.jpg?downsize=773:435)

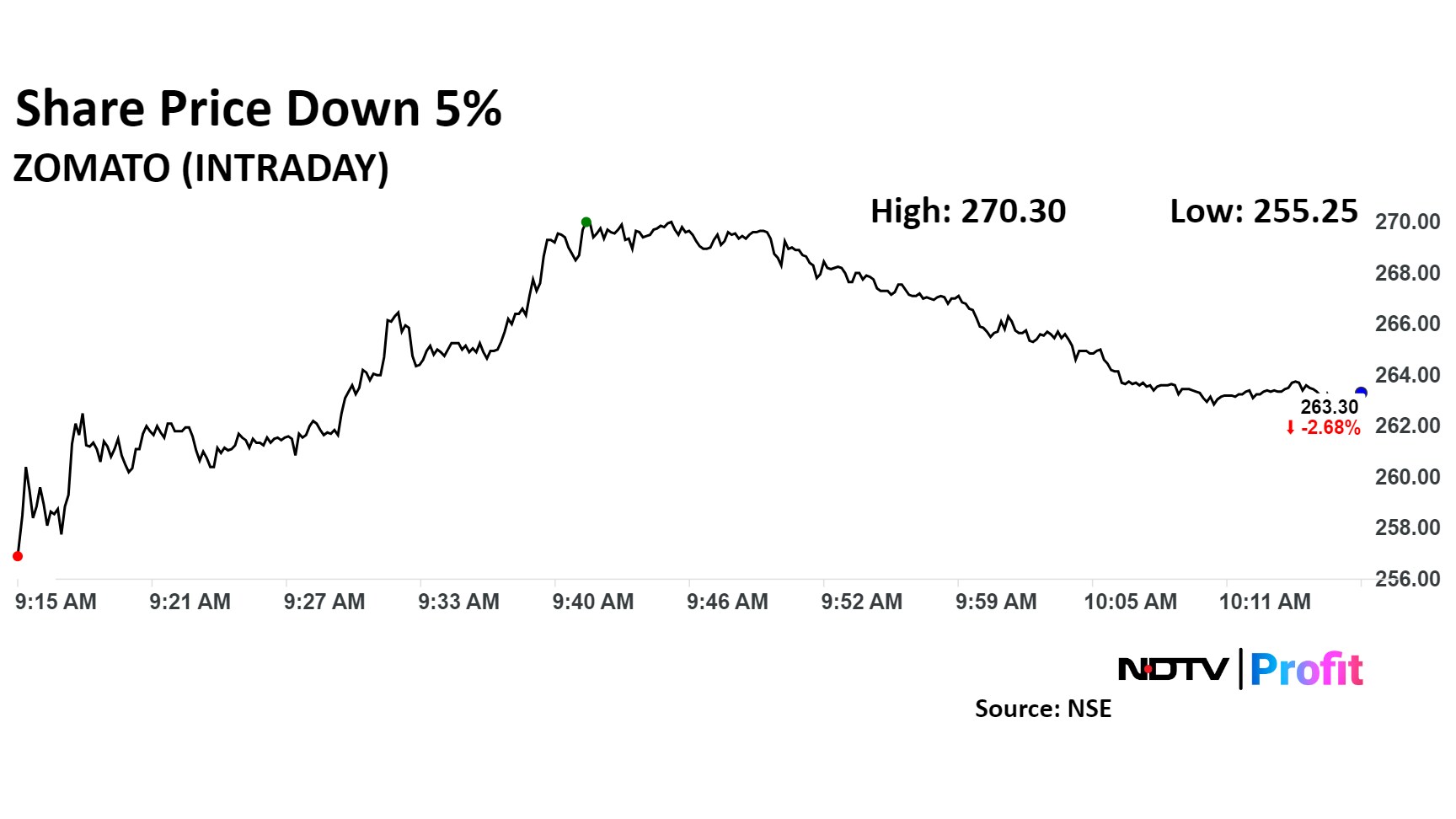

Zomato Ltd.'s share price fell by more than 5% on Friday after it said its board will meet on Oct. 22 to discuss plans for raising funds through a qualified institutional placement.

The meeting coincides with the company's scheduled release of its earnings for the September quarter, followed by an earnings conference call at 5 p.m.

Earlier, Zomato highlighted the launch of an innovative easy returns feature for its quick commerce platform, Blinkit. This feature allows customers to return or exchange items within just 10 minutes of raising a request, aiming to enhance customer satisfaction and streamline operations.

The decision to pursue QIP comes at a time when institutional investors are increasingly favouring this funding option. According to Grant Thornton Bharat, QIP activity has reached a decade-high of Rs 90,586 crore in 2024, with the June quarter seeing unprecedented volumes and values. This trend underscores a growing institutional confidence in QIPs as a viable mechanism for raising capital, even amid a recent boom in initial public offerings.

Shares of the company fell as much as 5.66% to Rs 255.25 apiece. The stock pared losses to trade 2.55% lower at Rs 263.65 apiece as of 10:10 a.m.

The stock has risen 132.91% in the last 12 months. Total traded volume so far in the day stood at 1.8 times its 30-day average. The relative strength index was at 42.

Out of 27 analysts tracking the company, 24 maintain a 'buy' rating and three suggest a 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 7.5%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.