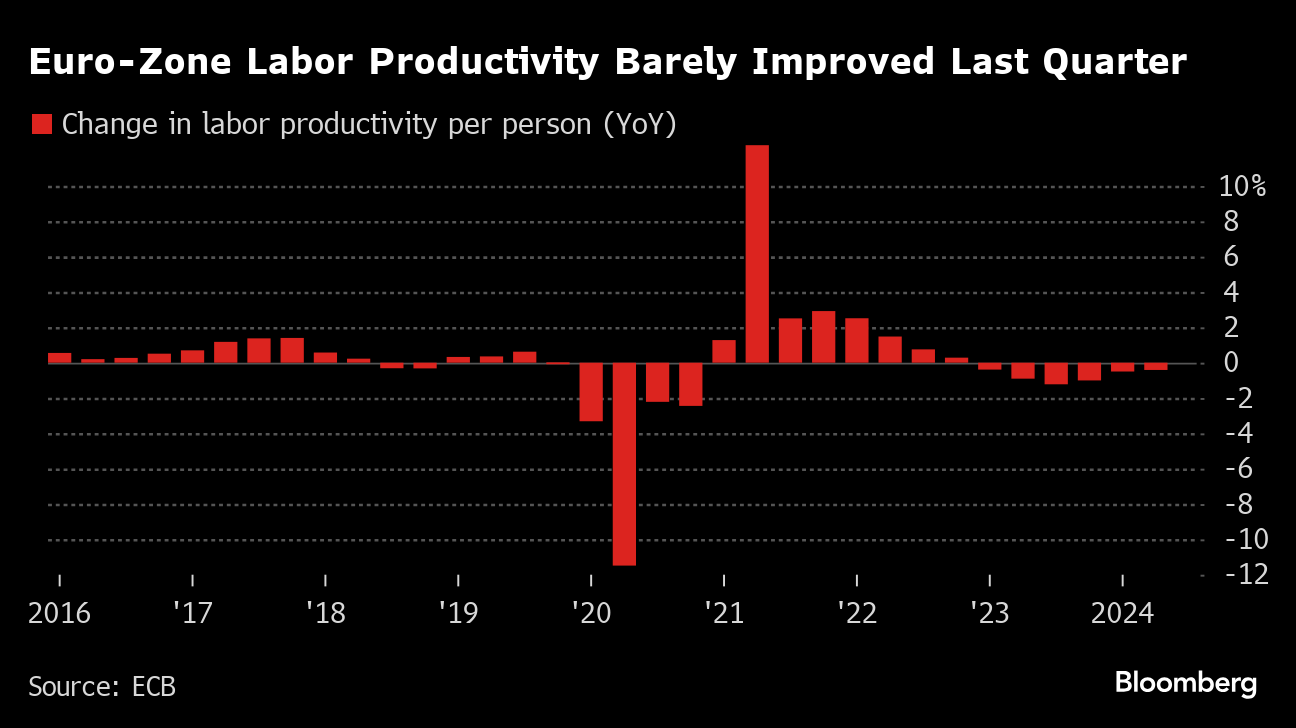

Euro-zone productivity barely improved in the second quarter and again missed the European Central Bank's expectations – a blow for its efforts to bring inflation back to 2%.

Labor productivity per person fell by 0.4%, according to new data published by the ECB. That follows a decrease of 0.5% in the first three months of 2024 and compares to a minus of only 0.3% envisaged in the ECB's June staff projections.

While a more productive labor force is essential for economic growth, it's also a key plank in the ECB's case for inflation returning to target. This builds on a combination of moderating wage growth, companies' profits absorbing part of the pay increases and higher productivity to lower the cost per unit of output.

Officials including President Christine Lagarde have highlighted the importance of “the nexus of profits, wages and productivity.” Should an adequate improvement fail to materialize, sustained cuts in interest rates may prove tricky.

Some analysts say the ECB's view that productivity will rise by about 1% in 2025 and in 2026 — faster than the 0.6% it averaged during the two decades before the pandemic — is too rosy, even after a downward revision in the June forecast.

The new data may add to this growing skepticism and fuel the discussion about further reductions in borrowing costs.

“With the further drop in productivity, the risk that inflation could remain high for longer clearly increases,” said Carsten Brzeski, head of macro research at ING.

For the next monetary-policy meeting in September “there is a new problem for the ECB slowly but surely boiling under the surface: how to sell a rate cut when your inflation forecasts are once again revised upwards,” Brzeski said.

In June officials delivered a widely telegraphed reduction in borrowing costs while simultaneously lifting the inflation projections for 2024 and 2025 — sparking a debate about whether the step was justified.

“More generally speaking, with these productivity numbers the argument for a rate cut would have to be weak euro-zone growth rather than inflation relief,” Brzeski said.

Piet Haines Christiansen, an economist at Danske Bank, called the new data “worrisome.”

“The first key release in ECB's triangulation shows that productivity growth in the second quarter is worse than the staff projected in June,” he said. “If wage growth fails to slow sufficiently, the ECB may not get sufficient comforting news to deliver yet another rate cut and thus deliver a ‘hold' in September.”

Markets are fully pricing two more rate reductions this year and see an 80% chance of a third — despite a surprise uptick in euro-area inflation in July to 2.6%.

Wages continued to advance at an elevated clip at the start of the year as workers strive to offset the inflation shock. The ECB will publish data on negotiated wages in the second quarter on Aug. 22.

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.