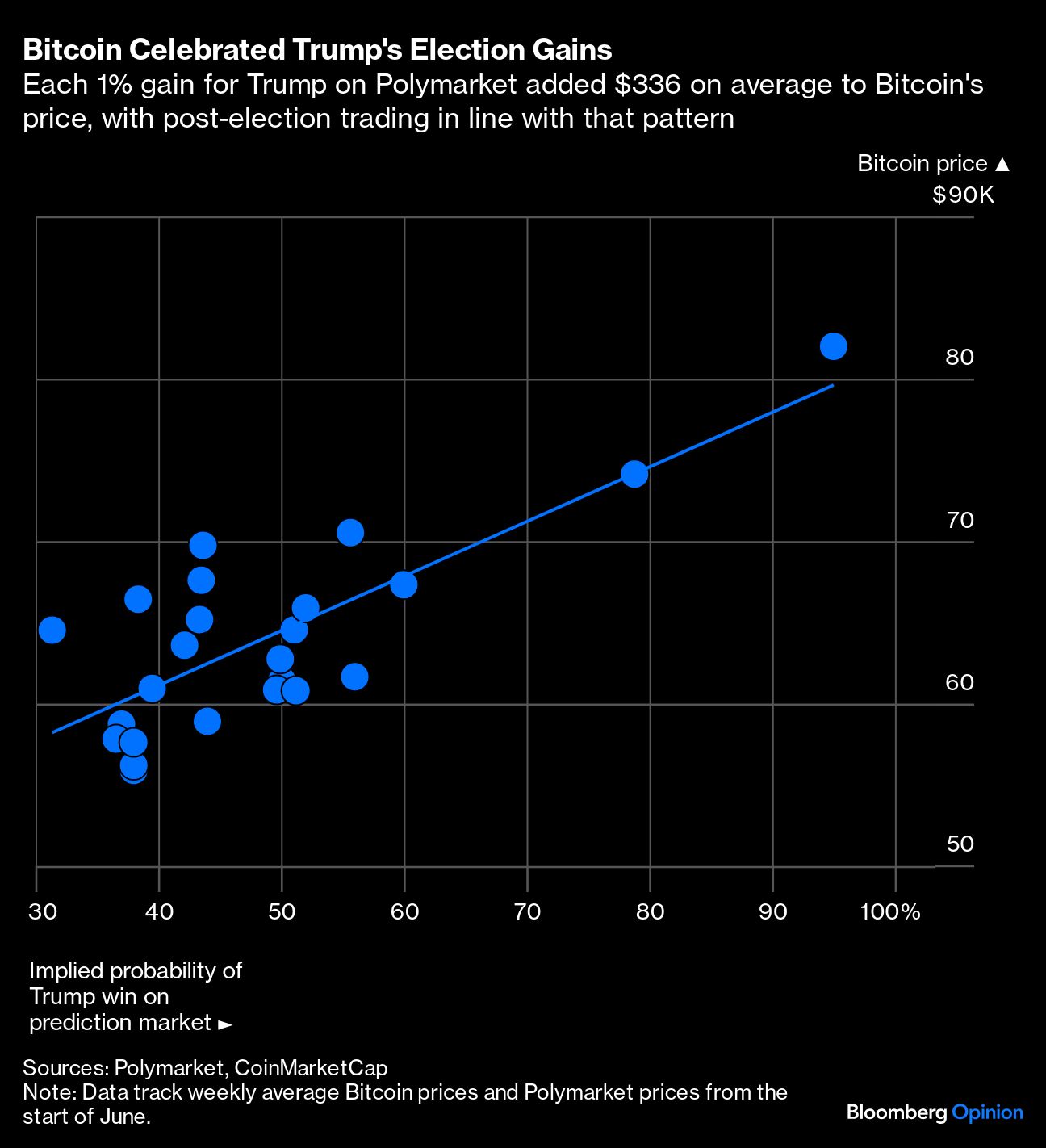

(Bloomberg Opinion) --The price of Bitcoin has jumped by more than $20,000 since the Nov. 5 elections in the US, with about one-third of the gains coming with favorable early results for Republicans, and the rest trickling in as Donald Trump's victory became certain and his party continued to pick up seats in the Senate and House of Representatives.

