DB Corp Ltd. reported nearly a 50% jump in its bottom line on a yearly basis for the first quarter of the financial year ending March 2025, driven by the growth in its advertising revenue.

The print media company reported a net profit of Rs 118 crore in the April-June quarter, as compared to Rs 79 crore registered during the same period last year, according to its stock exchange notification.

Revenue of the company rose 6.4% year-on-year to Rs 590 crore, the company said. The advertising revenue of the company rose by 8.4% to Rs 427 crore during the quarter on a high base and was underpinned by 'robust market alignment.'

The operating income—or the earnings before interest, tax, depreciation and amortisation—rose 41% on a yearly basis to Rs 164 crore, while the Ebitda margin expanded to 27.9% from 31% recorded during the same period last year.

The growth in Ebitda was led by the improvement in advertisement revenue with effective cost control measures and softening newsprint prices, the statement said.

The company is maintaining their growth trajectory across their print, radio, and digital platforms, underscoring the robustness of the omnichannel strategy and the underlying demand for our media offerings, according to Sudhir Agarwal, managing director, DB Corp. "Our Digital platform with currently 18 million monthly active users is a powerful pillar of growth."

Separately, the company has announced an interim dividend of Rs 7 per equity share.

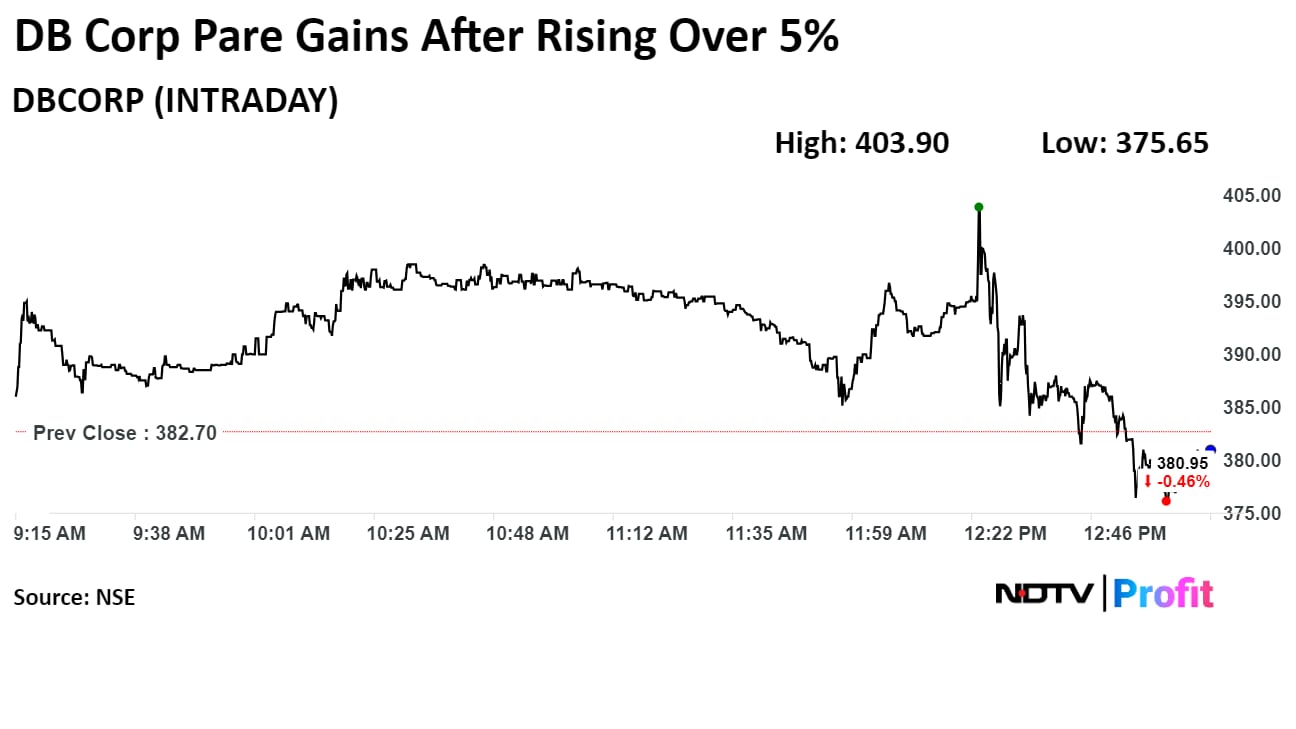

Shares of DB Corp's rose as much as 5.54% after the announcement of results to a seven-year high of Rs 403.9 apiece on the NSE. It was trading 0.71% lower at Rs 380 apiece, compared to a 0.26% advance in the benchmark Nifty 50 as of 1:08 a.m.

It has risen 102% in the last 12 months and 42% on a year-to-date basis. The relative strength index was at 68.

Four out of the five analysts tracking the company have a 'buy' rating on the stock, and one suggests a'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.