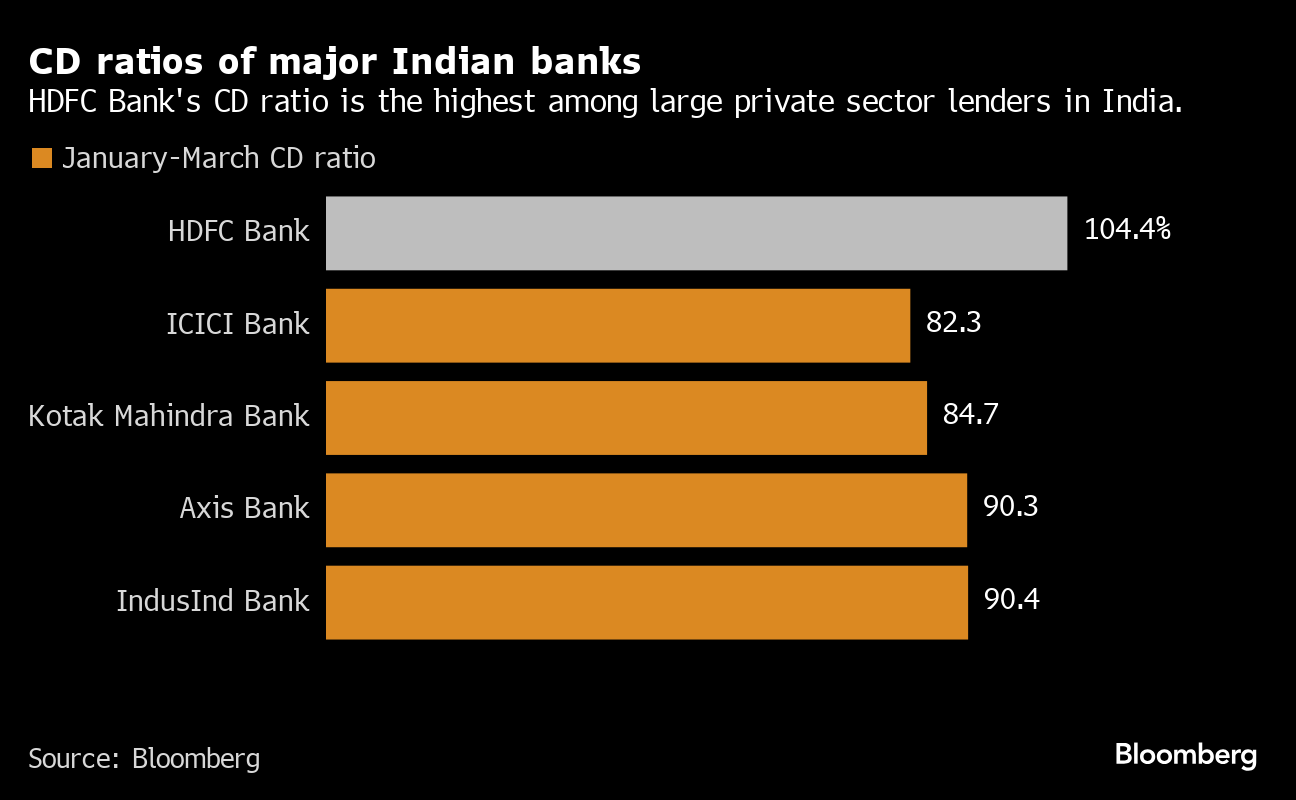

(Bloomberg) -- Earnings growth at India's banks will be weighed down by their struggle to rapidly grow customer deposits amid robust demand for loans, with lenders like HDFC Bank Ltd., Kotak Mahindra Bank Ltd. and Axis Bank Ltd. grappling with high credit-deposit ratios.

