Quant Small Cap Fund, the most popular equity scheme offered by Sandeep Tandon-founded Quant Mutual Fund, saw its assets under management increase over 8% in June, with the fund seeming to have weathered the immediate reputational impact of an ongoing investigation by the markets regulator.

India's fastest growing mutual fund sent a letter to its investors on June 23, confirming that the Securities and Exchange Board of India was conducting an investigation into alleged irregularities. Quant MF will provide all necessary support and continue to furnish data to SEBI on a regular and as-needed basis, it said in the letter.

Looking Under The Hood

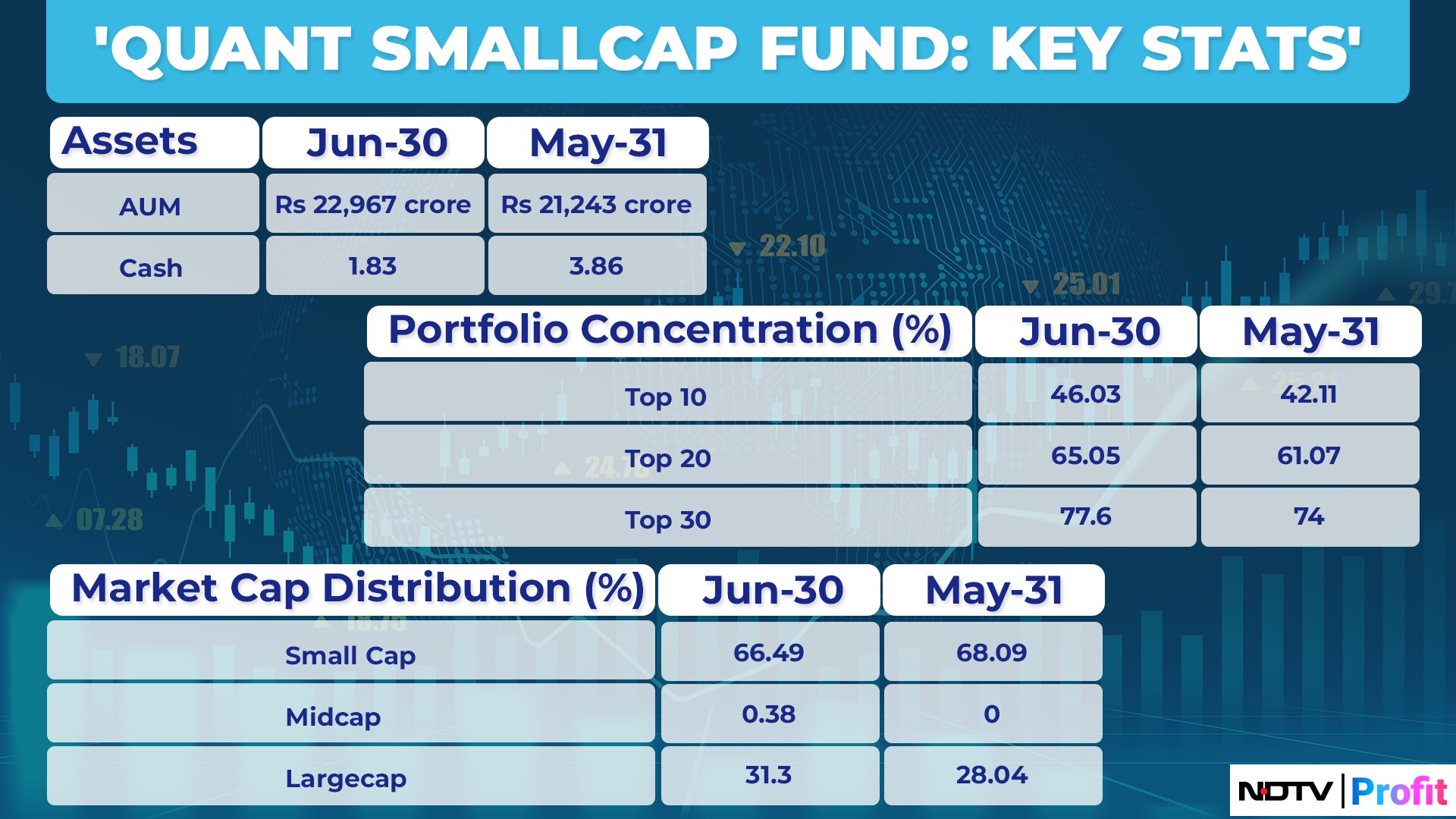

The latest factsheet released by Quant MF throws up a few interesting talking points. First, it's cash holding which stood at 6.25% in April, fell to 3.86% in May and then halved again to 1.83% at the end of June.

Second, the portfolio mix has moved further in favour of large-caps. Actively managed small-cap funds must have at least 65% of assets under management in these stocks. At the end of June, Quant MF had 66.5% of assets in small-caps and over 31% in large-caps. The holding of large-caps had stood at around 28% at the end of the previous month.

