I wonder whether Professor Arthur Laffer has ever visited Mumbai or picked up a smattering of Marathi, the preferred language of the Shiv Sena-led coalition government in Maharashtra? I reckon the answers to my unusual questions would be “no, and no”, but equally, I may have tickled your curiosity enough for you to ask, “what's this guy up to, has he lost it?”. So, let me explain.

Professor Arthur Laffer is a renowned American supply-side economist with Yale, Stanford, Ronald Reagan, and Donald Trump on his resume'. One fine evening in 1974, he was at dinner with Dick Cheney, Donald Rumsfeld, and Jude Wanniski at the Two Continents Restaurant at Washington Hotel. While Laffer doesn't recall his historic flourish, Wanniski insists Laffer drew a distorted bell curve on a napkin to convince his audience that President Gerald Ford's tax hikes would fail, since beyond a point of inflection, tax revenues fall even when tax rates are increased.

Laffer's napkin theory was neither unique nor original. It was propounded six hundred years earlier by Islamic Scholar Ibn Khaldun in Muqddimah, and later endorsed by such worthies as Adam Smith, John Maynard Keynes, and Andrew Mellon. But the legend got fastened on Professor Laffer that fateful evening. The theory's popular inversion that “tax revenues could rise if rates are cut” became known as the Laffer Curve for charismatic converts like President Reagan, who slashed peak taxes from 70% to 28% in 1981 at Laffer's bidding. Several academicians have refuted the Laffer Curve, but that hasn't diminished its sexy appeal for conservative politicians – remember Donald Trump's big slash down to 21%?

Mumbai's Property Market Flies Off The Laffer Curve

So far so good, but what's cooking between Amchi Mumbai and Laffer Curve? Well, if Professor Laffer was looking for a stunning vindication of his theorem, he's got it from the property market in the megapolis. On Aug. 26, 2020, the administration in Mumbai did what few statist Indian governments do, i.e. they hacked the stamp duty on property transfers to kick life into the Covid-dead real estate market. The 5% rate was brutally trimmed to 2% until Dec. 31, 2020.

Maharashtra cabinet takes the decision to reduce stamp duty in the state for a limited period. pic.twitter.com/hrF9Wp5BZX

