Greater high-frequency trading activity leads to wider bid-ask spreads, leading to unfavourable prices, according to a highly cited research paper, as mentioned in NSE's latest monthly report.

High-frequency trading, or HFTs, are a type of algorithmic trading technique that utilises high frequency financial data and electronic tools for trading. These have three essential elements—high speed, high turnover rates, and high order-to-trade ratios.

This correlation between HFTs and widening of bid-ask spreads comes from liquidity-demanding orders as opportunities get bought into and priced in, according to the study authored by Mahendrarajah Nimalendran, Khaladdin Rzayev, Satchit Sagade and published in Journal of Financial Economics.

A bid-ask spread in options pricing is the difference between the highest price a buyer is willing to pay for an option (bid price) and the lowest price a seller is willing to accept (ask price). It essentially represents the transaction cost associated with buying or selling an option contract.

As liquidity is removed from the market, the gap between the bid price, and the ask price widens, making the available pricing unfavourable for market participants.

This leads to the pricing to shift in a manner where for options buyers, the premiums are greater than desired, and lower for those selling them.

Who's Driving The Volumes In Options Market?

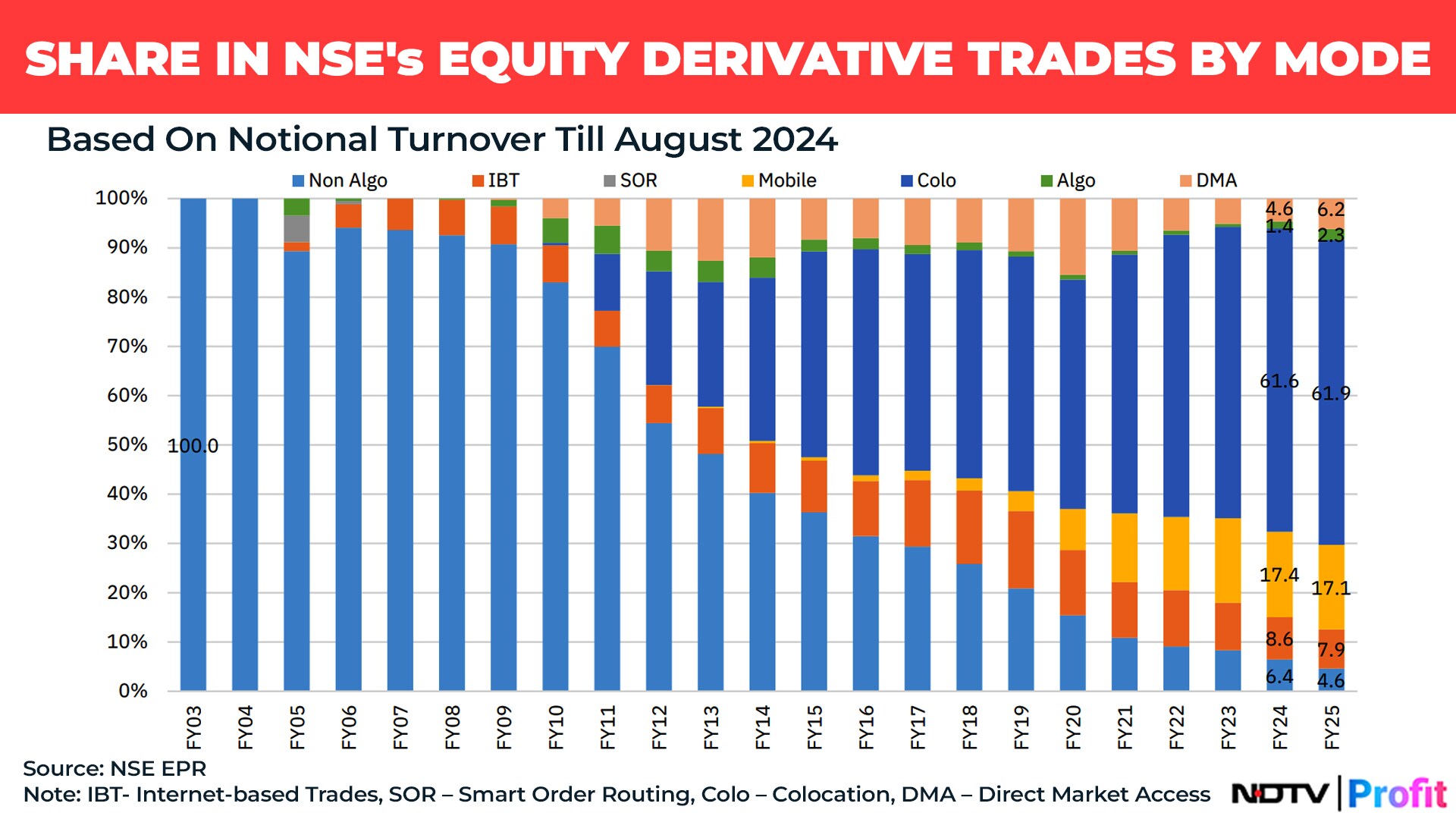

Among the cash market, as well as in equity derivatives, the mode of trading which continues to command the greatest share based on turnover, is co-location.

Co-location refers to the practice of shifting computers as close as possible to the exchange, in order to minimize the delay in execution of orders.

It commands a majority share in trading among equity derivatives, accounting for nearly 62% of trades made, based on their notional turnover.

The rise in co-location's share as a mode of trading reflects its critical role in high-frequency trading, according to NSE's Market Pulse report for the month of Sept. 2024.

Co-location as a mode of trading is predominantly used by proprietary traders, or prop traders for short, who leverage the firm's capital to trade across assets classes, and then share the generated profits with the firm.

This is also reflected in prop traders' share of client participation in equity derivatives, which stood at 61.1% in August. Among equity options, this share is lower at 48.4%, though still the highest among all client categories, followed by 34.4% for individual traders.

Proprietary traders' contribution towards high-frequency trades also shows up in their majority share as an investor category among higher turnover ranges.

Up till the turnover range of Rs 10 crore, individual investors make up for a minimum of 98.3% of the share in each range, but for the turnover ranging above Rs 10 crore, prop traders commanded a 67.7% share in July.

Trades with turnover ranging above Rs 10 crore also make up for over a 73% share among equity options, based on the premium turnover, according to NSE's Market Pulse report for August.

The recent consultation paper by the market regulator Securities and Exchange Board of India released in July mentions how "bursts of speculative hyperactivity in derivative markets, particularly by individual players" endangers both investor protection and market stability.

The regulator found in a 2023 study, that nine out of 10 individual traders incur losses in the equity derivatives segment, with an average loss of Rs 1.1 lakh in the financial year ended March 2023.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.