Ever scrolled through your feed and been tempted by promises of six-pack abs in six weeks or instant millions with a click? It's easy, and only natural, to crave instant gratification. But Rome wasn't built in a day, and neither is a strong body or a healthy financial future.

In the age of Instagram and X, formerly Twitter, it's easy to be dazzled by influencers flaunting their rapid transformations—whether physical or financial. Crash diets and investment fads are marketed as 'shortcuts' to success, but their allure hides significant drawbacks. Understanding the pitfalls of these quick fixes helps one appreciate the value of a disciplined, patient approach.

Is Simplicity Key?

The first step in both fitness and finance is setting clear, realistic goals. Then comes setting individual plans for a person's specific fitness and financial journey. "Your friend's asset allocation cannot be your asset allocation strategy," said Vishal Dhawan, founder and chief executive officer of Plan Ahead Wealth Advisors Pvt.

"Construct a portfolio that's good for you, considering your lifestyle, means, and simply, what you have access to," said Avinash Mansukhani, founder of Fight The Sunrise, a body fitness and health platform. In fitness, simplicity might mean focusing on whole foods and regular exercise rather than the latest diet craze, he said. Vishal echoed the sentiment for finances as well, saying it could be about sticking to time-tested principles like budgeting, saving, and investing wisely. Simplicity brings clarity and reduces the risk of making hasty decisions that could derail long-term progress.

What Should Be On Your Plate?

We've all been taught that in a nutritional diet, balance is key. Mansukhani, points out that cutting out entire food groups might give rapid results, but can lead to nutritional deficiencies and long-term health issues. Similarly, a balanced financial plan involves diversification. Relying solely on one type of investment, like stocks, can be risky. Instead, a mix of assets—stocks, bonds, real estate, and mutual funds—provides stability and growth potential, according to Dhawan.

Understanding what one needs nutritionally and financially helps build a sustainable plan. "When you want to start getting into fitness, you try a lot of different stuff. You'll try some crossfit, some bodybuilding, some pilates—exactly how you dabble in different investments when you start before you know what works for your portfolio," Mansukhani said.

In nutrition, it's about getting the right mix of proteins, carbs, and fats. In finance, it means knowing one's risk tolerance, setting up an emergency fund, and investing according to one's goals and timeline.

Balancing The Good, The Bad And The Ugly

Just as not all sugars are equal, not all debt is detrimental. Good debt can be seen as an investment in one's future, such as education loans or a mortgage on a home a person can comfortably afford, Dhawan said. Conversely, bad debt typically involves borrowing for non-essential, depreciating assets or beyond one's means, like high-interest credit card debt used for discretionary spending.

Much like budgeting for calorie-dense treats while maintaining a healthy diet, financial indulgences require planning and moderation. Budgeting a small portion of one's daily calorie intake for a dessert can satisfy cravings, without compromising overall health goals, Mansukhani said. Similarly, budgeting for discretionary spending allows for occasional splurges without jeopardising long-term financial stability.

Sustaining Gains

Long-term success in both areas hinge on discipline and patience. Crash diets and get-rich-quick schemes may offer a fast track to one's goals, but they are rarely sustainable. "You can get rich quick, but how often can you stay there?" Dhawan said. True transformation, whether it's achieving a fit body or financial independence, requires consistency.

In fitness, this could mean maintaining a regular exercise routine and healthy eating habits, even when progress seems slow Mansukhani said. In finance, it involves avoiding the temptation to cash out at the first sign of market volatility. The compounding effect is powerful in both domains. "The longer you stick with your plan, the greater the benefits you'll reap," said Dhawan.

