Just Dial Ltd.'s net profit more than doubled in the September 2024 quarter to Rs 154 crore, leading to a rally of nearly 10% in its shares on Friday.

The net profit during the quarter under review has climbed by 114.4%, as compared to Rs 71.8 crore in the year-ago period.

Sequentially, the net profit has climbed by 9.21% as compared to Rs 141 crore in the first quarter of the current fiscal.

The company's consolidated revenue from operations during the period under review rose 9.2% on-year and 1.5% sequentially to Rs 284.8 crore. Its earnings before interest, taxes, depreciation, and amortisation, or Ebitda, rose 1.7% to Rs 82 crore. The Ebitda margin climbed by 100 basis points to 28.8% quarter-on-quarter.

In the first quarter, the company had reported a 69.3% year-on-year jump in bottom-line. It posted a net profit of Rs 141.2 crore for the quarter ending June 2024.

Just Dial's revenue from operations had rose 13.6% to Rs 280.5 crore in the June quarter as against Rs 247 crore in the year-ago period.

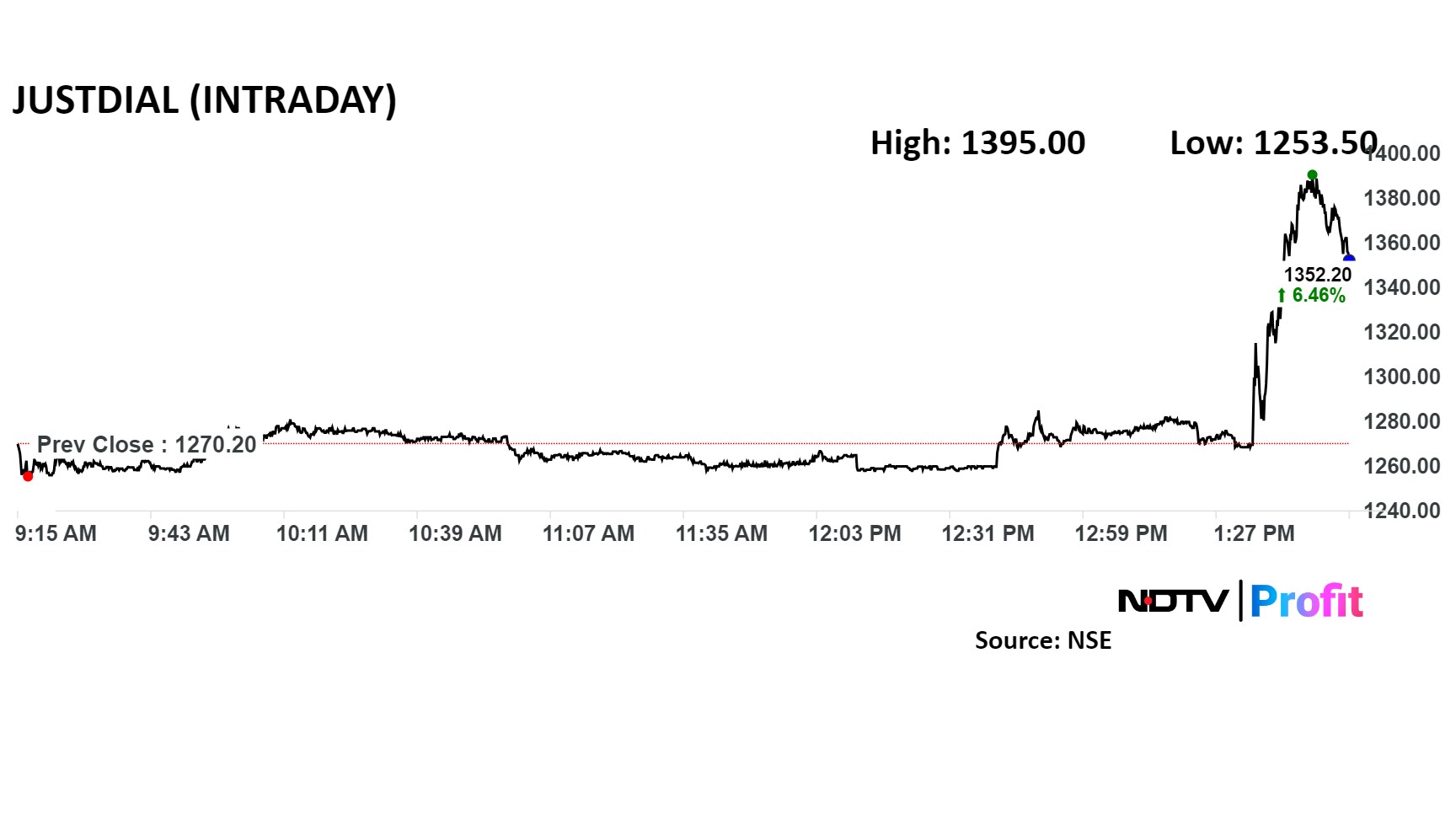

Shares of Just Dial jumped 9.8% to Rs 1,395 apiece on the NSE after the September quarter results were declared. By 3:17 p.m., it pared much of the gains to trade 2.8% higher at Rs 1,306 per share, compared to a 0.13% decline in the benchmark Nifty 50.

The stock has gained 62.5% on a year-to-date basis, and by 75.7% over the past 12 months.

Six out of the nine analysts tracking the stock have a "buy" rating, one suggests a "hold", and two recommend a "sell", as per Bloomberg data. The average of 12-month analysts' price target implies a potential downside of 5.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.