(25).jpeg?downsize=773:435)

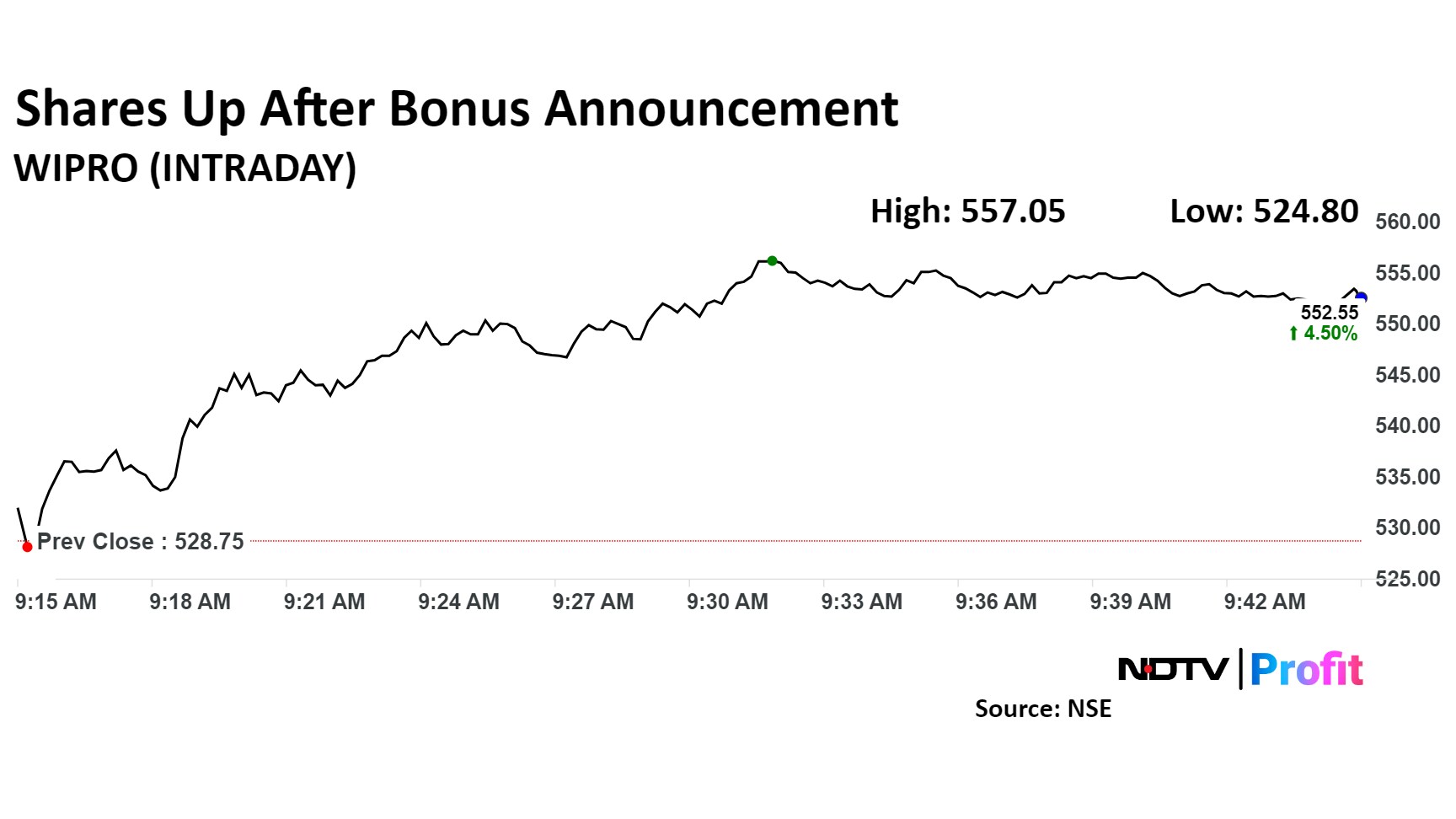

Wipro Ltd.'s share price experienced a significant boost of over 5% on Friday after the company reported its quarterly earnings and announced a bonus share issue.

Wipro proposed a bonus share issue in the ratio of 1:1, meaning eligible shareholders will receive one additional equity share for every fully paid-up share they hold. The record date for this bonus issue is yet to be announced. The company's Board of Directors will officially consider the proposal during their upcoming meeting on Sunday.

This marks the fourth bonus issue for the information technology company since its listing and the first in this decade. The last bonus issue was approved on Mar. 06, 2019, at a 1:3 ratio, according to BSE data.

The company's first bonus issue dates back to fiscal 2010, with a 2:3 ratio. This was followed by a 1:1 issue on Jun. 13, 2017.

Wipro's financial performance for the second quarter has exceeded market expectations. The company reported a sequential rise in the net profit of 6.2%, amounting to Rs 3,227 crore, surpassing analysts' consensus estimate of Rs 3,009 crore. Revenue for the quarter ending September 30, 2024, rose by 1.5% to Rs 22,302 crore, also higher than the anticipated Rs 22,235 crore.

Additionally, Wipro's earnings before interest and taxes grew by 1.3% to Rs 3,672 crore, slightly above the Bloomberg consensus estimate of Rs 3,625 crore. The Ebit margin remained stable at 16.5%, compared to the expected 16.3%.

The scrip rose as much as 5.05% to Rs. 555.45 apiece. It pared gains to trade 5.03% higher at Rs 555.35 apiece, as of 09:43 a.m. This compares to a 0.44% decline in the NSE Nifty 50 Index.

It has risen 36.30% in the last 12 months. Total traded volume so far in the day stood at 9.4 times its 30-day average. The relative strength index was at 58.

Out of 42 analysts tracking the company, seven maintain a 'buy' rating, 11 recommend a 'hold,' and 24 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 4.2%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.