Shares of Zee Entertainment Enterprises Ltd. tumbled nearly 14% on a report that Sony Group Corp. intends to cancel the proposed merger agreement between its Indian subsidiary and Zee Entertainment Enterprises.

The Japanese conglomerate is looking to cancel the deal due to a standoff over whether Zee's Chief Executive Officer Punit Goenka would lead the merged entity, Bloomberg reported on Monday, quoting unnamed people.

Sony plans to file the termination notice before a Jan. 20 extended deadline for closing the deal, saying some of the conditions necessary for the merger had not been met, the report said.

At least 94.7 lakh shares or 1% equity stake changed hands in four large trades, according to Bloomberg data. Buyers and sellers not known immediately.

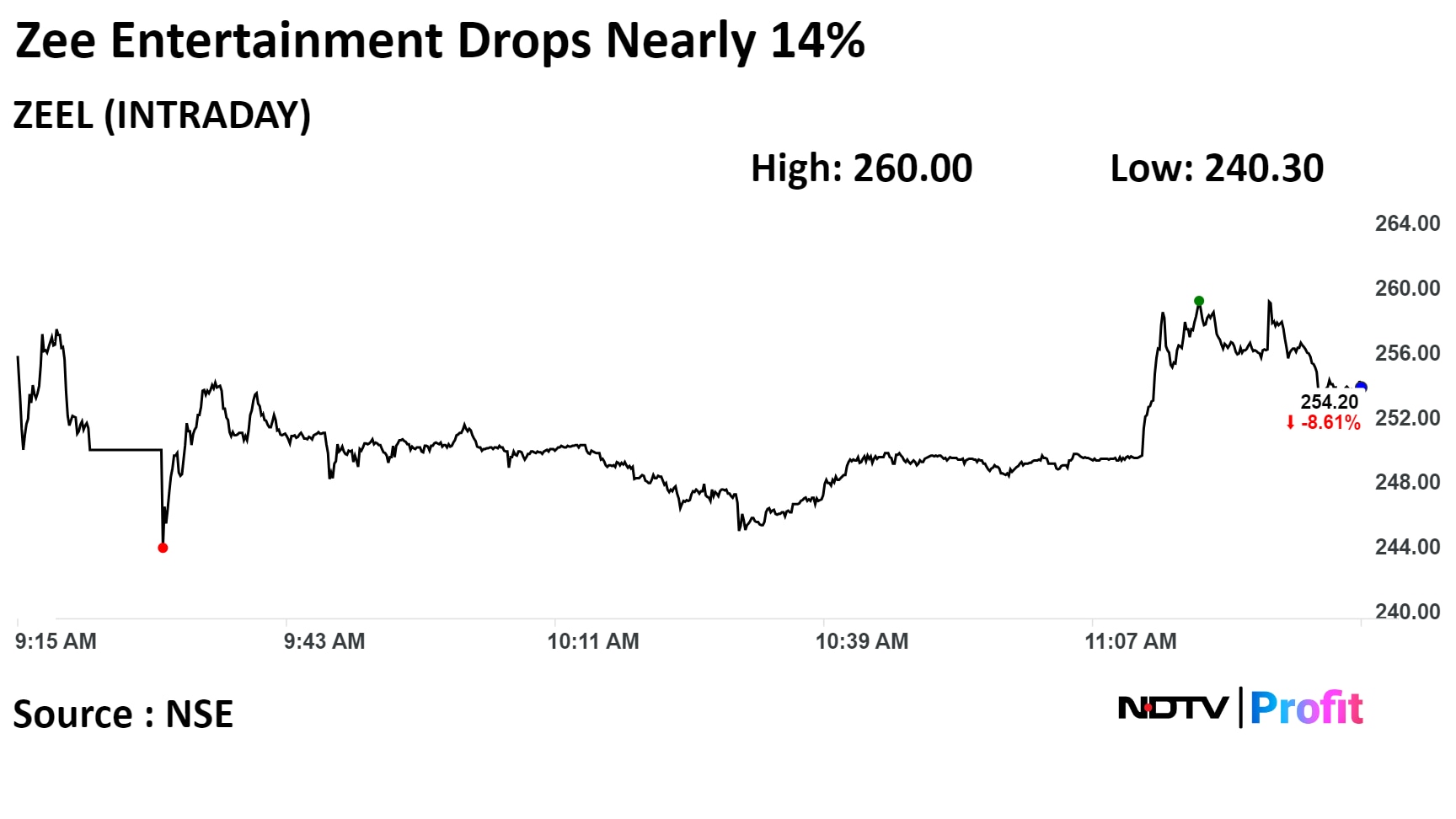

Shares of the company fell as much as 13.61% to Rs 240.30 apiece, the most Feb 23, 2023. It was trading 8.59% lower at Rs 254.25 apiece, compared to a 0.85% advance in the benchmark NSE Nifty 50 as of 11.33 a.m.

Total traded volume so far in the day stood at 7.9 times its 30-day average. The relative strength index was at 40.17

Of the 23 analysts tracking the company, 17 maintain a 'buy', four recommend a 'hold', and two suggest a 'sell', according to Bloomberg data. The average 12-month consensus price target implies a upside of 15%

"Just for one CEO name, the deal to be called off would be an uphill task," Karan Turani, senior vice president of Elara Capital Pvt., told NDTV Profit. He said Goenka's promoter holding of around 4% limits his bargaining power.

"There was less likelihood of this happening. The deal is important for both. We don't foresee the entire deal being put at risk because a lot of investors are involved and his (Punit Goenka's) holding in the company is about 4%," he said, adding a note of optimism that the deal will sail through by the Jan. 20 deadline.

After receiving all necessary regulatory approvals, this breakdown can be a setback to both Sony and Zee, having both reported subpar growth over the last year, according to Emkay Global Research.

"We believe the merger not going through will be a lose-lose for both parties, particularly in the face of competition with a much larger entity, Reliance-Disney (if the merger goes through). Both parties will potentially have to recalibrate their strategies from ground zero, which would be a tall order," Emkay Global Research said in a note.

Emkay believes clarity should emerge in the next couple of weeks regarding a final decision concerning the merger, "and if it does not go through, we see significant downside from current levels. Hence, we advise caution in the stock".

Last month, the Indian media giants and Sony Group agreed to discuss the extension of the merger deadline, following a two-year delay.

The initial deadline for the completion of the merger was set for Dec. 21. On Dec. 17, Zee had requested Culver Max Entertainment Pvt.—formerly known as Sony Pictures Networks India Pvt.—and Bangla Entertainment Pvt. to extend the timeline required to make the merger effective.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.