(Bloomberg) -- Staffers at China's main securities regulator had been working around the clock for weeks on ways to prop up the nation's tumbling stock market when the bombshell dropped.

Late Wednesday, the official Xinhua News Agency reported that their boss Yi Huiman had been ousted, becoming the biggest Communist Party casualty of a $5 trillion selloff that's undermining confidence in the fragile economy.

The announcement sent shockwaves across the industry and within the China Securities Regulatory Commission, according to people familiar with the matter, who asked not to be identified discussing private information. Prior to the Xinhua news, there had been no internal announcement from the Communist Party's organization department, which typically shares key personnel changes internally before they go public, the people said.

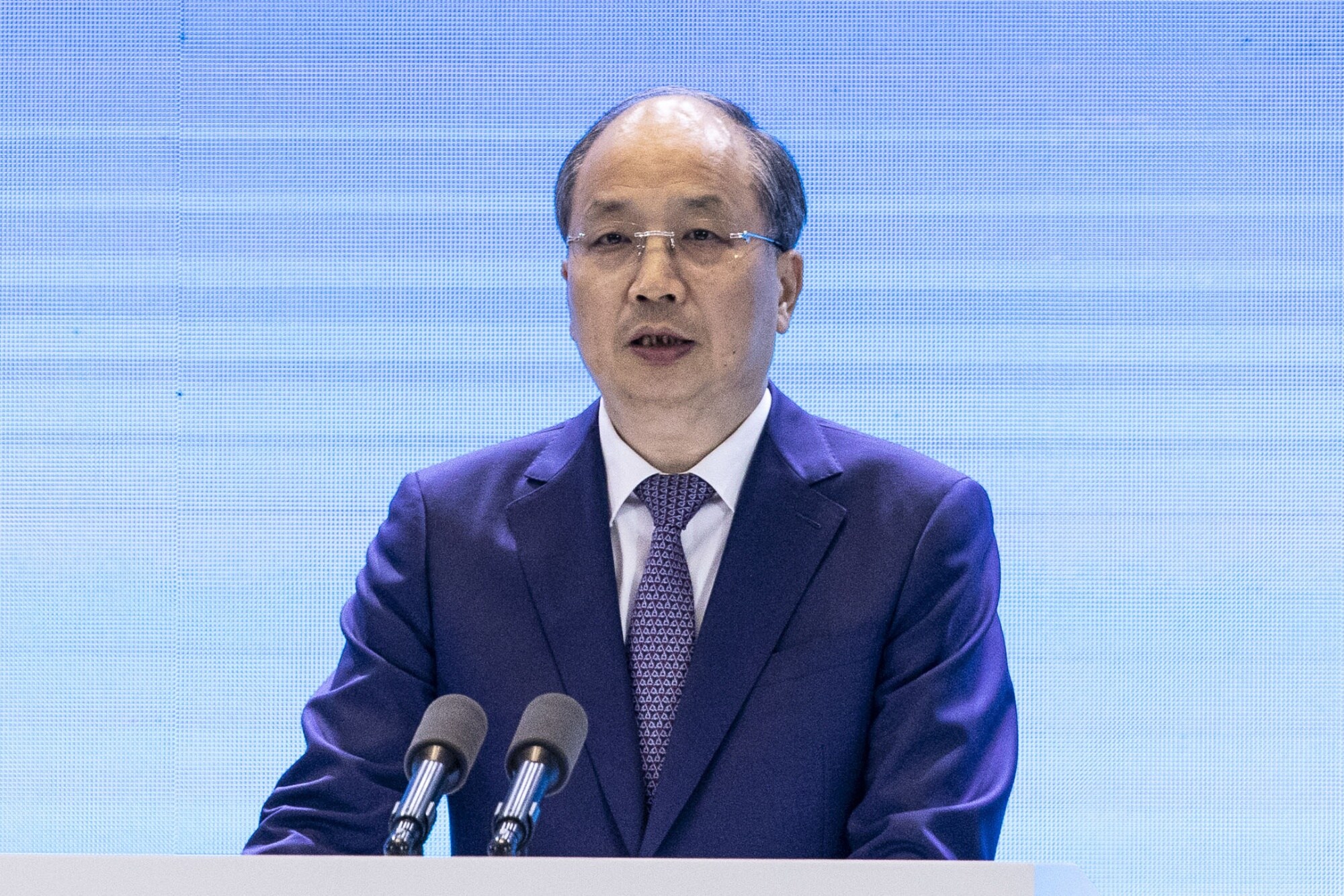

The departure of Yi, a surprise to even high-ranking CSRC officials, underscores the growing sense of alarm within President Xi Jinping's government over the speed and scope of the market meltdown that's now entering its fourth year. Wu Qing, a close ally of Premier Li Qiang, is taking over as chairman of the regulator.

The CSRC didn't immediately respond to a request for comment.

China watchers say the move may signal additional measures to revive the world's second-largest stock market. An earlier flurry of support in the runup to the Lunar New Year holiday, when exchanges are closed for six days beginning Friday, had failed to restore investor confidence.

“This is long overdue in my opinion, if one chief cannot do the job, then maybe we should give someone else a chance,” said Jiang Liangqing, managing director at Zhuhai Greenbamboo Private Fund Management. “At the minimum, a new broom sweeps clean and he could be more bold in taking action instead of just words.”

Anticipation of more fulsome efforts to end the rout had been mounting for days, after Bloomberg News reported that regulators led by the CSRC planned to brief President Xi on the markets as soon as Tuesday. There's been no public disclosure yet on whether Xi had that briefing. It was not known what role Yi had, if any, in that planned briefing.

