(Bloomberg) -- China's top leaders pledged to strengthen fiscal support and emphasized the importance of economic “progress” at a meeting Friday that supported economists' expectations for a growth goal of around 5% for next year.

The Politburo, comprising the ruling Communist Party's top 24 officials and chaired by President Xi Jinping, announced after the gathering that fiscal policy will be stepped up “appropriately,” the official Xinhua News Agency reported.

The Politburo's introduction of a new slogan — “use progress to promote stability” — signals that next year's growth target may be set at 5%, said Xing Zhaopeng, a senior strategist at Australia & New Zealand Banking Group. While that would be the same as this year's objective, in practice it would be tougher to achieve, because 2023 had the benefit of a weak base of comparison due to coronavirus restrictions in 2022.

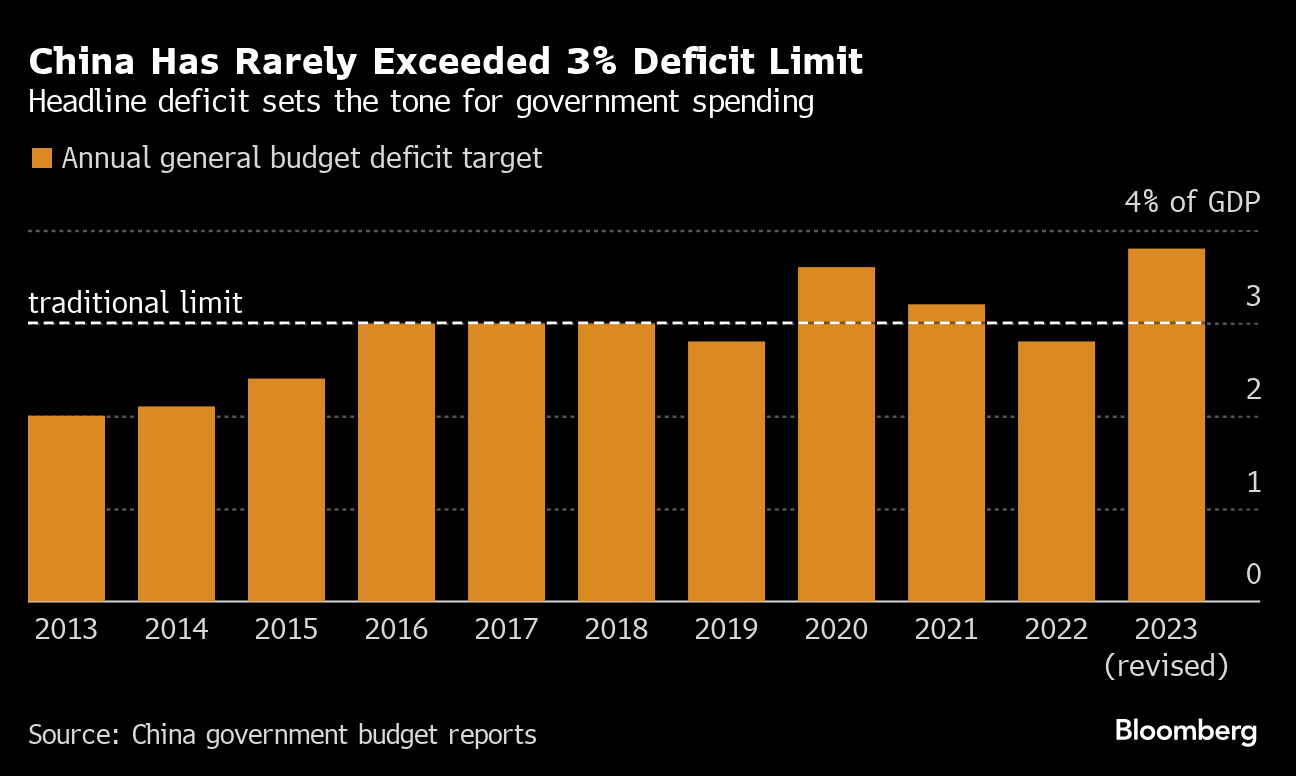

Language on stronger fiscal policy suggests the government's headline deficit ratio may exceed 3% of gross domestic product in 2024, Xing said. Beijing made a rare move in October to raise this year's headline deficit to 3.8%, which suggested policymakers have adopted a more flexible stance.

