(Bloomberg) -- When Walt Disney Co. reports earnings after Wednesday's close, top of mind for investors is what clarity the company can offer on when its streaming business will deliver profits.

The Burbank, California-based firm said in its last report that it expects its combined streaming business to reach profitability in the fourth quarter of 2024, but warned that “progress may not look linear from quarter to quarter.”

Analysts covering the company expect its direct-to-consumer business to bring in $5.5 billion in revenue in the first quarter, and estimate an operating loss of about $391 million. While that's a narrower decline than the $420 million the segment shed in the fourth quarter, it's far from competitor Netflix Inc., which is the only streamer that's been able to turn a profit.

“Things are getting less bad, and we're getting more clarity finally, one of them being on the streaming side,” said David Wagner, portfolio manager at Aptus Capital Advisors LLC. “We're going to see how forgiving the market tape is for a turnaround story.”

Pressure is on for Disney to show that it's making progress in a turnaround that includes a profitable streaming segment and cost-cutting. Alongside revival efforts, the company is facing activist pressure from investors including Blackwells Capital and Trian Fund Management LP's Nelson Peltz. The stock has gained so far this year - it's up nearly 10% through Tuesday's close - but still lags Netflix Inc, which has gained 14%.

“Any commentary about reaching profitability earlier than 4Q24 will be a positive catalyst,” Bloomberg Intelligence analyst Geetha Ranganathan wrote in a note.

Investors will also be looking for updates on other parts of Disney's business, such as linear networks including ESPN, theme parks and its movie studio. The company, alongside Fox Corp. and Warner Bros. Discovery announced Tuesday after market close that they would join forces to launch a sports streaming service, one-third owned by each company.

Though bulls are hopeful that the stock's 25% run from an October trough has legs, it's still beaten-down from a 2021 high near $202 per share. Disney trades at about 21 times forward earnings, a slight premium to the S&P 500 Index at 20 times.

Read more: Peltz Makes Pitch for Restarting Disney's Creative Engine

“It is a value stock, so the question is, is it a value trap or is this a great opportunity?” said Rhys Williams, portfolio manager at Spouting Rock Asset Management LLC. He added that the gap between Disney and Netflix, seen as the leader in streaming, has been an issue for convincing investors to jump back into the stock.

In its last earnings release, Netflix reported its best subscriber growth since the pandemic, signaling that its content and new advertising-supported subscription helped draw consumers amid a password crackdown.

“If they can have something close directionally like Netflix's results, that would be great for Disney. But, I think there's some skepticism that they're going to be able to do that,” Williams said. Analysts are expecting that Disney subscribers will total 151.2 million in the quarter, showing sequential growth.

Overall, analysts expect Disney to report nearly $24 billion in revenue, a 1% increase from the same quarter a year ago, and $1.01 in adjusted earnings per share.

Also in focus is Disney's Chief Financial Officer, Hugh Johnston, who joined the company in November. The earnings release will be his first as CFO.

“We will be listening for any key messages regarding his key priorities,” Citigroup Global Markets Inc. analysts led by Jason Bazinet wrote in a note dated Feb. 1. “We expect the focus will continue to be on right sizing costs and driving towards streaming profitability.”

