Shares of Zee Entertainment Enterprises Ltd. rose nearly 3% in a special trading session on Saturday after a Delhi court has ordered Bloomberg to take down an article that alleged corporate governance issues at the company.

The court directed the media company to take down the article dated Feb 21 from its online platform within one week of receiving the order. "The defendants are further restrained from posting, circulating or publishing the aforesaid article in respect of the plaintiff on any online or offline platform till the next date of hearing."

The company argued that it wasn't given a chance to respond during these SEBI proceedings. It alleged that the article made "unverified claims" and linked Zee Entertainment to the SEBI orders.

The court also noted that the information in the article is said to come from anonymous sources and that SEBI has not officially disclosed any large financial irregularities.

Zee argued that the article was "false and factually incorrect, with a pre-meditated and malafide intention to defame the company".

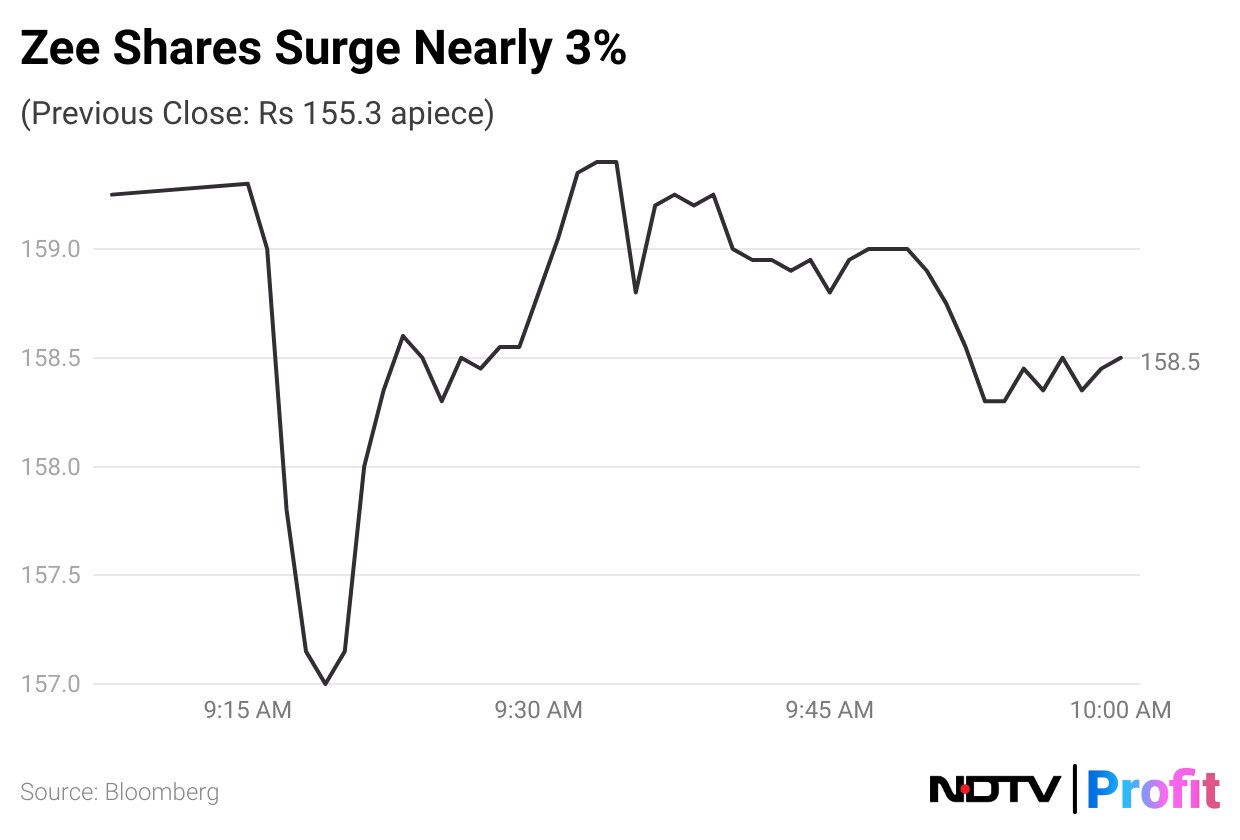

Zee's stock rose as much as 2.83% during the day to Rs 159.7 apiece on the NSE. It was trading 2.06% higher at Rs 158.5 apiece, compared to a 0.25% advance in the benchmark Nifty 50 as of 10:00 a.m.

It has declined 19.71% in the last 12 months. The total traded volume so far in the day stood at 0.3times its 30-day average. The relative strength index was at 37.

Two out of the 22 analysts tracking Zee have a 'buy' rating on the stock, as many as four recommend a 'hold' and 16 suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 14%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.