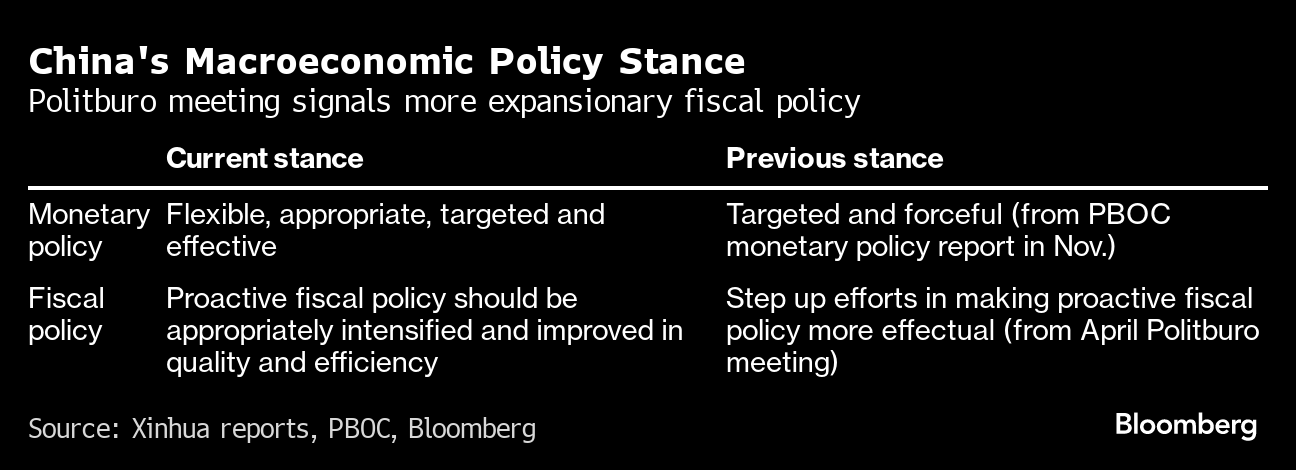

China's Politburo also declared that monetary policy should be flexible, appropriate, targeted and effective, with the previous wording “forceful” dropped from the statement.

That change indicates more caution toward broad monetary easing and a greater focus on targeted tools, according to economists. The size of cuts to interest rates and bank reserve requirements may be smaller next year than in 2023, said ANZ's Xing.

Citigroup Inc. economists led by Yu Xiangrong said that the Politburo's language suggests a shift of focus “more toward economic progress.” They also expect a GDP target of “around 5%” next year.

However, there was “no indication for mega stimulus from the meeting,” they added.

The Politburo's call for the government to “act within its capabilities” to improve people's livelihoods suggests little appetite for income transfers to households, they said.

Economic targets for 2024 will be set at the Communist Party's annual economic work conference, expected to be held later this month.

China is expected to meet the government's GDP target this year, due mainly to a rebound in consumption compared to a lockdown-hit 2022.

But an ongoing property market slump and record-low consumer confidence have dragged on growth, leading Beijing to increase fiscal support as the year continued.

In line with previous December Politburo meetings, there was little mention of the crucial property sector. China's government in recent weeks has hinted at more supportive measures to stabilize real estate, as sales are still falling.

Some economists saw the Politburo's vow Friday to “build the new before abolishing the old,” as reference to the need to continue supporting real estate until new growth drivers can pick up the slack. The meeting also vowed more efforts to prevent and resolve risks in key areas — likely hinting at troubles in property and local government debt.

“The key message from today's meeting is that growth is becoming more important to policymakers,” Larry Hu, head of China economics at Macquarie Group Ltd. wrote in a note. “Top leaders are telling government officials not to use stability as an excuse against growth.”

The meeting called for efforts to stabilize foreign trade and investment.

Besides economic policies, the meeting also discussed anti-corruption measures and reviewed the party's regulations on discipline. Beijing has been cracking down on graft in the financial sector as well as in the military.

The readout didn't provide a date for the third plenum, a party meeting closely watched by investors for signs of China's long-term policy agenda.

--With assistance from Zibang Xiao and Tom Hancock.

(Updates with economist reaction, context)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.