President-elect Donald Trump said he would impose additional 10% tariffs on goods from China and 25% tariffs on all products from Mexico and Canada, citing the levies as necessary to clamp down on migrants and illegal drugs flowing across US borders.

In posts to his Truth Social network that jolted financial markets on Monday, Trump claimed China had failed to follow through on promises to institute the death penalty for traffickers of fentanyl, writing that “drugs are pouring into our Country, mostly through Mexico, at levels never seen before.”

“Until such time as they stop, we will be charging China an additional 10% Tariff, above any additional Tariffs, on all of their many products coming into the United States of America,” Trump said.

In another post, the incoming president also vowed to hit neighbors Mexico and Canada with a 25% tariff on “ALL products,” saying he would sign an executive order to that effect on his first day in office.

“As everyone is aware, thousands of people are pouring through Mexico and Canada, bringing Crime and Drugs at levels never seen before,” he said. “This Tariff will remain in effect until such time as Drugs, in particular Fentanyl, and all Illegal Aliens stop this Invasion of our Country!”

Trump's tariff threats highlight how the incoming president aims to use trade levies to implement his policy agenda, despite concerns from some business leaders about the impact. It comes just days after he tapped Scott Bessent to be the next US Treasury Secretary, a move that was seen as potentially moderating the incoming president's tariff plans.

The Mexican peso fell more that 1% as traders reacted to the headlines about the proposal, while the Canadian dollar dropped about 0.5%. China's yuan edged lower offshore.

The Mexican Foreign Affairs Ministry and Economy Ministry didn't immediately respond to a request to comment. A representative for Canadian Finance Minister Chrystia Freeland also didn't immediately answer an inquiry.

Trump campaigned on pledges to implement sweeping tariffs on allies and adversaries alike, vowing to hike tariffs to 60% for all goods imported from China and to 20% for those brought in from the rest of the world — policies he says will help pressure companies to re-shore manufacturing jobs in the US and raise revenue for the federal government.

Ripple Effects

The Republican has long said he favors tariffs as a negotiating tool, even with US partners, and during the presidential campaign in 2024, he mused about replacing the federal income tax with revenue from tariffs. Most mainstream economists though have warned that Trump's levies would raise prices for consumers, fueling already high inflation and redirecting or reducing trade flows.

