After a lean couple of years, bankers in Asia are seeing signs of a recovery in initial public offerings.

The number of Chinese firms considering public flotations in Hong Kong is increasing as the benchmark Hang Seng Index heads for its first annual gain since 2019. India has already notched up a record year in terms of funds raised from share sales, with more planned, while blockbuster deals are lighting up Tokyo's stock market.

Although the overall value of share sales in Asia may end this year below 2023's level, partly due to Beijing throttling the number of IPOs on mainland Chinese exchanges, dealmakers are optimistic next year will likely show improvement as Hong Kong's market picks up.

Among Chinese companies considering selling shares in Hong Kong are drugmaker Jiangsu Hengrui Pharmaceuticals Co., Chery Holding Co.'s automotive unit, condiment maker Foshan Haitian Flavouring & Food Co., Chinese express-delivery company SF Holding Co. and online retail platform Dmall Inc.

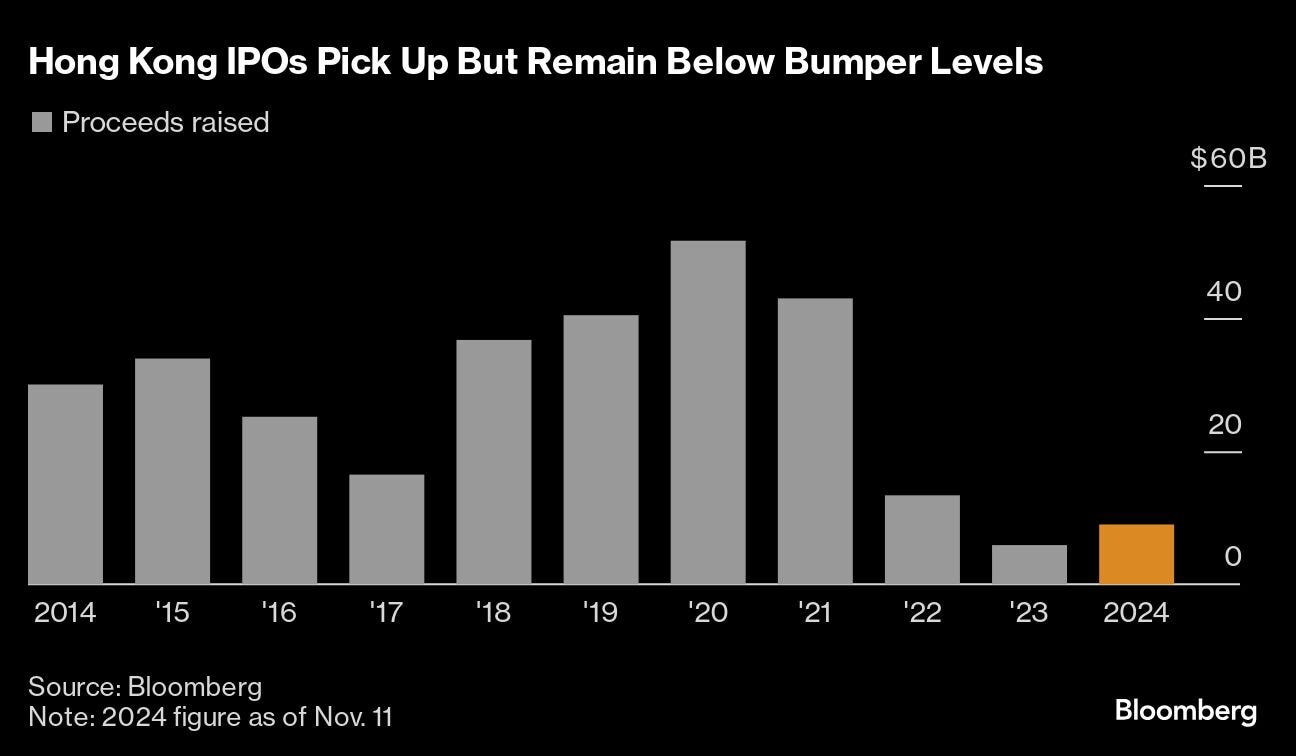

Hong Kong IPOs have raised about $9 billion this year, a significant increase from 2023's level of $5.6 billion — which was the lowest since 2001. The Hang Seng Index has climbed almost 20% this year, buoyed by the Chinese government's efforts to stimulate the economy. The gauge slumped an annual average of 12% in the past four years.

China is getting renewed focus from global investors, as the recent policy stimulus shows that Beijing is actively working to address deflation, said Cathy Zhang, head of Asia Pacific equity capital markets at Morgan Stanley.

“We've seen investors go from anything but China to all about China almost overnight,” said James Wang, co-head of Asia ex-Japan equity capital markets at Goldman Sachs Group Inc.

