Zee Entertainment's share price recorded its best jump since August 27 after Punit Goenka resigned as managing director of the company. But, he will continue to hold the position of CEO and shall entirely focus on his operational responsibilities, an exchange filing by the company said Monday.

The filing did not mention about the new MD of the company. The company has also approved the designation of its current Chief Financial Officer Mukund Galgali, as deputy CEO.

These changes are effective Monday. Goenka will continue his existing full time employment but the variable portion of his salary (40%) will be paid to him only on achievement of certain milestones, subject to a maximum cap as defined by the board.

"In order to ensure we maintain a sharp focus on achieving our targeted aspirations, the core businesses require dedicated time and energy, which can only be achieved in an operational capacity," Goenka said.

The Securities and Exchange Board of India had barred Goenka from holding a key managerial position over an alleged fund diversion. While he won relief from the Securities Appellate Tribunal, the regulatory scrutiny continues.

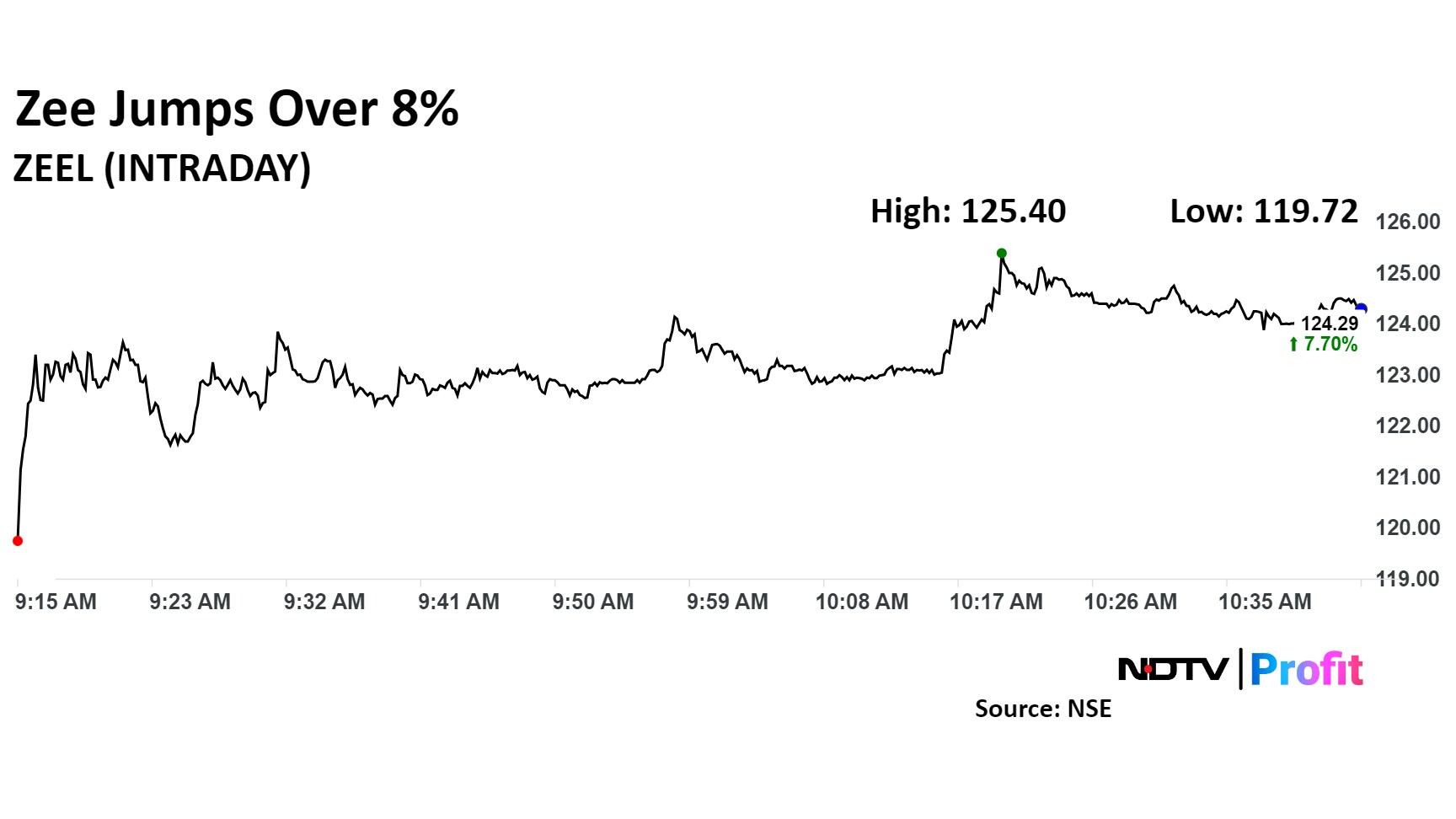

Zee share price rose as much as 8.67% to 125.4 apiece, the highest level since November 7. It pared gains to trade 7.8% higher at Rs 124.44 apiece, as of 10:46 a.m. This compares to a 1.1% advance in the NSE Nifty 50 index.

It has fallen 54% on a year-to-date basis. Total traded volume so far in the day stood at 2.63 times its 30-day average. The relative strength index was at 52.7.

Out of the 20 analysts tracking the company, 13 maintain a 'buy' rating, four recommend a 'hold,' and seven suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 30.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.