It's easy to see why Republican victories are good for crypto. Trump boasted he would be a pro-crypto president, pledged to prevent the federal government from selling the crypto it acquires (mainly in seizures from criminals) as it currently does, said he would fire crypto-skeptic Securities and Exchange Commission Chair Gary Gensler, push the US to dominate Bitcoin mining, and promised to appoint a crypto advisory council so rules will be written by cryptophiles rather than cryptophobes. He celebrated election night with well-known crypto boosters including Elon Musk, Robert Kennedy Jr. and Howard Lutnick.

But it's important to separate things that are good for Bitcoin specifically from things that are good for crypto in general — and possibly bad for Bitcoin.

We have a window into how government oversight may shape up because Congress has already done quite a bit of work on crypto-friendly legislation, although no major bills have yet passed both houses. The House passed a major bill, the Financial Innovation and Technology for the 21st Century Act, and a resolution to invalidate some anti-crypto SEC rules — both with significant Democratic support. Neither has been taken up by the Senate, and both were opposed by the White House. Two other major crypto bills cleared committee in the House but did not receive floor votes, and in the Senate, a bill was introduced to establish a federal strategic Bitcoin reserve.

If you work in crypto or follow it closely, you're likely most excited about the potential for friendly legislation to encourage real crypto projects that add real economic value. If you have less interest in crypto, you probably focus on the price movements of Bitcoin.

Bitcoin was intended to be a transaction currency and store of value, but it has been long surpassed in both areas by superior crypto implementations and innovations in traditional finance such as stablecoins with prices linked to major traditional currencies, crypto coins including Ripple that are cheaper, faster and easier to use and phone apps such as Wise Plc's international remittances. However, rather than being sidelined by such innovations, Bitcoin has emerged as a gateway between the traditional and crypto financial systems and continued to gain value.

I am reminded of the initial public offering of Netscape Communications Corp. that is credited with touching off the internet boom, and the aftermath. By 1995, many investors — including me — were excited about the potential of the internet, but there were no public vehicles to invest in the sector. When Netscape offered the first public internet stock, demand soared. It wasn't because investors thought all internet profits would be reaped by browsers, or that Netscape would be the dominant browser, it was that Netscape was the only easy way to bet on the internet. Similarly, for most of the history of cryptocurrencies, Bitcoin has been the only easy way to bet on crypto.

Netscape was enormously influential in the development of the internet, and generated profits every quarter until the fourth quarter of 1997; not long after, it merged with America Online Inc. Its software lived on the form of Mozilla and other not-for-profit institutions. But from an IPO investor's standpoint, the trillions of dollars of value generated by the internet essentially passed Netscape by. Bitcoin will be enormously influential in the development of crypto, but it may not capture the economic value of crypto for its owners.

With this in mind, the most consequential measures being discussed are those that will broaden the connection between the traditional financial system and the crypto economy — removing the need for a gateway currency — and improve legal certainty for stablecoins and transaction cryptocurrencies, making them more attractive stores of value than Bitcoin.

Much of the proposed US federal support for crypto is likely to bypass Bitcoin by making it easier to use stablecoins for transactions, and to invest in decentralized autonomous organizations pursuing real economic value. DAOs blur the distinction between owners, employees and customers and — if legal hurdles are removed and uncertainties resolved — could prove to be a superior form of business organization to traditional corporations. Other crypto projects support smart contracts, such as Ethereum, or track and trade value that has never been captured by the traditional economy such as Cardano. To invest in these today generally means converting dollars or other major currency into Bitcoin, then Bitcoin into other crypto assets. Streamlining this process could reduce demand for Bitcoin and sever its value from overall crypto success.

In the short run, if the federal government holds more Bitcoin and major financial institutions feel secure in buying it for their funds and retail clients, the additional demand should continue to drive increases in price. But longer term, if investors start building diversified portfolios in crypto DAOs and using stablecoins — or perhaps even central bank digital currencies — for transactions, it's possible that Bitcoin will lose its economic rationale.

As a cryptophile, I have great faith that crypto will continue to thrive as an economic sector, but no confidence that Bitcoin — or any existing cryptocurrency — will capture that growth; just as in 1995 I was very bullish on the internet, but neutral about Netscape as an engine for generating profits to be returned to investors. While a crypto-friendly political administration in the US is nice, it could be short-sighted to pile into Bitcoin at all-time highs, without a clear story to support valuations. If you have avoided crypto up to this point, it could be time to start learning about it in enough detail to evaluate real projects. If you have speculated on Bitcoin and meme coins and other headline crypto, it might pay to focus on economic substance rather than investor enthusiasm.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.