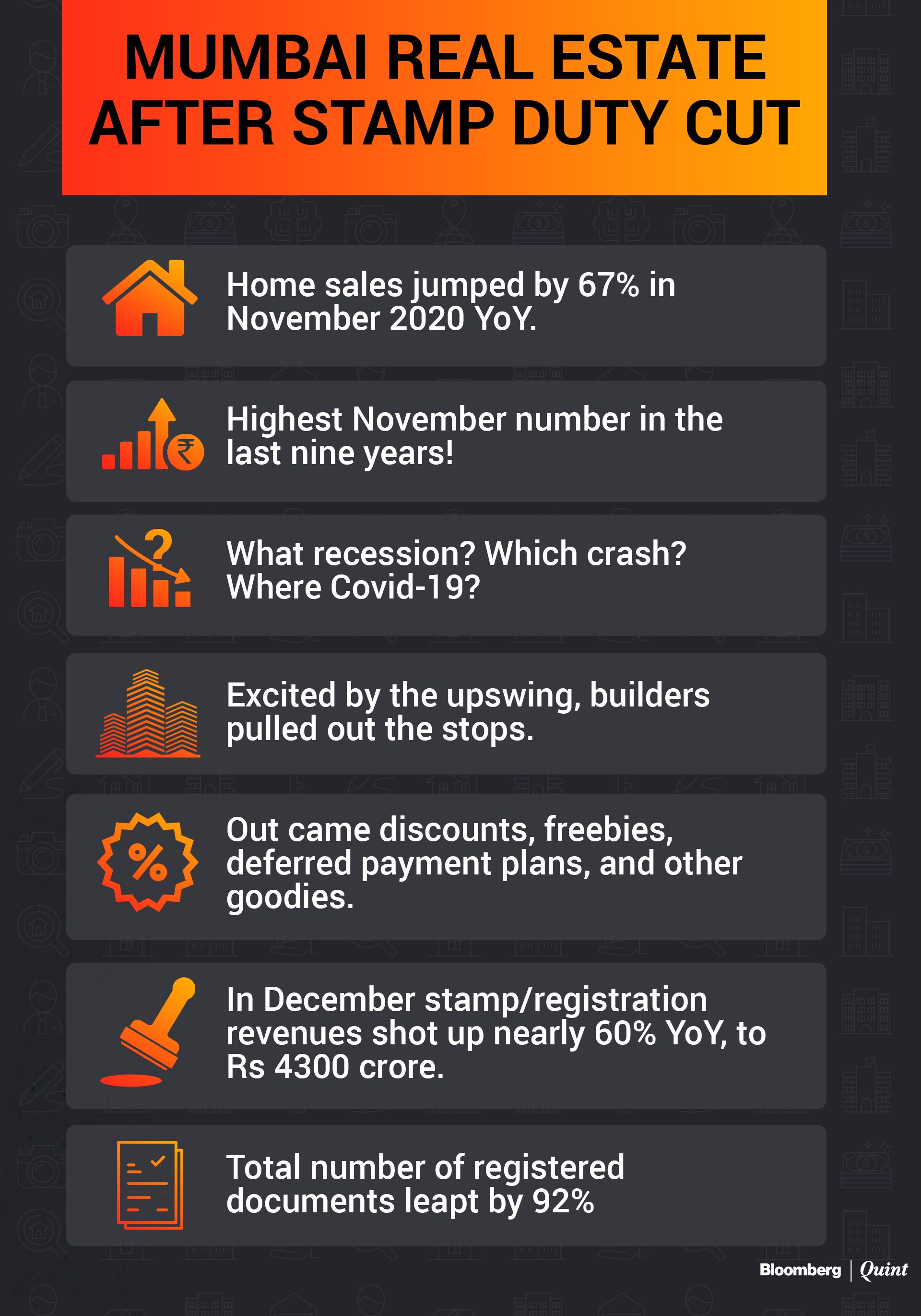

The impact was magical:

The state's finance minister couldn't stop crowing: “It has put our economy back on track. In four months, registrations are up by 48% and the revenue by Rs 367 crore as compared to the same period last year”. He didn't say it in as many words, but what recession? Which crash? Where Covid-19?

Why Finance Minister Sitharaman Should Consider Some ‘Fiscal Heresy'

Finance Minister Nirmala Sitharaman is all over television asking all and sundry to give her adventurous ideas because “this union budget is going to be the most important one in 100 years”. I couldn't agree more. It's critical to reboot a comatose economy. But the ideas she seems to be getting are more of the ‘same same':

- Increase/slap surcharge on the super-rich and long-term capital gains taxes (yuck, please resist!);

- Hike customs duties to give greater atmanirbharta (protective self-reliance) to Indian industry;

- Sprinkle a little more interest subvention on affordable housing,

- Enhance outlays on healthcare and infrastructure;

- Sell a few more public sector shares,

- Recapitalise some battered banks etc. etc. etc.,

- And don't worry if the fiscal deficit slips by a few basis points.

In short, Dear Minister, be a tiny bit more aggressive but stick to the tried, tested, and tired playbook.

I violently disagree.

This is the time to think out of the box, and perhaps invite Professor Arthur Laffer to dinner at the Golden Dragon Restaurant at Taj Colaba, hoping he would draw another bell curve on the napkin.Yes, It's The Time To Cut Taxes

With the economy contracting 8% now but bouncing 10% next year, it will reclaim the values of FY20. In fact, FY22 could be identical to FY20. So, if we were to work on the real numbers of that year, we would be pretty accurate about our math next year:

- The central government collected nearly Rs 20 lakh crore in corporate, personal income, GST, and excise taxes that year (it also earned Rs 1.25 lakh crore in customs duties, but for obvious reasons of amplifying domestic demand, I am not advocating a cut in this levy). After handing over approximately Rs 6.50 lakh crore to the states, the center kept Rs 13.50 lakh crore with itself.

Just like the Maharashtra government cut stamp duties by 60%, what if the central government were to announce a one-time/one-year tax cut of 50% in FY22, i.e. theoretically giving a demand stimulus of Rs 6.75 lakh crore, or about 3% of GDP?

- How much would that propel private consumption expenditure, since everything, from houses to cars to alcohol to apparel to gym equipment to whatever would become significantly cheaper? I won't speculate on exact percentages, except to say...

The demand booster could add an extra Rs 10-20 lakh crore to economic output, benchmarked to how Mumbai's property market reacted to the duty cuts.

- Such a huge demand jump would inevitably add Rs 1-2 lakh crore in additional taxes for the central government, thereby reducing the size of the tax giveaway, as the Laffer Curve kicks in on the extraordinary spike in private consumption expenditure.

So, the additional fiscal deficit—aka demand stimulus engineered by the government—which our conventional policymakers dread, could drop from the ‘heretical' 3% to between 1-2% of GDP. Fortune would indeed favor the brave – just by daring to take a big risk, the risk would diminish itself!That is the beauty of a government policy that is entrepreneurial.

To conclude: Dear Finance Minister Sitharaman, this is the time to shed convention, dogma, fear, and stasis. Go for broke. Listen to ‘fiscal heresy'. Cut taxes. Yes, I've exaggerated for impact, but the principles are inviolable. If 50% is a tad too heretical for you, jump start with a 33% slash. If you want to hedge your bet, try it for a limited six-month window—a la the loan moratorium—not the whole year. But do go ahead, surprise, and delight yourself!

Raghav Bahl is the co-founder and chairman of Quintillion Media, including BloombergQuint. He is the author of three books, viz ‘Superpower?: The Amazing Race Between China's Hare and India's Tortoise', ‘Super Economies: America, India, China & The Future Of The World', and ‘Super Century: What India Must Do to Rise by 2050'.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.