.jpg?downsize=773:435)

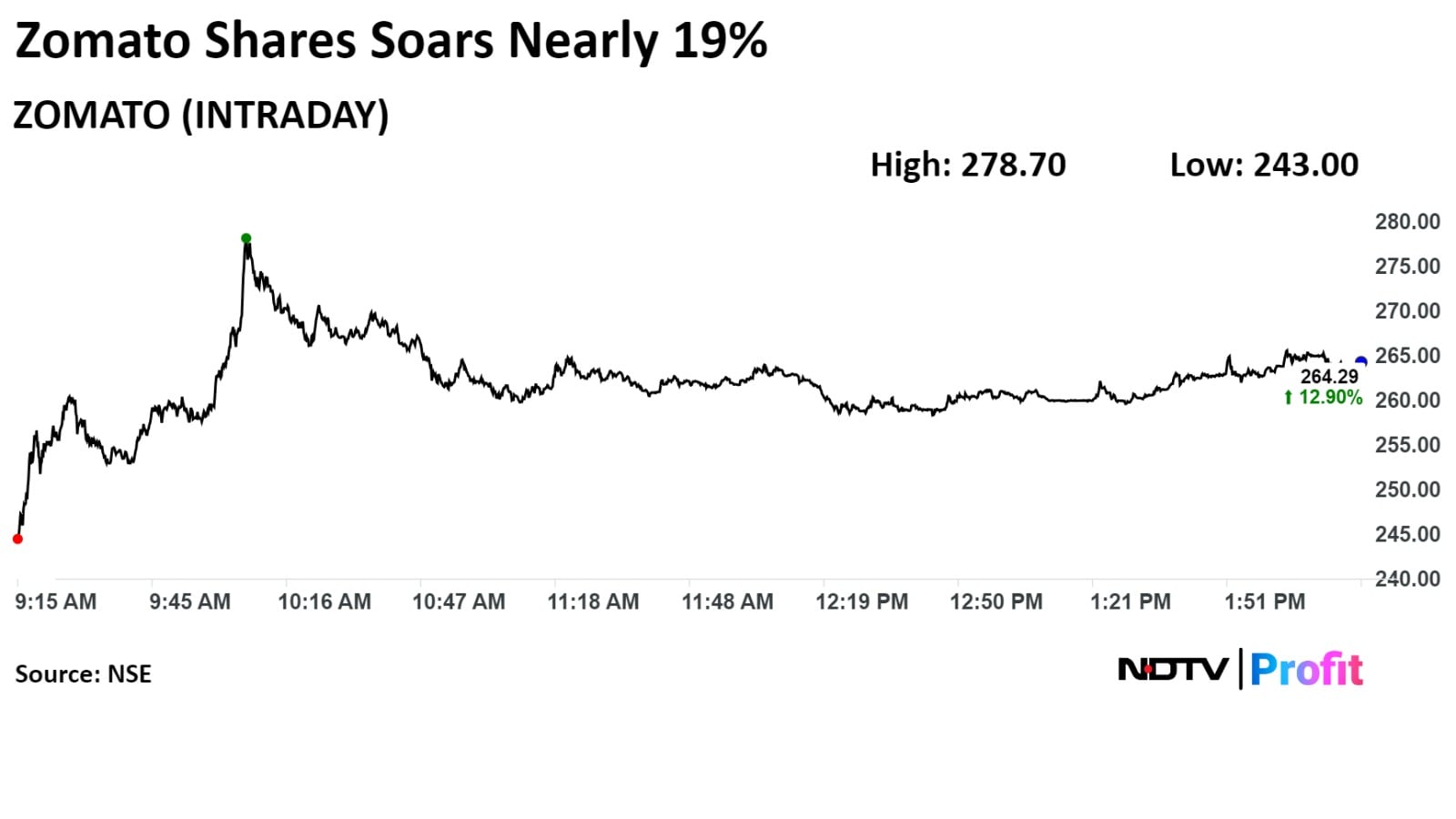

Shares of Zomato Ltd. rose 19% to a fresh life high after the company's first quarter net profit rose, beating analyst estimates. Brokerages were optimistic on both the food delivery business and Blinkit's growth, on the back of expansion plans and increased gross order value estimates.

Net profit of the food delivery platform was up 45% year-on-year at Rs 253 crore in the April-June quarter of fiscal 2025. This compares to Rs 175 crore in the same period last year.

Zomato's rapid growth and improving profitability show that there's still a lot of potential for both its food delivery and quick commerce businesses, according to Nomura. The brokerage maintained its 'buy' rating on the company and raised the target price to Rs 280 per share, implying a 20% upside.

It has also increased its FY26 Ebitda estimates by 26-60%. However, Zomato's operation of its $1.5-billion cash reserve and a slower growth in the food delivery and quick commerce sectors are risks, it said.

Zomato's businesses are still growing quickly, according to Nuvama, which also retained its 'buy' rating.

The company is posting strong growth and better profitability, and also plans to add 2,000 dark stores by the end of calendar year 2026, it said in a note. "It shows the company is aiming high."

Nuvama values the food delivery business at about $14 billion and Blinkit at around $13 billion.

Zomato is Citi's top India internet pick with its focus on growth and top-notch execution. It reiterates 'buy' call and target price of Rs 280 per share, implying an upside of 17% from the previous close.

The brokerage also raised the gross-order-value estimates for fiscal 2025 by 1% and for fiscal 2026 by 2% for the food delivery business. While, Blinkit's GOV estimates for fiscal 2025 were increased by 18% and by 16% for fiscal 2026.

Zomato's GOV is expected to see 20% compound annual growth rate over FY24-27, Citi said. While Blinkit's GOV is estimated to grow at compound annual growth rate of over 50% over the period.

Blinkit reported a gross-order-value of Rs 4,930 crore, up 22.2% from the previous quarter and 130% year-on-year, driven by 19% increase in monthly transacting users and the addition of 113 new stores.

With low market penetration and strong acceptance, Blinkit plans to significantly increase its store count to 2,000 by fiscal 2026. It aims to make new store openings financially self-sustaining.

Due to these expansions, the brokerage expects quick commerce to see 100-110% year-on-year growth in GOV for fiscal 2025 and 2026.

Shares of Zomato rose as much as 19.06% during the day before paring some gains to trade 13.14% higher at Rs 264.85 apiece, compared to a 0.98% fall in the benchmark Nifty 50 as of 2:25 a.m.

The stock has risen 211.41% in the last 12 months and 113.65% year-to-date. Total traded volume so far in the day stood at 12 times its 30-day average. The relative strength index was at 81.56, indicating that the stock was overbought.

Out of 28 analysts tracking the company, 25 have a 'buy' rating and three suggest a 'sell', according to Bloomberg data. The average of 12-month analysts' consensus price targets implies a potential upside of 0.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.