Tech Chart of the Day

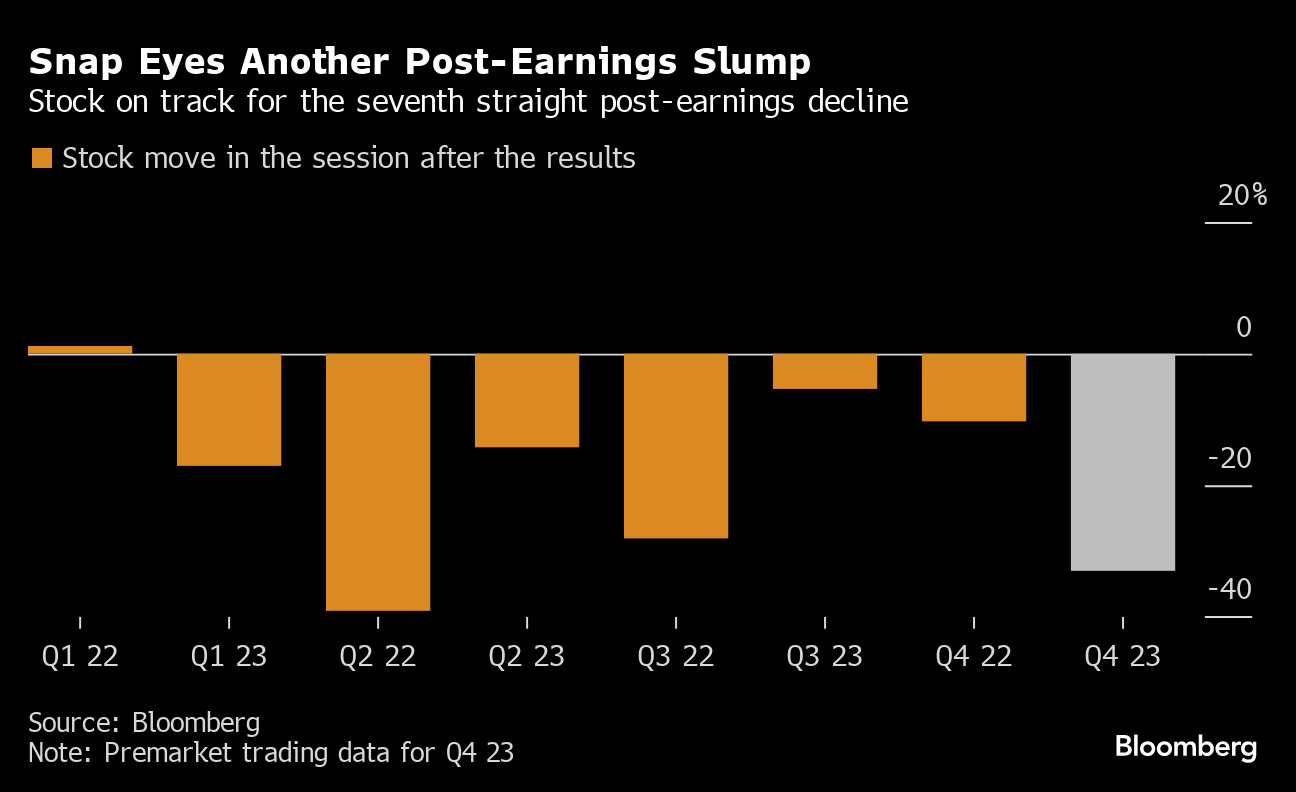

Snap Inc. shares plunged more than 30% in US premarket trading after the social media company reported disappointing revenue in the fourth quarter as it continues to reel from a slump in the digital advertising market. If the stock closes lower on Wednesday, it would mark the seventh straight quarterly report met with a negative session.

Top Tech News

- Alibaba Group Holding Ltd. unveiled a $25 billion addition to its stock repurchase program as it reported disappointing revenue, reflecting how rivals such as PDD Holdings Inc. are eroding its dominance in China.

- After a series of brutal setbacks, Masayoshi Son has SoftBank Group Corp. on track for one of its strongest quarters in years.

- Apple Inc. won't have to face a lawsuit alleging its smartwatch copied heart-monitoring technology from a Khosla Ventures LLC-backed startup, AliveCor, a federal judge ruled.

- The head of ByteDance Ltd.'s China operations is stepping down, a week after Chief Executive Officer Liang Rubo said the company needed to avoid complacency and make up lost ground in the AI race.

- Target Corp. is weighing a new paid membership program akin to Amazon Prime or Walmart+ as it looks for ways to fuel growth and compete against bigger rivals, according to people familiar with the matter.

Earnings Due Wednesday

- Premarket

- Alibaba

- Roblox

- Silicon Labs

- Vishay Intertech

- TTM Tech

- Postmarket

- Disney

- PayPal

- Monolithic Power

- Confluent

- MKS Instruments

- Qualys

- Axcelis Technologies

- Rapid7

- FormFactor

- Knowles

- Digital Turbine

- Netgear

- GoPro

--With assistance from Subrat Patnaik.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.

:max_bytes(150000):strip_icc():focal(722x523:724x525):format(webp)/Savannah-Guthrie-mother-Nancy-Guthrie-020226-02-0368cb6ddb864bf09919fd100fe546b0.jpg?im=FeatureCrop,algorithm)