Such a move can be interpreted as a measure to de-risk the portfolio. The Indian equity market is in the midst of a bull run, with stocks—particularly at the broader end of the market capitalisation spectrum—hitting all-time highs on a regular basis. With valuations in several stocks at historic highs, fund managers generally shuffle their holdings and tend to prefer large-caps as a store of value.

How The Portfolio Changed

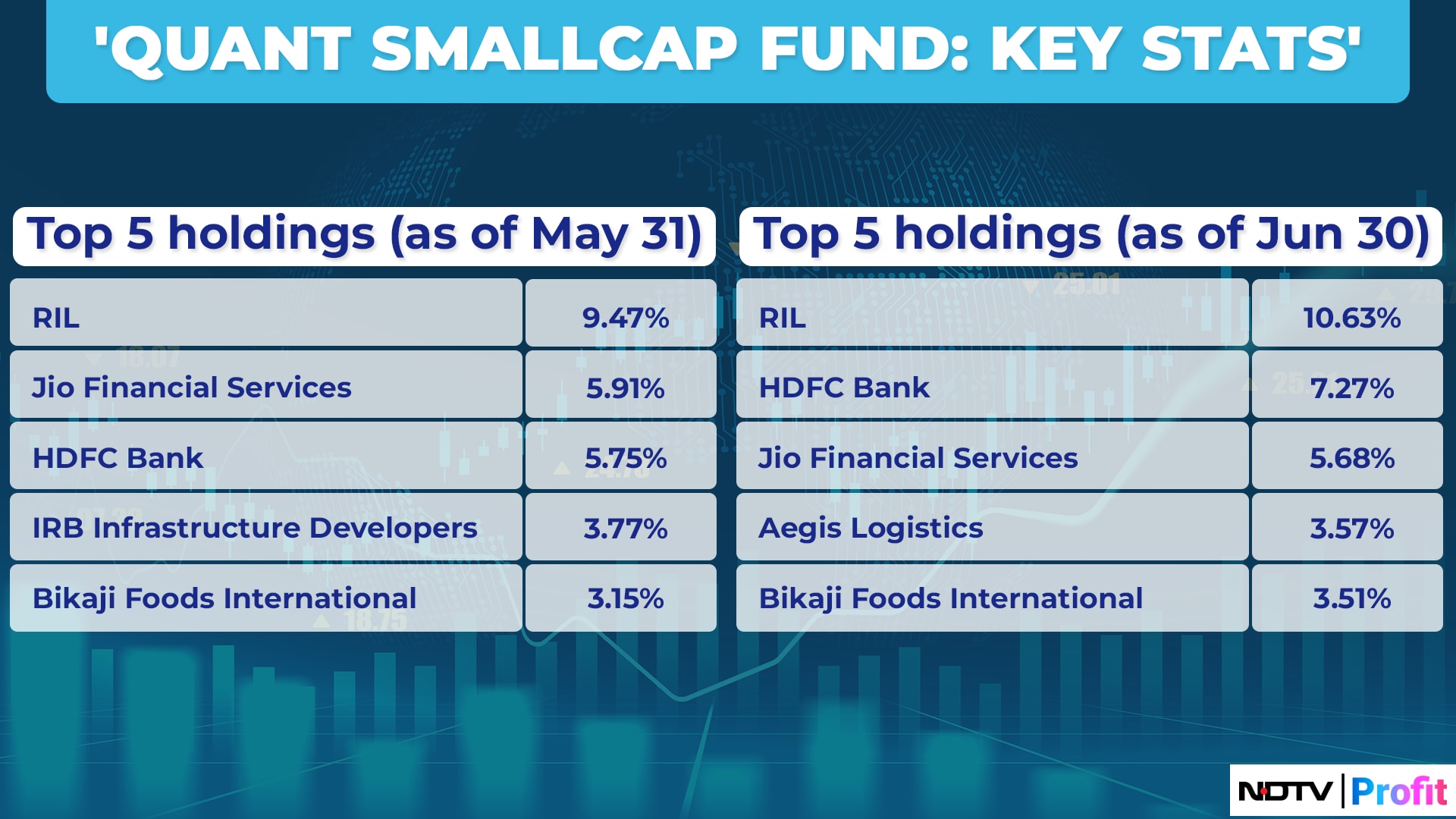

The fund managers at Quant MF's small-cap fund decided to bulk up on high conviction large-cap holdings. Reliance Industries Ltd., which accounted for 9.5% of AUM at the end of May, accounted for 10.6% as on June 30.

The scheme significantly raised its holdings in HDFC Bank Ltd., making it the second largest holding. It also added Kotak Mahindra Bank Ltd., Pfizer Inc., Sun TV Network Ltd., Marico Ltd. and Aurobindo Pharma Ltd. to its holdings.

Finally, the scheme has completely sold its holdings in Aarti Industries Ltd., Metropolis Healthcare Ltd., NLC India Ltd., KNR Construction Ltd. and Adani Green Energy Ltd. It also reduced its holdings in a few stocks, most notably in TV18 Broadcast Ltd., Rain Industries Ltd., Confidence Petroleum India Ltd. and Life Insurance Corp. of India.

Disclaimer: NDTV Profit is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.