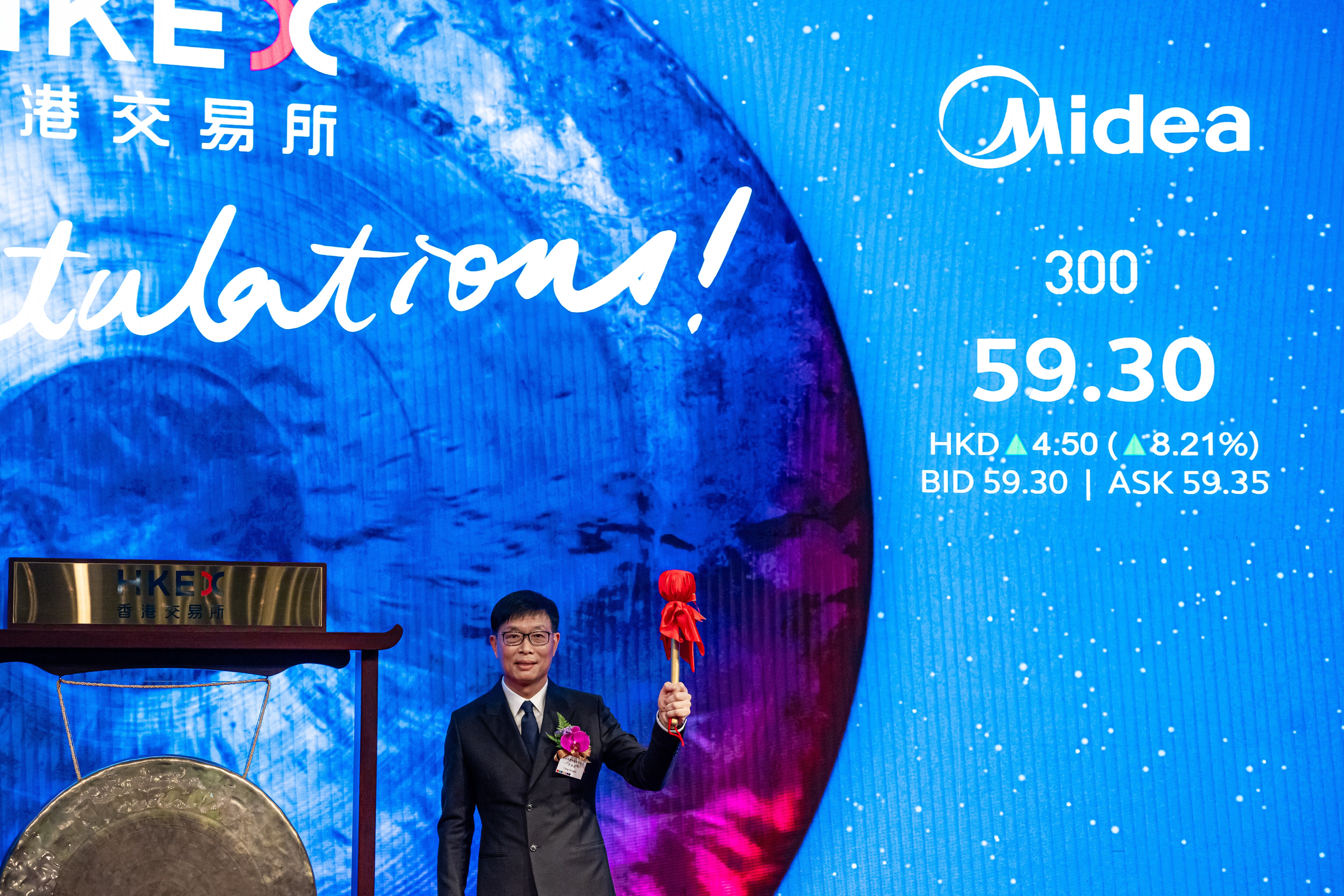

As a sign that companies are regaining confidence in Hong Kong's market, Midea Group Co. raised $4.6 billion in September in the city's biggest listing since early 2021. That was quickly followed by the $696 million float of Horizon Robotics and the slightly smaller listing of bottled water maker China Resources Beverage Holdings Co.

Midea's chairman and chief executive officer Fang Hongbo, during the company's listing ceremony at the Hong Kong Stock Exchange on Sept. 17. (Photographer: Lam Yik/Bloomberg)

There are risks ahead. Hong Kong's stock market has turned increasingly volatile, with a measure of 50-day price swings in the Hang Seng rising the highest since January 2023. Donald Trump's election victory means tensions between Beijing and Washington could worsen. And it's unlikely the city's bourse will return to the heady days of pre-2023, when companies were raising about $30 billion on average a year for a decade.

The long reach of Chinese regulators may also pose another hurdle for certain companies in the world's second-biggest economy to carry out transactions.

In order to see a sustained increase in IPOs, Chinese stocks will need to do well for a few quarters given their longer-term underperformance, said Jason Hsu, the Boston-based chief investment officer at Rayliant Global Advisors.

Despite an improved pipeline, ECM underwriting fees have plunged 70% in China this year driven by a sharp decline in IPO fees, according to LSEG data. That compares with a more than 80% increase in India, where companies have raised a record $49 billion through first-time and secondary share sales.

India's IPO pipeline for next year is significant, supported by growing demand from both international and local investors, according to Saurabh Dinakar, co-head of Asia Pacific global capital markets at Morgan Stanley.

“We are spending more time on India than ever before,” Dinakar said. “There is clearly a buzz.”

Last month, Hyundai Motor India Ltd. raised $3.3 billion in the nation's largest-ever IPO. LG Electronics Inc. is moving ahead with a flotation of its India unit which may raise as much as $1.5 billion, Bloomberg News reported on Monday.

Confetti falls during the listing ceremony of Hyundai Motor India Ltd. at the National Stock Exchange (NSE) in Mumbai on Oct. 22. (Photographer: Dhiraj Singh/Bloomberg)

India's IPO pipeline for next year is significant, supported by growing demand from both international and local investors, according to Saurabh Dinakar, co-head of Asia Pacific global capital markets at Morgan Stanley.

“We are spending more time on India than ever before,” Dinakar said. “There is clearly a buzz.”

Last month, Hyundai Motor India Ltd. raised $3.3 billion in the nation's largest-ever IPO. LG Electronics Inc. is moving ahead with a flotation of its India unit which may raise as much as $1.5 billion, Bloomberg News reported on Monday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.