(Bloomberg Opinion) --

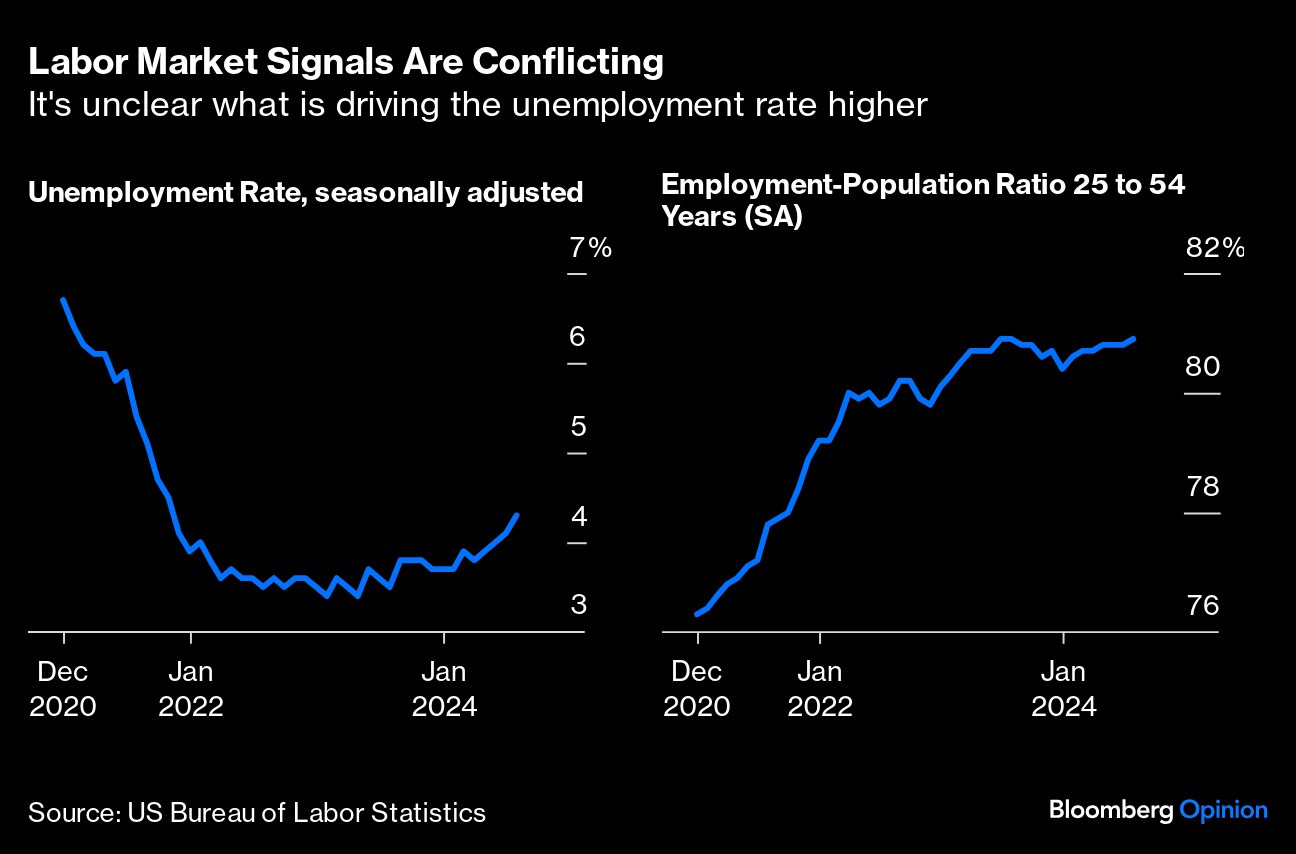

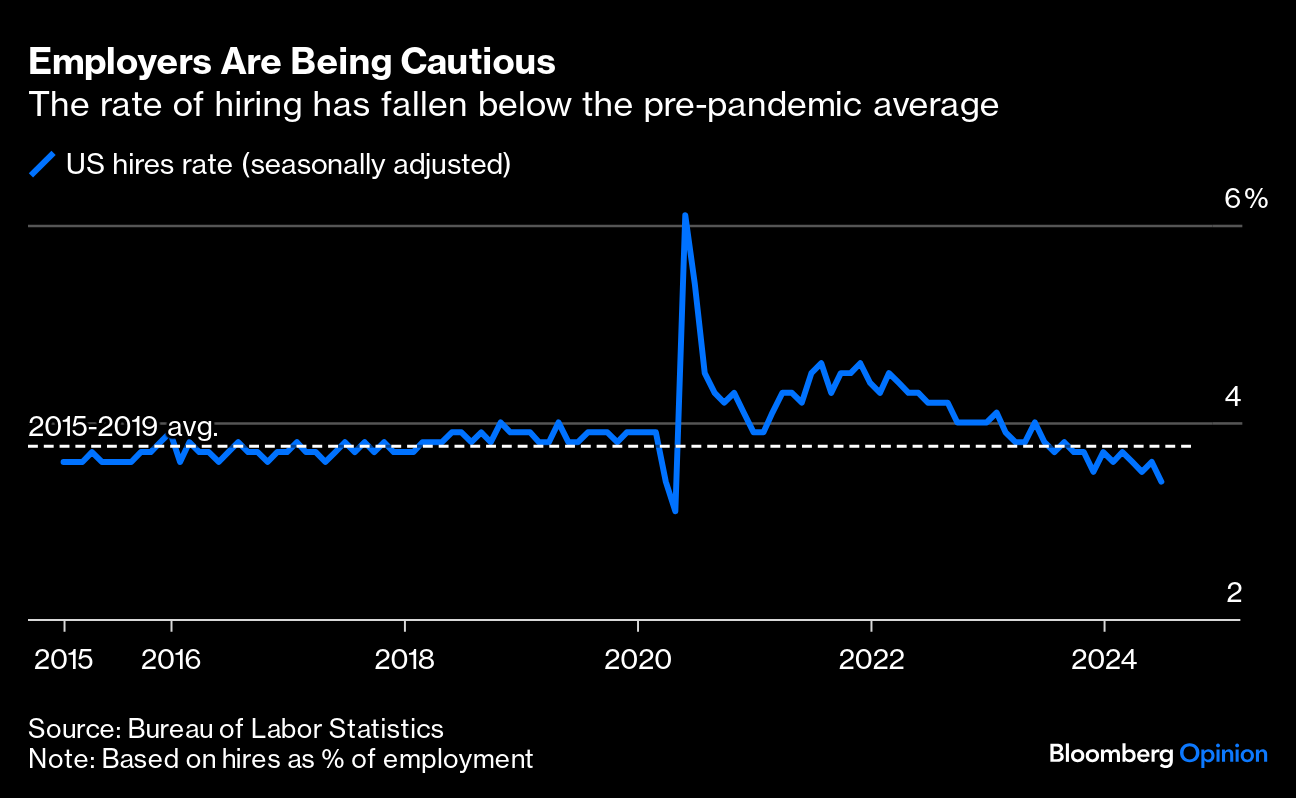

It's possible that the explanation of a gradual normalization is the correct one, that there's little risk of a rapid increase in unemployment, and that the Fed has time to be patient.

Swift rate cuts would relieve pressure for Americans struggling to make payments on floating-rate credit card debt or to get financing for a new car. It would help the millions of homeowners who bought when mortgage rates were high, with refinancing at lower rates freeing up household budgets for other types of consumption. The main headwind for the economy right now is high borrowing costs.

More From Bloomberg Opinion:

- Jobs Report Should Put Jumbo Rate Cut on Table: Jonathan Levin

- Keep Economic Tools Out of Foreign Policy: Allison Schrager

- The Gap Between Productivity and Pay Is a Delusion: Clive Crook

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Conor Sen is a Bloomberg Opinion columnist. He is founder of Peachtree Creek Investments.

More stories like this are available on bloomberg.com/opinion

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.