18_04_2024..jpg?downsize=773:435)

Paytm's stock fell by 5% on Tuesday following the company's quarterly earnings report, despite posting a net profit of Rs 930 crore for July-September quarter of fiscal year 2025.

Analysts had anticipated a loss of Rs 631 crore, but the profit was largely attributed to a one-time gain, making it not directly comparable to previous earnings. The one time gain came from the company's sale of its events and movies ticketing business to Zomato Ltd., which generated Rs 1,345 crore after accounting for transaction costs.

The company's revenue increased by 10.5% year-on-year to Rs 1,660 crore, compared to Rs 1,502 crore in the previous quarter. Additionally, Paytm's Ebitda loss narrowed to Rs 403 crore from Rs 792 crore in the prior quarter, indicating improved operational efficiency. However, when adjusted for the one-time gain, the loss stands at Rs 415 crore, reflecting ongoing challenges.

In the June quarter, the fintech reported a widening net loss of Rs 838 crore compared to Rs 357 crore in the same period last year.

This ongoing trend of increased losses, even with a reported profit, has put pressure on the stock. Paytm also announced that it would provide default loss guarantee toward its merchant lending business. To this effect, the company has provided Rs 225 crore to non-bank lending partner SMFG India Credit.

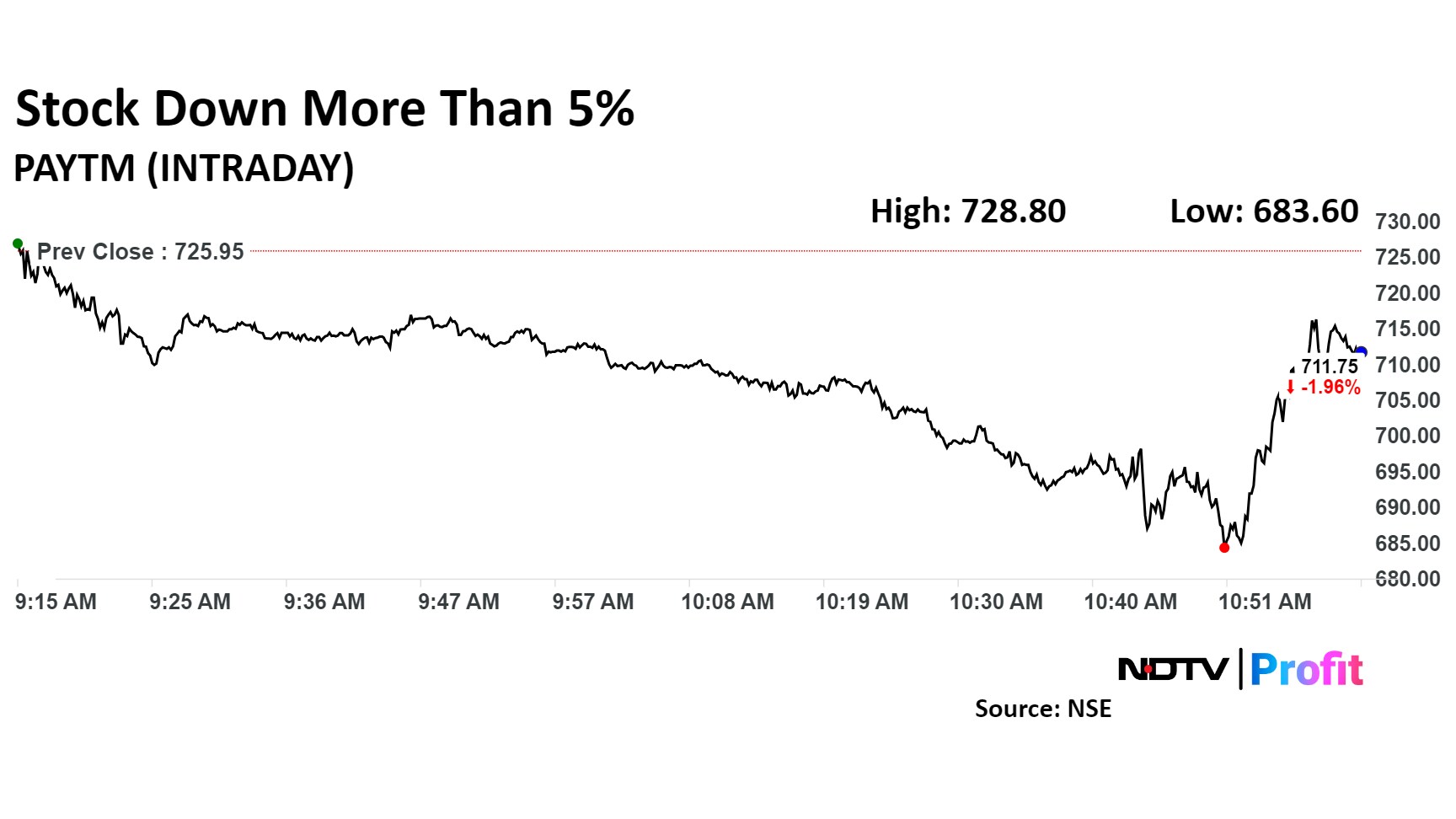

The scrip fell as much as 5.83% to Rs 683.6 apiece, It pared losses to trade 1.3% lower at Rs 716 apiece, as of 10:59 a.m. This compares to a 0.2% decline in the NSE Nifty 50 Index.

It has fallen 22.6 % in the last 12 months. Total traded volume so far in the day stood at 0.55 times its 30-day average. The relative strength index was at 54.

Out of 18 analysts tracking the company, six maintain a 'buy' rating, six recommend a 'hold,' and six suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downsideof 6.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.