Shares of Zomato Ltd. were on an upwards trajectory after Morgan Stanley positioned the company as a strong contender for significant market gains, projecting the stock has the potential to double in value within five years—or even in less than three years under a bullish scenario.

The brokerage has an 'overweight' rating on the stock and has revised its price target for the food delivery and quick commerce player to Rs 355, up from Rs 278, citing Zomato's dominant market position and promising growth trajectory in the quick commerce segment.

Zomato's rise is pinned on its expanding share in India's quick commerce market, expected to evolve rapidly over the next decade. With a base case projection of the quick commerce market reaching $42 billion by 2030—and Zomato maintaining its commanding 40% market share, the company is set to carve out a large slice of the industry's profit pool.

The report acknowledges near-term challenges, such as fierce competition and high spending on expansion, but highlights Zomato's 'deep balance sheet' and ability to weather competitive pressures. Its food delivery business also remains robust, underpinned by a loyal customer base and solid operational metrics, said Morgan Stanley.

If Zomato can capitalise on its market leadership and deliver on projections, the stock's growth could surprise on the upside, holds the brokerage.

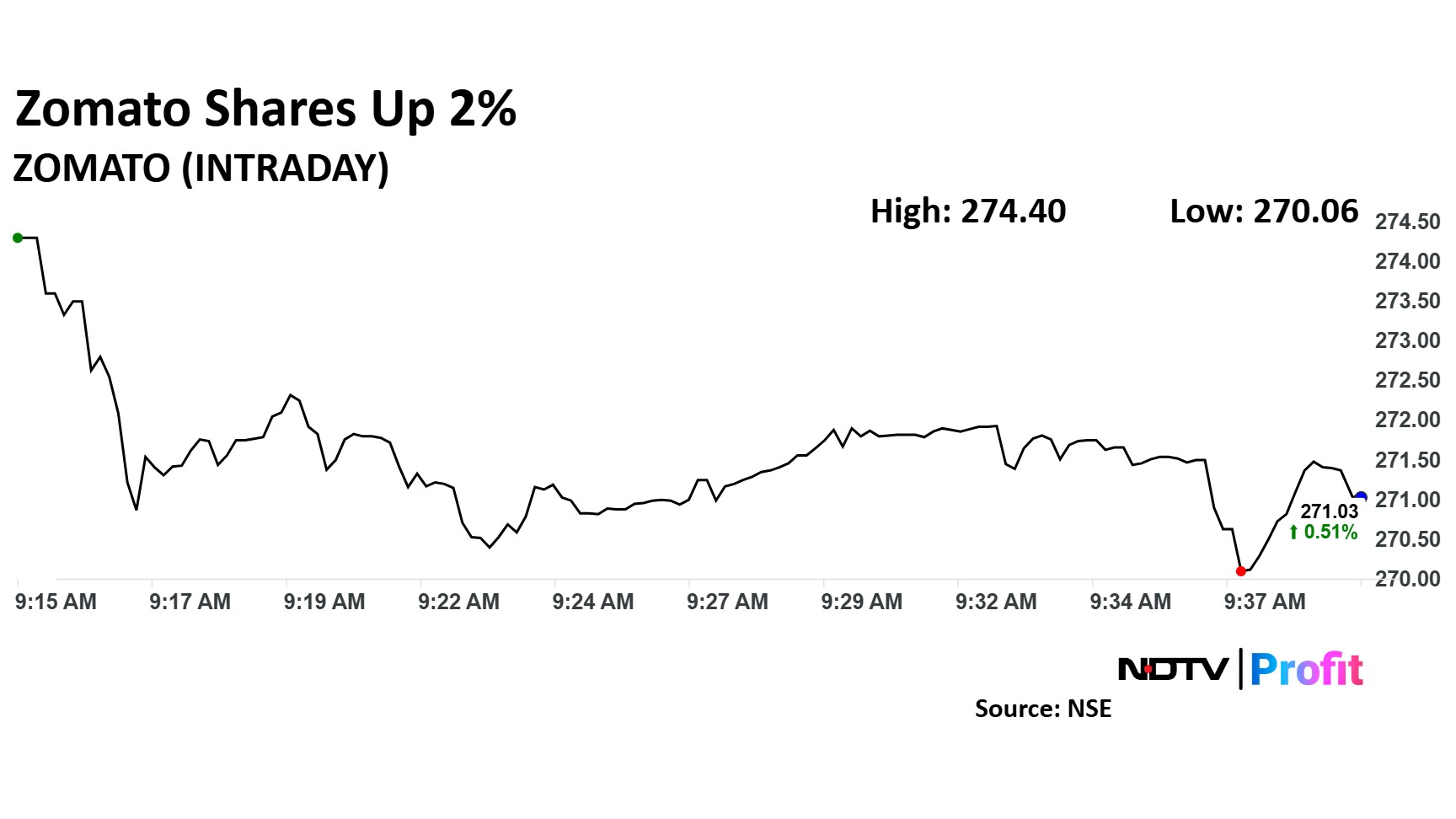

Zomato Share Price Today

Zomato share price rose as much as 1.76% to Rs 274.40 apiece, snapping a three-day falling streak. It pared gains to trade 0.66% higher at Rs 271.43 apiece, as of 09:42 a.m. This compares to a 0.61% decline in the NSE Nifty 50 Index.

It has risen 118.25% on a year-to-date basis. The relative strength index was at 57.40.

Out of 27 analysts tracking the company, 24 maintain a 'buy' rating and three suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 11.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.