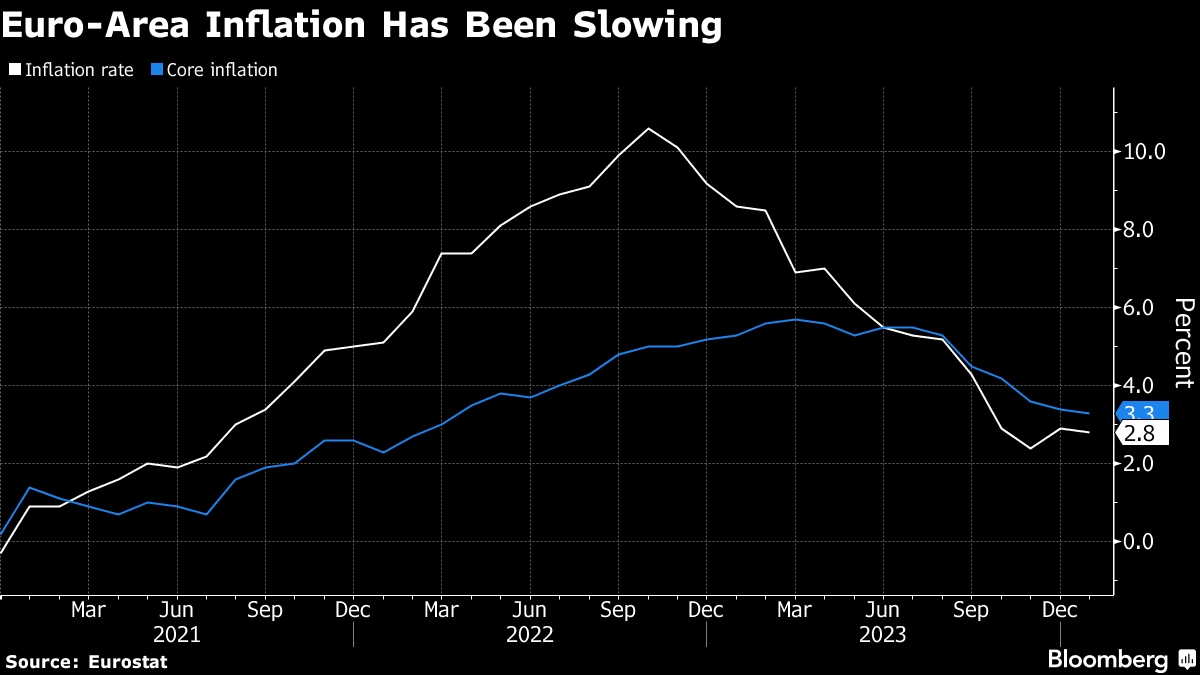

ECB officials are preparing to loosen policy this year — probably from April or June — with investors leaning toward the earlier of the two. The outcome will hinge on inflation, which has plunged over recent months but isn't expected to meet the 2% target again until next year.

“There has been no upward de-anchoring of inflation expectations — if anything downside risks are emerging,” Panetta said. “Concerns about the hypothesis of persistently high core inflation have also proven groundless.”

Several policymakers have suggested that wage increases could feed through to consumer-price growth and the ECB needs to wait for those data. The Italian central bank chief, known for his dovish stance, said such a threat is exaggerated.

“The risk remains that still strong nominal wage growth could reignite inflation,” Panetta said. “This possibility should not be underestimated, but a closer look at the data allays these concerns.”

He also warned against delaying a move too much.

“If monetary policy were to take too long to accompany the ongoing disinflation, downside risks to inflation could emerge that would conflict with the symmetrical nature of the objective set by the ECB's Governing Council,” he said.

Some officials have started thinking about how to pace easing once it starts. Panetta joined colleagues pushing for a step-by-step approach.

“We need to consider the pros and cons of cutting interest rates quickly and gradually, as opposed to later and more aggressively, which could increase volatility in financial markets and economic activity,” he said.

Italy Situation

Speaking about Italy's economic outlook, Panetta pointed out that the deficit will decrease but debt is unlikely to shrink.

“The information available for 2023 suggest that the fiscal deficit and public debt as a percentage of GDP have fallen,” he said. “Over the next few years, despite the expected decline in the deficit, debt should remain broadly stable.”

He painted a rosier picture of Italian banks' situation saying balance sheet indicators are positive with liquidity ratios well above regulatory requirements and improved profitability.

Panetta however warned that such favorable conditions for banks are not likely to last and lenders must prepare for the future by maintaining balanced maturity structure of assets and liabilities, good management of non-performing loans, and safeguarding the soundness of their capital base.

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.