Shares of Yes Bank Ltd. gained over 4% on Monday after the private lender's net profit rose in the first quarter of fiscal 2025 on lower provisions, beating analysts' estimates.

The standalone net profit increased 46.4% year-on-year to Rs 502.4 crore for the quarter-ended June 30, 2024, compared to a Bloomberg estimate of Rs 376.4 crore. Sequentially, the profit rose 11.1%.

Net interest income, or core income for the lender stood at Rs 2,243 crore, up 12.2% year-on-year. Net interest margin, a key profitability indicator, stayed flat sequentially at 2.4%.

Provisions for the quarter fell 41.1% year-on-year to Rs 211.7 crore.

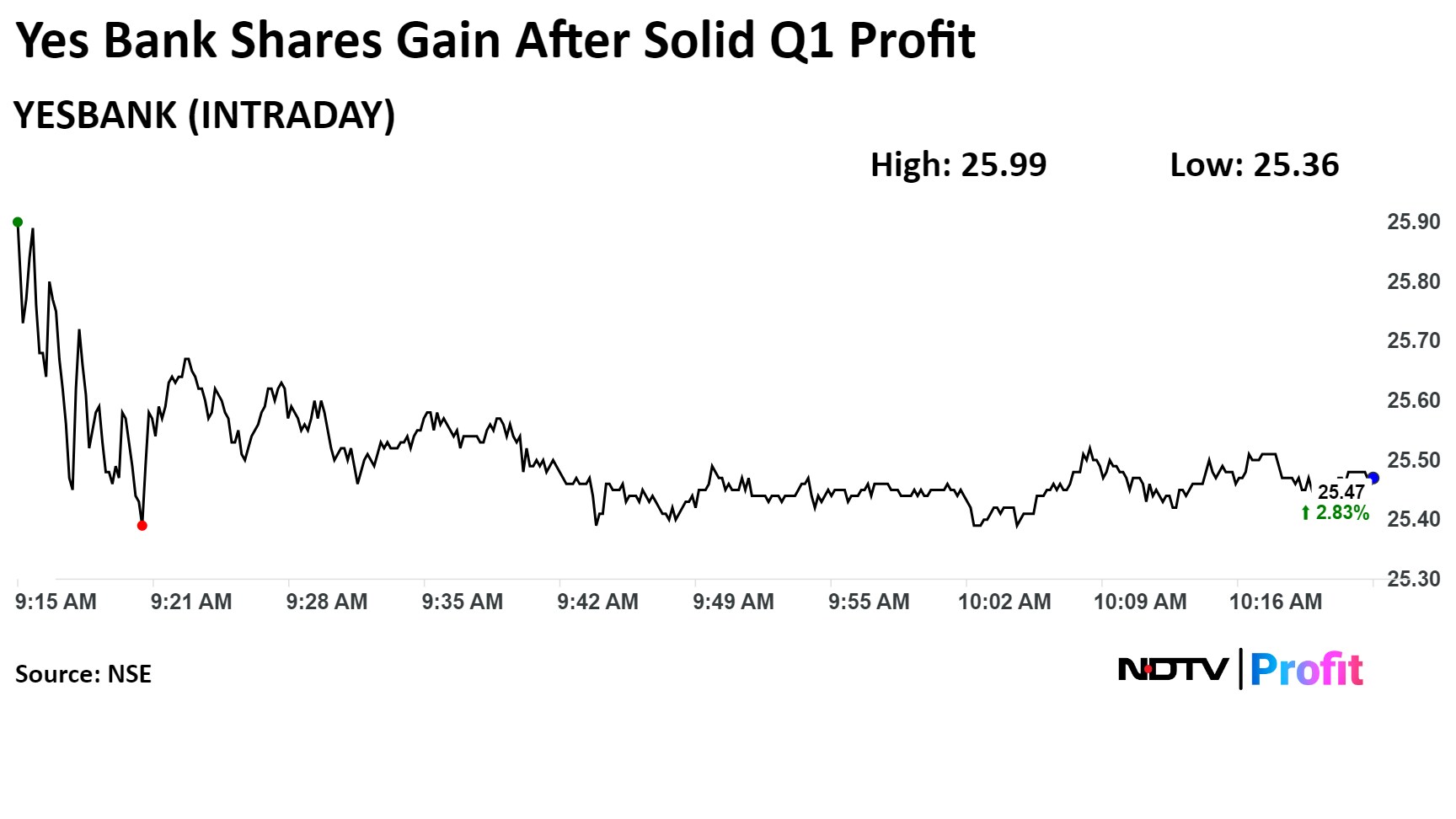

Yes Bank stock rose as much as 4.5% in early trade before paring gains to trade 2.83% higher at Rs 25.47 apiece, compared to a 0.11% advance in the Nifty 50 as of 10:20 a.m.

It has risen 46.5% in the last 12 months and 12.4% year-to-date. The relative strength index was at 54.87.

Ten of the 12 analysts tracking Yes Bank have a 'sell' rating on the stock and two recommend a 'hold', according to Bloomberg data. The average of 12-month analysts' price targets implies a potential downside of 33%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.