The Reserve Bank of India has advised lenders to maintain more a prudent credit-deposit ratio with Governor Shaktikanta Das stressing that the growth in deposits should keep pace with expansion in loans, he told CNBC-TV18 earlier in January. While the RBI has not set a target ratio, analysts see 70% to 80% as a comfort level. HDFC Bank's is well past 100%, and a pre-earnings update showed deposits were flat on quarter, and advances fell slightly. CEO Sashidhar Jagdishan said the bank aims to bring the ratio down to levels seen before its merger with its parent and would grow loans slower than deposits until the adjustment is done.

Kotak Mahindra Bank is investing more to strengthen its data security and risk management systems after the RBI barred the lender in April from adding new customers through its digital channels and from issuing fresh credit cards citing deficiencies and non-compliance in various processes.

Demands for agriculture loan waivers from farmer groups, if allowed, may also upset credit quality at the country's banks, analysts said. Any proposal related to farm credit will be in focus in next week's federal budget. Engineering firm Larsen & Toubro Ltd., with sizable revenue generation from government contracts, stands to benefit if the budget proposes higher infrastructure spending, while consumer goods firm Hindustan Unilever Ltd. will gain from pro-consumption policies.

Highlights to look out for:

Saturday: HDFC Bank (HDFCB IN) and Kotak Mahindra Bank (KMB IN) should grow profit 31% and 8.9% respectively, per consensus estimates. HDFC Bank's credit-deposit ratio is projected at 104%, while Kotak Mahindra's is 84%. Kotak Mahindra's capital gains from selling a majority stake in its general insurance arm to Zurich Insurance will likely be utilized for making general and contingency provisions, according to analysts at Nuvama.

Tuesday: Nidec (6594 JP) first-quarter net income is expected to decline by nearly a third, weighed by lower operating profit across segments including automotive products, electronic and optical components, consensus estimates show. That said, the Japanese electronics part maker, together with its peers may benefit from a gradual rebound in local demand for car parts, according to Bloomberg Intelligence.

- Hindustan Unilever (HUVR IN) probably saw muted growth in first-quarter revenue as there was only a slight pick up in volume expansion. The sweltering summer likely boosted sales of ice cream and cold drinks, but limited the sales of tea and coffee and out-of-home consumption. The forecast for an above-normal monsoon should be positive for the firm.

- Bajaj Finance's (BAF IN) profit growth may slow slightly to 16% in a seasonally weak quarter for lending. Assets under management grew 31%, the firm said in a pre-earnings update.

Wednesday: SK Hynix (000660 KS) could have an edge over its competitors with high demand for its product line-up and higher average selling price, said Korea Investment & Securities. Operating income in second-quarter likely surged about two fold, while revenue for its DRAM products rose 130%, according to estimates.

- Axis Bank (AXSB IN) may report softer business growth in the first quarter, and lower deposit growth, according to ICICI Securities. The Indian lender's net interest margin is also expected to be lower by less than 10 basis points on quarter, it added.

- Larsen & Toubro's (LT IN) revenue growth in the core infrastructure segment should slow to about 14% as the company completed projects ahead of Indian elections and as labor availability was hit by voting and heat waves. The firm, buoyed by a recent rating upgrade, hopes to increase its share of international orders, aiming for a 10% share of Saudi Aramco's annual spending.

Thursday: Nissan Motor (7201 JP) first-quarter earnings may be supported by lower material costs and a weak yen, despite intense competition slowing its sales, BI said. Watch for comments on EV battery space, after Nikkei reported that Nissan plans to develop a system that manages health and performance of batteries digitally with other Japanese companies.

Friday: Contemporary Amperex Technology (300750 CH) may see headwinds as US lawmakers propose the Chinese battery maker should be added to an import ban list, but earnings impact might be limited as most of their batteries are sold within China and Europe, according to a BI note in June. Still, long-term regulatory challenges could persist in its US expansion. The firm is also in talks to launch a $1.5 billion fund to expand its global supply chain.

--With assistance from Shinhye Kang.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.