State Bank of India's profit missed estimates for the three months ended March as provisions stood at Rs 16,500 crore.

India's largest lender reported a net profit of Rs 840 crore in the January-March period, compared with a Rs 7,719-crore loss in the same quarter last year, according to its Q4 results. That's much lower than the 4,840 crore estimated by analysts tracked by Bloomberg.

“It looks like they have front-loaded their provisions and that has resulted in the net income missing the estimate,” Rati Pandit, analyst at Sunidhi Securities & Finance Ltd. told Bloomberg.

Provisions nearly doubled to Rs 16,501 crore from around Rs 8,670 crore in the previous quarter. Of this, Rs 11,000 crore came from just three accounts, Essar Steel Ltd., Alok Industries Ltd. and Bhushan Power & Steel Ltd., the bank said. The provision coverage ratio went up to 78.73 percent.

Provisions, however, fell 41 percent on a yearly basis. The bank set aside Rs 3,984 crore in financial year 2018-19 towards arrears of wages due for revision, the lender said in the filing. The bank wrote off loans worth more than Rs 17,000 crore during the January-March period.

Rajnish Kumar, chairman at SBI, said this is a “balance sheet management exercise” to reduce the level of chunky bad loans on the bank's books.

Other Highlights:

- Total advances rose 13 percent year-on-year.

- Deposits rose 7.6 percent year-on-year.

- Net slippage at Rs 7,505 crore

- Additions due to ageing of NPAs at Rs 456 crore

- Gross slippage at Rs 7,961 crore

- Recoveries & upgrades at Rs 5,712 crore

Net interest income of the lender rose 15 percent year-on-year to Rs 22,954 crore, lower than the Rs 23,796-crore estimate.

Also, the bank's asset quality improved during the quarter. Gross non-performing assets ratio contracted to 7.53 percent in the fourth quarter of financial year 2018-19 from 8.71 percent in the year-ago period. Net NPA ratio also contracted to 3.01 percent from 3.95 percent. “Asset quality has improved and we expect the provisions to be lower as the year progresses,” Pandit said.

“It seems that the bank has opted to go for a balance-sheet cleanup. If you see the provision numbers, they have moved up significantly sequentially,” Lalitabh Shrivastawa, banking analyst at Sherkhan, said. “Simultaneously, GNPA and NNPA has also moved down.”

‘Balance Sheet Repaired'

SBI's Kumar said the balance sheet of the bank has been fully repaired and that the “shadow of the past” will not affect the bank's financials.

On Jet Airways

SBI has received two unsolicited bids and is likely to receive one more today, Kumar said at the press conference when asked about the Jet Airways (India) Ltd.'s crisis.

“SBI, as the leader of consortium for Jet Airways, has made disproportionate effort to keep the airline up,” he said, adding that the lender has already made more than required provisions.

On Path Ahead

- Will shift to data analytics in a big way in the next 12 months; that will help in curtailing frauds.

- For loans below Rs 10 lakh, we want to improve performance in underwriting.

- In pre-approved personal loans, the bank has already underwritten Rs 3,800 crore this year, thanks to analytics, without any delinquencies.

- Have sufficient cushion to absorb any costs that might hit the bank.

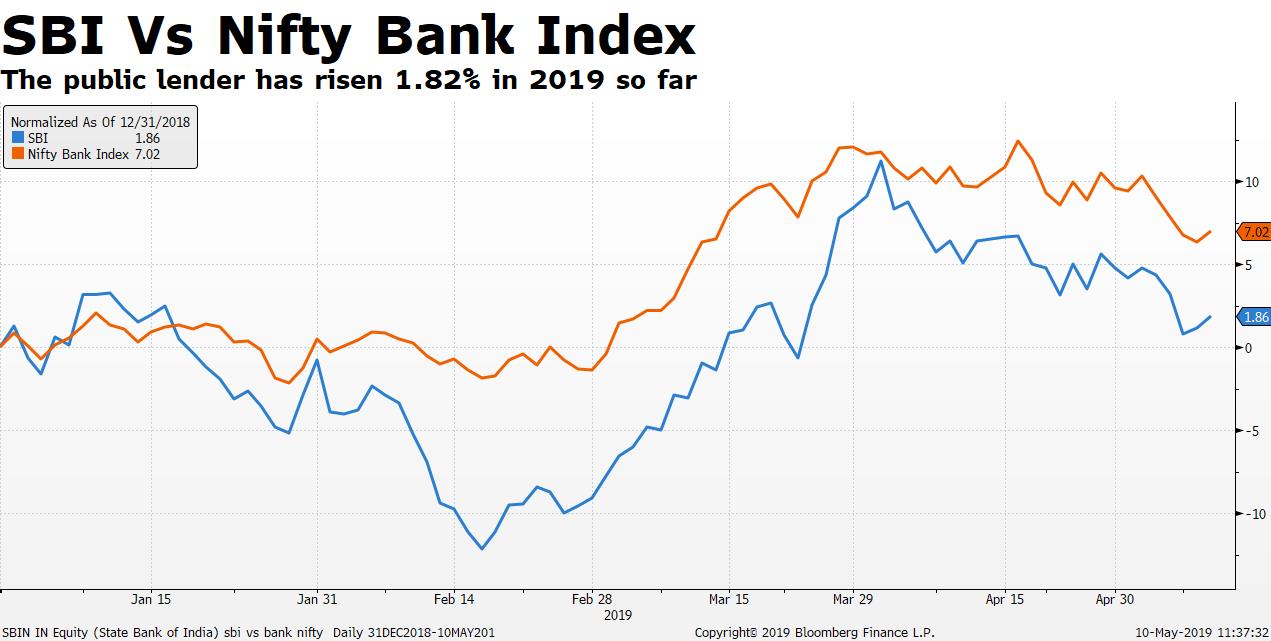

SBI share prices rose as much as 3.8 percent to Rs 311 after falling 2.3 percent post the Q4 results announcement. The stock has risen 1.82 percent in 2019 so far compared with a 6.99 percent rise in the NSE Nifty Bank Index.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.