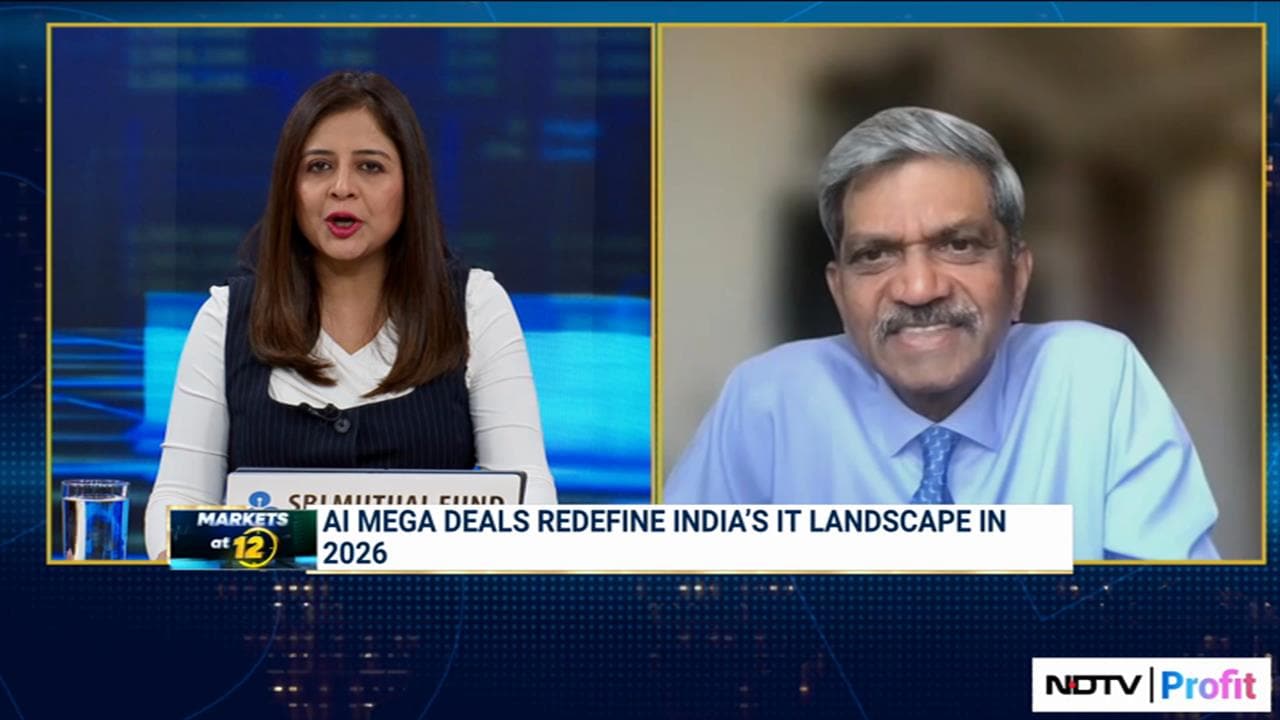

Catch up more about striking parallels between fitness and finance, commitment to long-term goals and embracing a sustainable approach on the upcoming episode of Big Decisions on July 5 with Avinash Mansukhani and Vishal Dhawan.

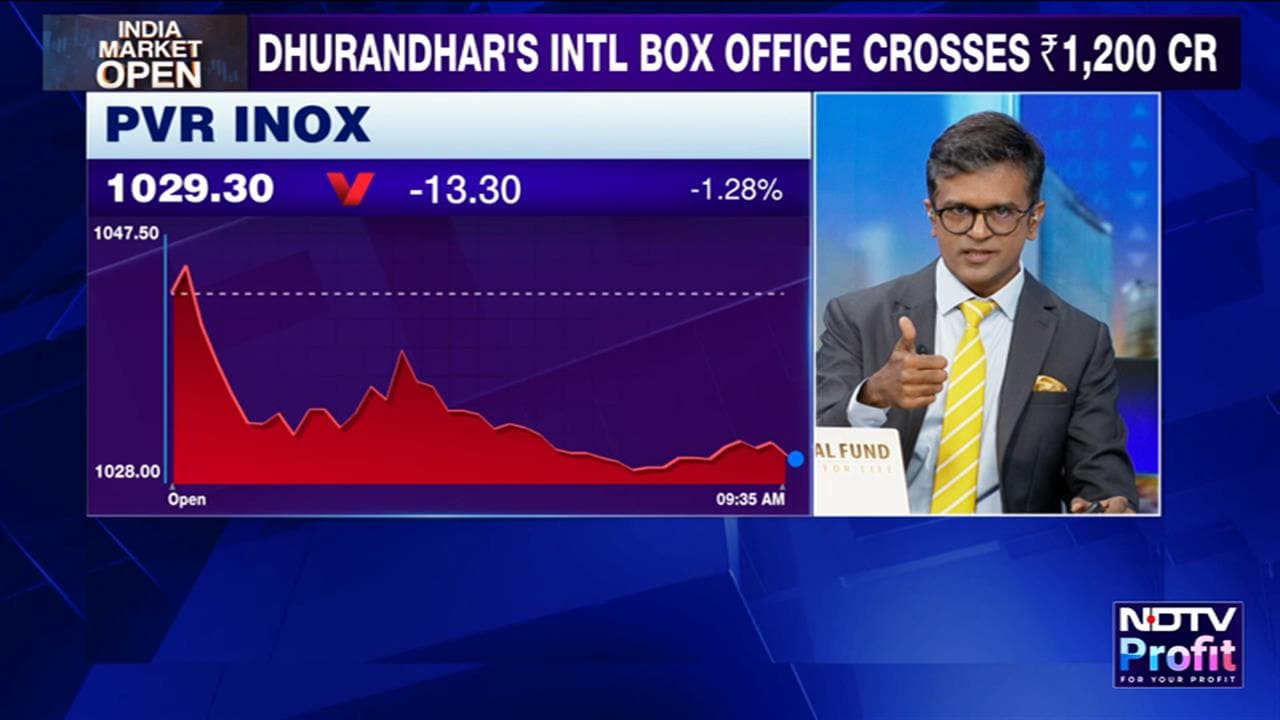

Watch LIVE TV, Get Stock Market Updates, Top Business, IPO and Latest News on NDTV Profit.