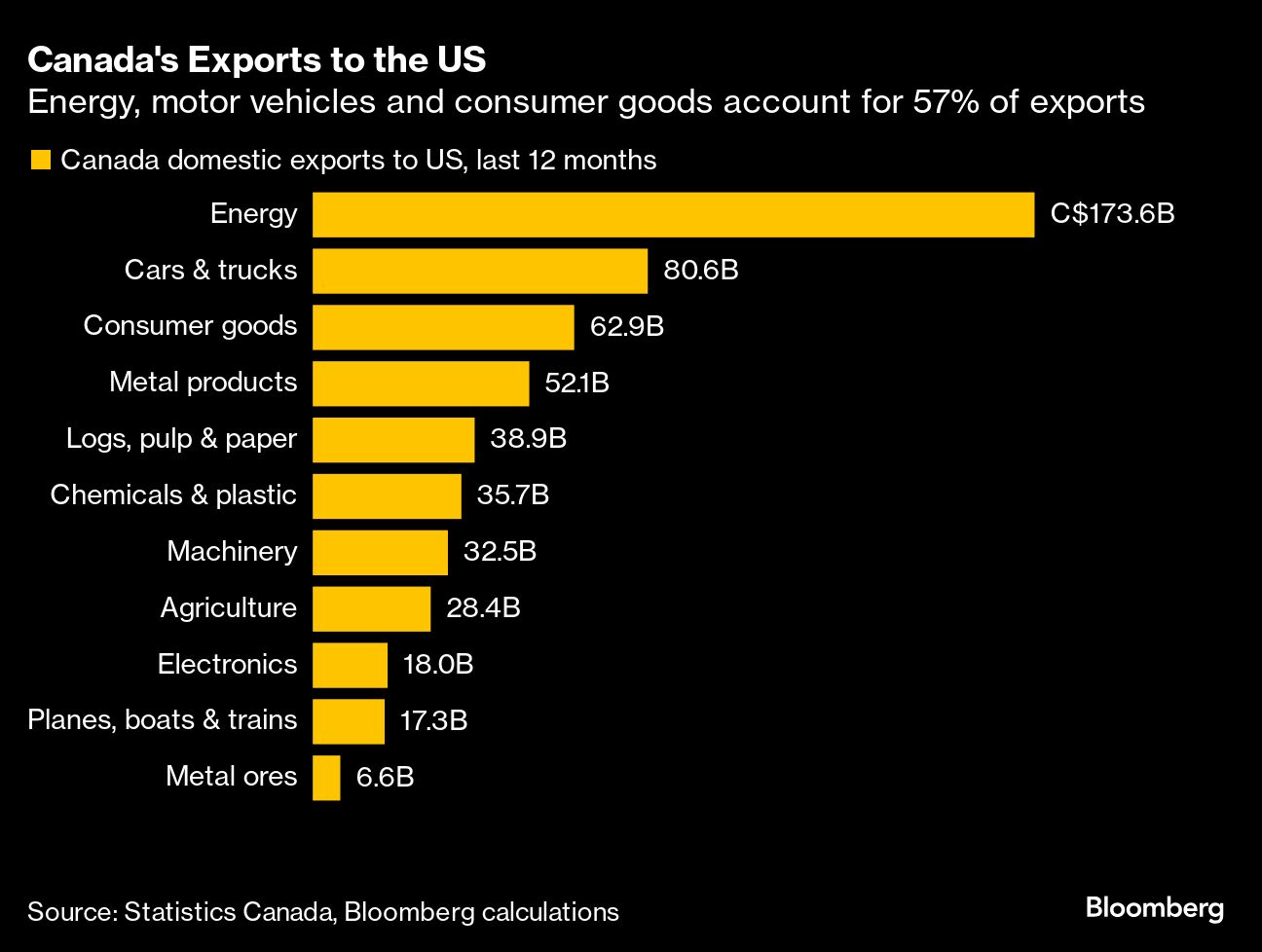

A 25% tariff applied to all imports from Canada would put pressure on energy costs. Oil, gas and other energy products are Canada's largest export to its southern neighbor; it's by far the largest external supplier of crude to the US. Wilbur Ross, Trump's former Commerce secretary, said earlier this month that duties on Canadian energy would raise prices for Americans and do little to boost US jobs.

Higher North American tariffs would upend the auto industry and other consumer sectors including food in which the three countries are highly integrated.

The move on Mexico and Canada would reignite a trade feud that simmered across the continental bloc during Trump's first term, where he forced a renegotiation of the North American Free Trade Agreement and imposed tariffs on certain sectors, including steel.

Currently, the re-branded trade pact, known as the United States-Mexico-Canada Agreement, allows for duty-free trade across a wide range of sectors. It's not clear what recourse American importers, who would pay the duties, would have under the pact to head off any levy.

Economic Team

Beyond Bessent, Trump still has a number of top economic roles to fill in his administration. One of the chief architects of Trump's tariff agenda, former United States Trade Representative Robert Lighthizer has yet to land a role in the second term.

Trump has also vowed to move quickly to secure the US border — one of the top issues for voters in November's presidential election — following a surge in migrants that taxed communities across the country and became a major political liability for President Joe Biden and Vice President Kamala Harris, the Democratic nominee.

The president-elect says he will carry out the largest mass deportation of undocumented migrants and to finish building the wall on the US-Mexico border that he started during his first administration. Last week, he confirmed his intention to use the US military to carry out the deportations.

Trump's team has also been taking shape with him selecting South Dakota Governor Kristi Noem to lead the Department of Homeland Security and Tom Homan, the former acting head of the US Immigration and Customs Enforcement agency, to serve as his border czar.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.