Syngene is a subsidiary of Biocon Ltd..jpg?downsize=773:435)

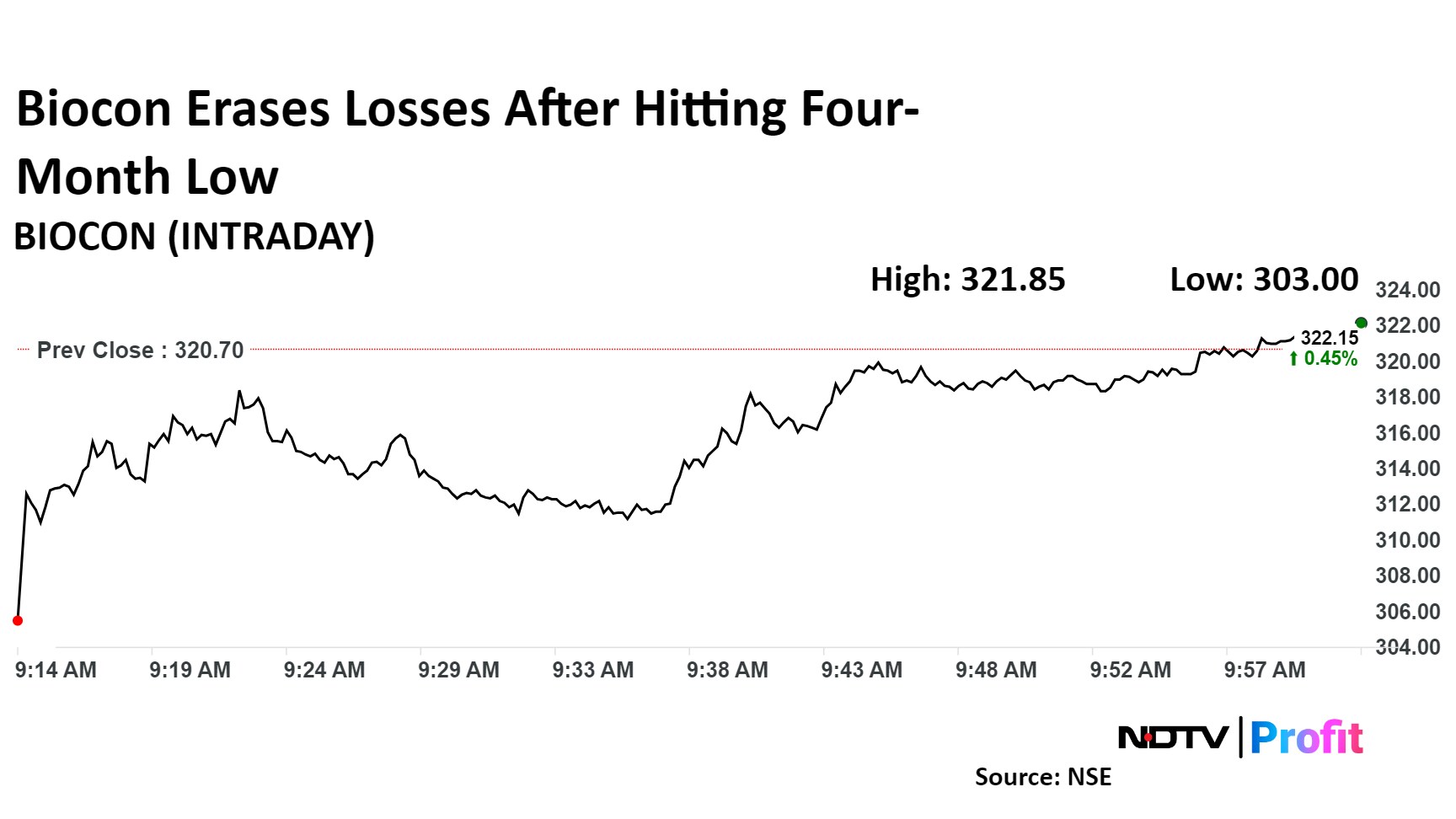

Biocon Ltd.'s share price recovered from its four-month low on Thursday after its second-quarter profit beat analysts' estimates.

The company's net profit declined 84.3% on year to Rs 27.1 crore against Bloomberg's consensus estimate of Rs 24 crore. Revenue was up 3.7% to Rs 3,590 crore compared to Rs 3,623 crore estimated.

Currency headwinds in the biologics segment, pricing challenges, and a planned shutdown in the generics segment affected the overall performance of the company in the second quarter of fiscal 2025, according to Motilal Oswal.

"Despite these challenges, Biocon delivered improved profitability sequentially thanks to a strong revival in its Syngene business," it said. "It also continued to gain decent market share by volume in its key biosimilars in the US and EU. New launches, including liraglutide in the UK market, should boost the outlook of its generic segment in the second half of FY25."

The brokerage maintained its 'neutral' stance but lowered the target price from Rs 340 to Rs 300, implying a downside of 6.3%.

Nuvama has also slightly lowered its target price for the stock from Rs 315 to Rs 310, implying a 3% downside while maintaining a 'hold'. It said that the target price cut was due to a reduction in generic value and rollover to December 2026.

The company experienced a muted performance in the first half of this fiscal year, as anticipated, and it eagerly anticipated a pickup in the second half, the brokerage said. "Management has maintained its stance that H2FY25 should see an improvement due to continuing recovery in Syngene, momentum in biosimilars, and new launches in generics coupled with cost efficiency programs."

"With the recent debt refinancing at a lower cost, we await the benefits to flow through to aid profitability. The continued investment in peptides in the generics business along with additional capabilities and capacities in areas such as ADCs and oligonucleotides are welcome," it said.

Shares of the company fell as much 5.52% to Rs 303 apiece, the lowest level since June 5. It pared losses to trade 0.8% lower at Rs 318.10 apiece, as of 10:37 a.m. This compares to a 0.3% decline in the NSE Nifty 50 Index.

The stock has risen 27.7% on a year-to-date basis and 45.4% in the last 12 months. Total traded volume so far in the day stood at 2.85 times its 30-day average. The relative strength index was at 36.94.

Out of 18 analysts tracking the company, eight maintain a 'buy' rating, three recommend a 'hold,' and seven suggest a 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 5.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.