.jpg?downsize=773:435)

The market cap of Zomato Ltd. surpassed the Rs 2 lakh crore mark on Monday, led by a surge in the share price following announcement of a platform fee hike.

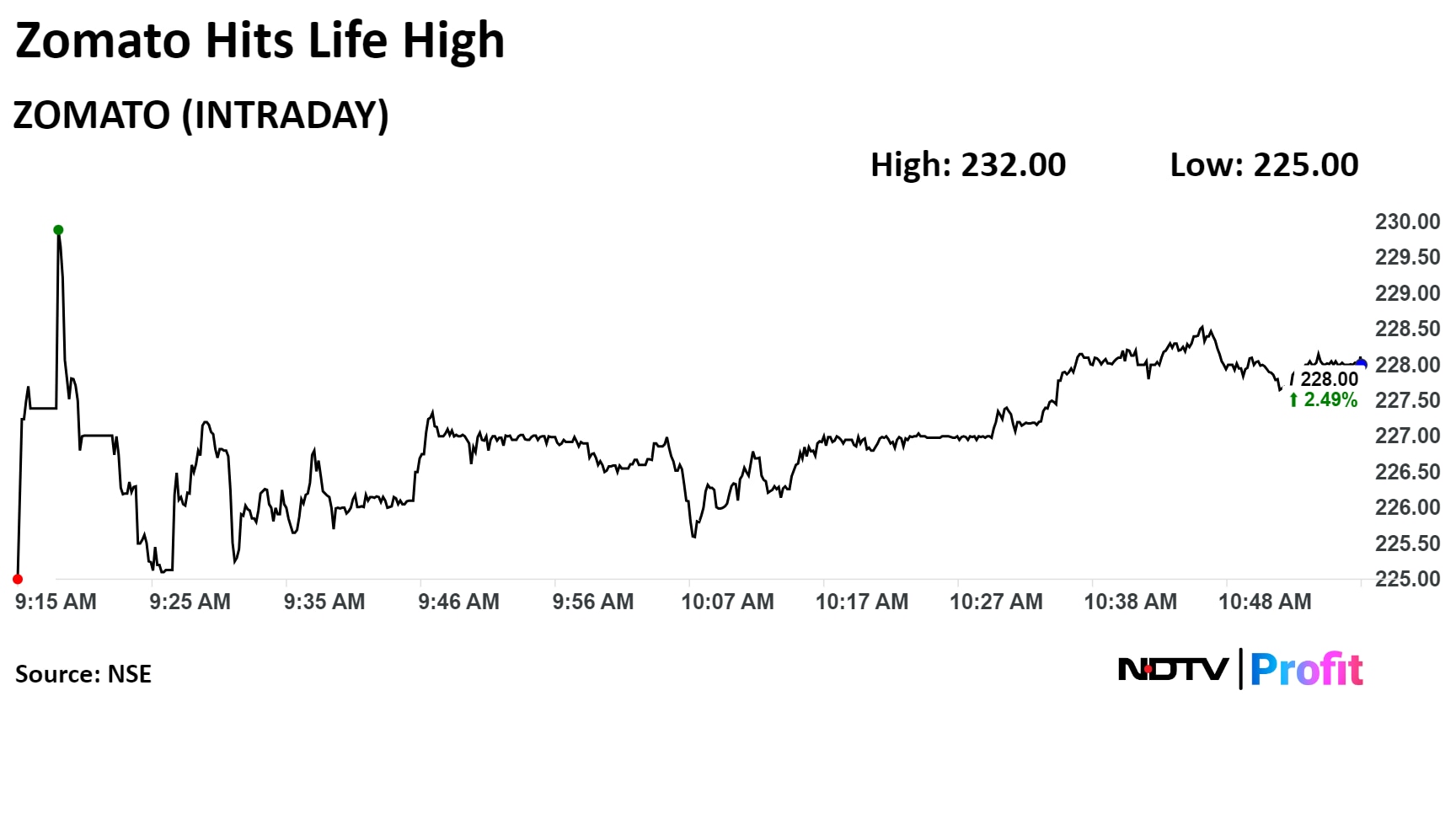

The counter hit a life high as it surged nearly 4%. The platform fee has been raised to Rs 6 from Rs 5 previously.

The market cap has risen by 86% from 1.07 lakh crore in the beginning of the year. As of 2:00 pm, the market cap of the restaurant aggregator stood at slightly over Rs 2 lakh crore.

The platform fee, hiked by Zomato, is a flat charge levied by food delivery apps over and above delivery charges, Goods and Services Tax and other restaurant and handling fees. The hike will apply to each order across key markets such as Bengaluru, Mumbai and Delhi NCR.

The new hike comes just three months after Zomato raised the compulsory platform fee for each order to Rs 5. It's peer Swiggy is teasing a Rs 7 platform fee, which it shows discounted to Rs 5 currently.

Elara in a note on Monday said that this hike in platform fee is a way for the company to improve profitability. The brokerage also expects the fee to move towards Rs 8-10 in a phased manner.

The note also said that the increase by one rupee will have a positive impact of 30-35 basis points on take rates. But the positive impact on Ebitda by 1-2% will only be seen in selective markets.

Zomato Ltd. stock rose as much as 4.28% during the day to Rs 232 apiece on the NSE. It was trading 2.94% higher at Rs 229.05 apiece, compared to a 0.40% advance in the benchmark NSE Nifty 50 as of 3:08 a.m.

The stock has risen 182.10% in the last 12 months and 85.25% year-to-date. The relative strength index was at 79.06 indicating that the stock may be overbought.

Twenty-four out of the 28 analysts tracking the company have a 'buy' rating on the stock, one recommends a 'hold' and three suggest a 'sell', according to Bloomberg data. The average of 12-month analysts' price targets implies a potential downside of 2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.