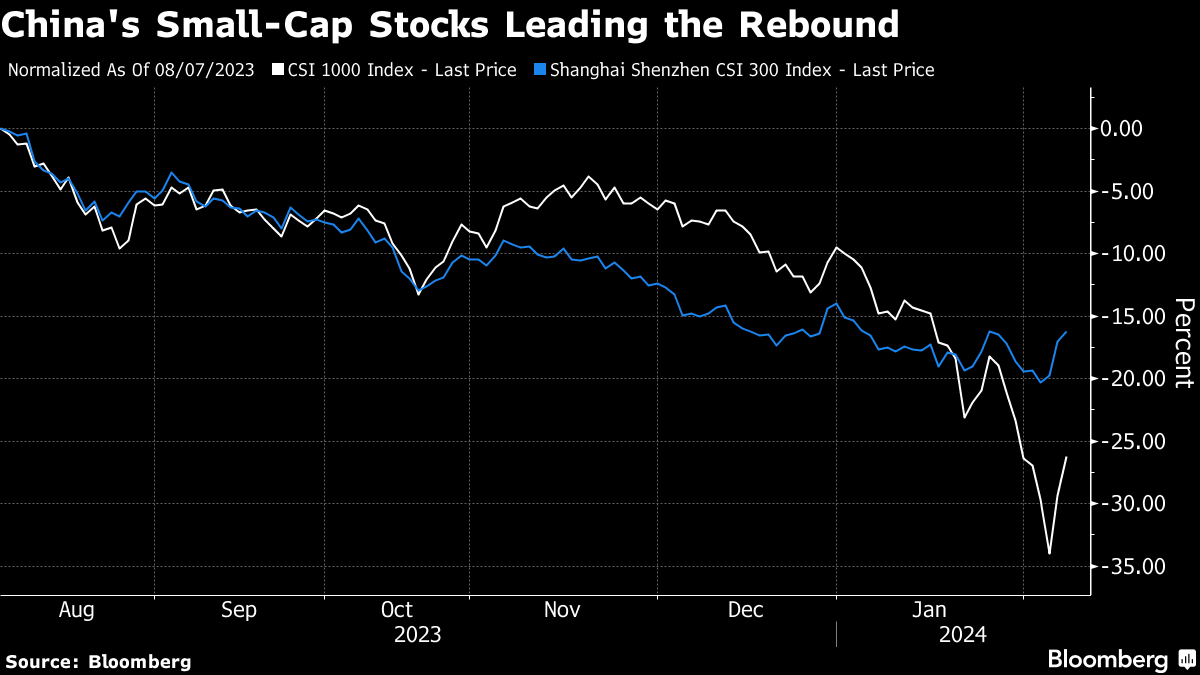

China's latest measures, including curbs on short-selling and purchases by state-owned entities, had some effect this week as the main equity gauge jumped three straight sessions to pare declines for the year. China's “national team” bought about 70 billion yuan ($9.7 billion) in shares over the past month, Goldman Sachs Group Inc. estimated in a report Monday. At least 200 billion yuan is needed to stabilize the market, according to the US bank.

“Government buying might help circuit-break the downward spiral, but we think reforms, policy consistency, and plans to address structural macro headwinds are required to re-rate China equity,” the Goldman analysts wrote.

Read more: Everything China Is Doing to Rescue Its Battered Stock Market

If history is any guide, more gains may be afoot. The past two sackings of CSRC chiefs heralded extended equity rallies. The benchmark CSI 300 Index rose more than 40% in almost a two-year span after Liu Shiyu replaced Xiao Gang in 2016. The gauge jumped more than 80% over two years after Liu was ousted for Yi in 2019.

Major market interventions in China have rarely been smooth, however. And the country's economy is facing bigger challenges than during previous market slumps: The property crisis shows no sign of ending, geopolitical tensions with the US continue to simmer and foreign investors are wary of a government that has clamped down on private enterprise.

What's more, the CSRC is constrained by what it can do to turn markets around, notes 22V Research analyst Michael Hirson. It can't command an intervention by the “national team” or launch some kind of stabilization fund, and can do little on its own to drive economic growth.

“Changing the chairmanship at the CSRC alone does not change anything fundamentally,” said Yan Wang, chief China strategist at Alpine Macro in Montreal. “The stock market performance is a reflection of weak growth and poor confidence. Unless Beijing addresses these issues, the stock market will likely continue to struggle.”

The tall task now rests with Wu, 58, who had been tipped last year to take over the CSRC before he was promoted to deputy party secretary for Shanghai. Before that, he worked closely with Premier Li — President's Xi's top deputy — who was previously party secretary in the nation's financial capital.

Read more: ‘Broker Butcher' Set to Be China's Top Securities Regulator

Wu is well connected in China's halls of power. He earlier headed the Shanghai Stock Exchange for almost two years and held various roles at the CSRC, earning him the nickname “broker butcher” after shuttering 31 firms over regulation breaches. He then oversaw the fund industry until 2010.

Wu also worked at the national planning committee, which later morphed into the National Development and Reform Commission. Wu, who holds a PhD in economics from the Renmin University of China, is known as a low-key technocrat who has zero tolerance for wrongdoing, a person familiar with him has said. Wu sometimes jokes he's more fit to be a surgeon, the person said.

“Wu's background in financial regulation suggests he might do a better job in cracking down on malicious short selling and illicit behaviors in the market,” said Sun Jianbo, president of China Vision Capital. “While that'll soothe investor nerves in the short term by cultivating a more favorable environment, it requires more policy efforts.”

--With assistance from April Ma, John Cheng and Jacob Gu.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.