14_05_2024..jpg?downsize=773:435)

Zomato Ltd.'s share price dropped over 5% in early trade on Wednesday as its net profit fell in the second quarter of fiscal 2025 to miss analysts' estimates.

Net profit was down 30% at Rs 176 crore in the July-September period, while the Bloomberg estimate was Rs 245 crore. This compares to Rs 253 crore in the preceding quarter ended June 30.

The Gurugram-based company, however, marked its sixth consecutive profitable quarter on a consolidated basis.

The board also approved a share sale to institutional investors to raise Rs 8,500 crore.

The food delivery major's second-quarter profit miss has led to mixed reactions from brokerages. Many brokerages are revising their target prices upward, but concerns over margin pressures and competition persist.

Views Split

Citi Research retains its 'buy' rating, raising the target price to Rs 310, with a 21% upside. The brokerage noted that Zomato is unlikely to face significant margin pressures in the short term despite Blinkit's rapid expansion.

Nuvama Institutional Equities echoed optimism, increasing its target price to Rs 325 from Rs 285, citing faster-than-expected Blinkit dark store additions.

Macquarie, however, remains bearish with an ‘underperform' rating and a significantly lower target price of Rs 100, reflecting a 61% downside. It acknowledged Blinkit's strong growth and margin stability but highlighted underperformance in Zomato's core food delivery business.

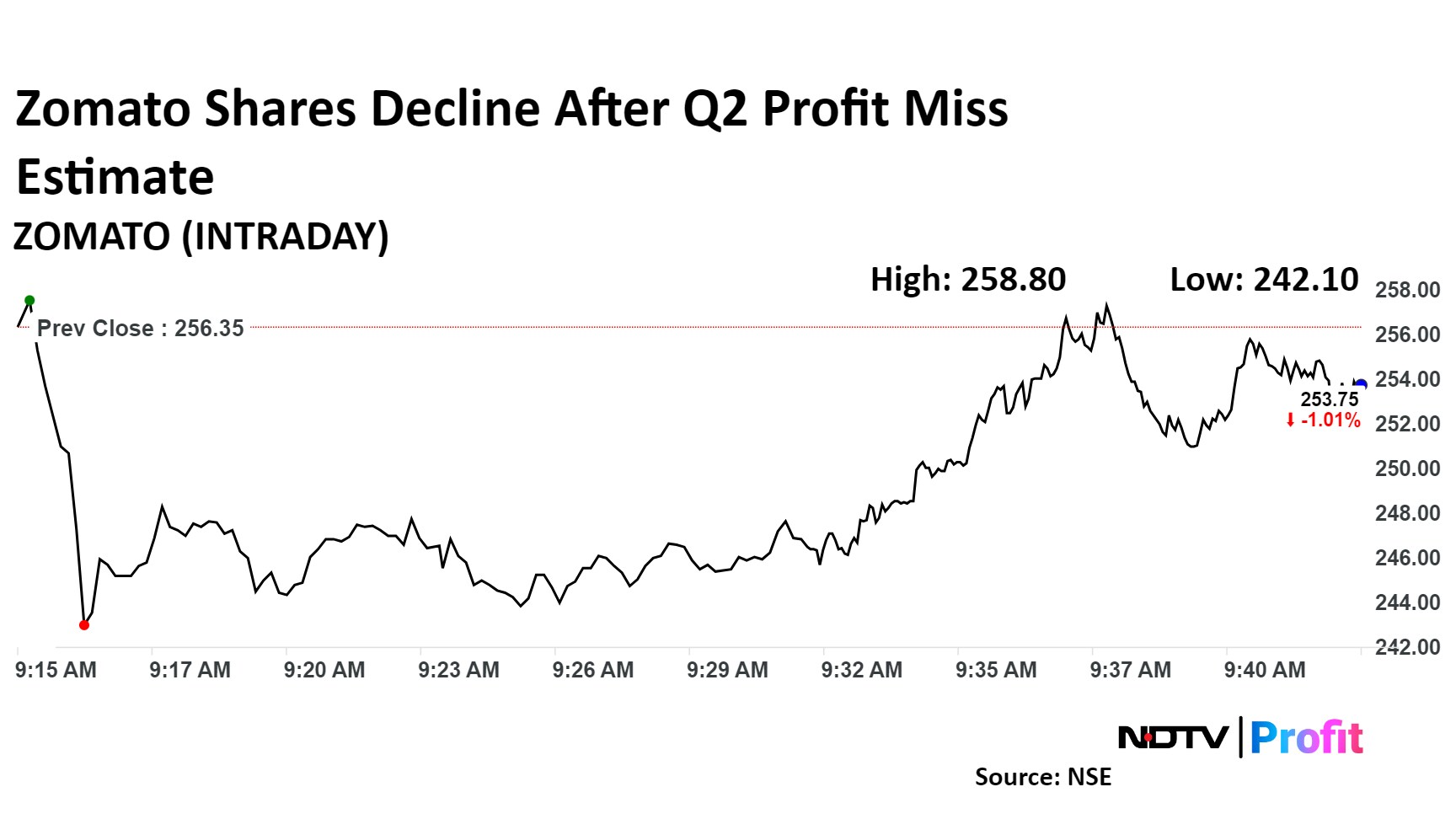

Zomato Share Price Movement

Zomato was trading 1% lower at Rs 253.75 by 9:43 a.m.

Zomato share price dipped 5.6% intraday to Rs 242.10 apiece. It was trading 1% lower at Rs 253.75 by 9:43 a.m. This compared to a 0.3% decline in the benchmark Nifty 50.

The stock has risen 133% in the last 12 months and 105% on a year-to-date basis.

Out of 27 analysts tracking the company, 24 maintain a 'buy' rating and three suggest a 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 20%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.