Varun Beverages Ltd.'s profit rose in the third quarter of calendar year 2024, beating analysts' estimates.

The company's net profit rose 22% year-on-year to Rs 628.8 crore in the July–September period, according to an exchange filing on Tuesday. This compares with a Rs 557 crore consensus estimate of analysts tracked by Bloomberg.

Key Highlights From Q3 Results:

Revenue up 25.25% to Rs 4804.7 crore. (Bloomberg estimate: Rs 4,711 crore).

Ebitda up 30.5% to Rs 1,151.1 crore. (Bloomberg estimate: Rs 1,053 crore).

Ebitda Margins rose 116 bps to 23.95%. (Bloomberg estimate: 22.4%).

Net profit up 22.3% to Rs 628.8 crore. (Bloomberg estimate: Rs 557 crore).

Varun Beverages reported a robust 21.9% year-on-year growth in consolidated sales volumes for the third quarter, reaching 26.75 crore cases, up from 21.95 crore cases in the corresponding quarter a year earlier. This figure includes contributions from acquisitions like South Africa's BevCo and foray into Democratic Republic of Congo, which added approximately 3.4 crore cases during the quarter.

Despite heavy rainfall impacting operations, India's sales volume still managed to grow by 5.7%, while international volumes expanded organically by 7.9%. In terms of product mix, carbonated soft drinks (CSD) accounted for 75% of total sales, packaged drinking water made up 21%, and juices and bottled drinks (JBD) contributed 4%.

On the financial front, Varun Beverages saw a slight improvement in gross margins, which rose by 22 basis points to 55.5% in quarter under consideration. The company's focus on operational efficiencies led to a 117-basis-point increase in Ebitda margins, now standing at 24.0%.

A notable shift was also observed in consumer preferences, with nearly 49% of the company's consolidated sales volumes in nine months of calendar year 2024 coming from low-sugar or no-sugar products, highlighting a growing trend towards healthier beverage options.

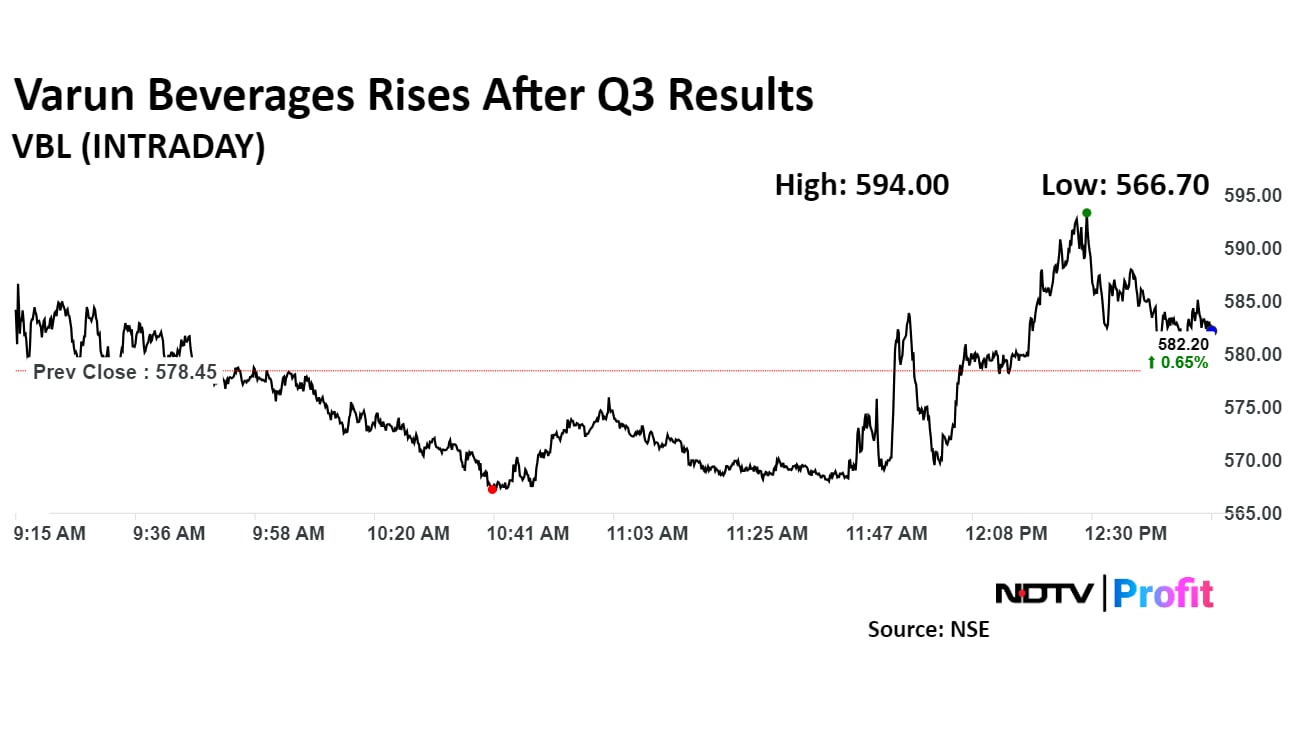

Shares of Varun Beverages spiked to intraday high of Rs 594 apiece, or 2.7% up, before cooling off to trade 0.65% higher at Rs 582.2 per share around 12:55 p.m. Meanwhile, the benchmark Nifty 50 was trading 0.7% lower.

The stock has risen 17.63% year-to-date and 57.09% in the past 12 months. The total traded quantity stood at 1.06 times the 30-day day average. RSI for the counter was 49.25.

Out of the 23 analysts tracking the company, 20 maintain a 'buy' rating, three recommend a 'hold,' and none suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 23.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.

:max_bytes(150000):strip_icc():focal(722x523:724x525):format(webp)/Savannah-Guthrie-mother-Nancy-Guthrie-020226-02-0368cb6ddb864bf09919fd100fe546b0.jpg?im=FeatureCrop,algorithm)