Morgan Stanley is “inclined to buy” into this market, especially if there is a dip, as it expects index returns to moderate over time.

Here are Morgan Stanley's four reasons to buy and four reasons to sell the market:

Reasons to Buy

- Policy and politics appear to be in good shape as the GST rollout has been smooth so far. This augurs well for growth in 2018.

- The growth cycle is turning assuredly as is reaffirmed by macro leading indicators like public investments, consumption and trade.

- Valuations are reasonable in most parts and have come off compared to emerging markets.

- Liquidity looks solid. Corporate balance sheet recession has likely ended.

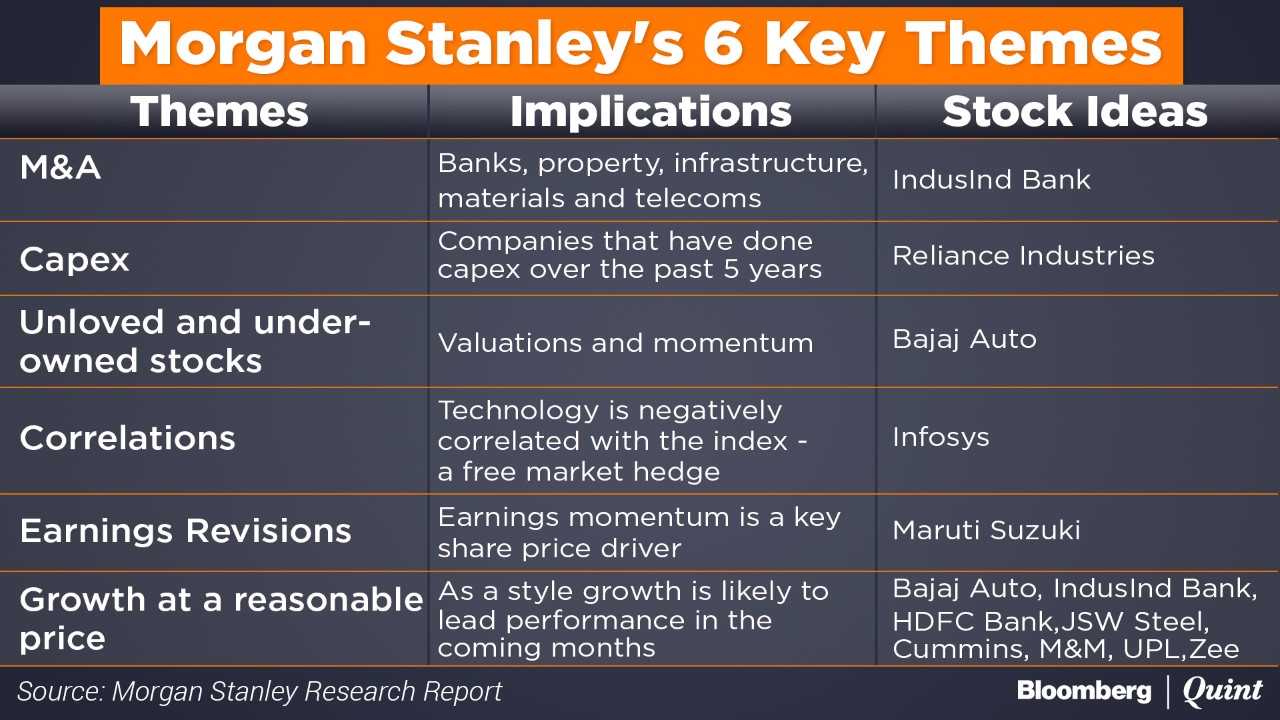

Morgan Stanley has outlined six key themes in its portfolio where investors may find buying opportunities. In all of these themes, the brokerage has shown a preference for growth stocks and sector-wide positions.

Resons to Sell

- Fiscal slippages at the state level could hurt the market.

- The sell side estimates are too high as evidenced by weak earnings revisions breadth, suggesting that earnings are not strong enough.

- Mid-cap valuations look stretched; stocks of some high-quality companies also appear expensive.

- Market dynamics are challenging as there is pent-up equity supply given the rise in prices and valuations.

Also Read: Morgan Stanley Picks 14 Indian Mega-Cap Stocks As Likely Winners

What Will Drive The Index Higher?

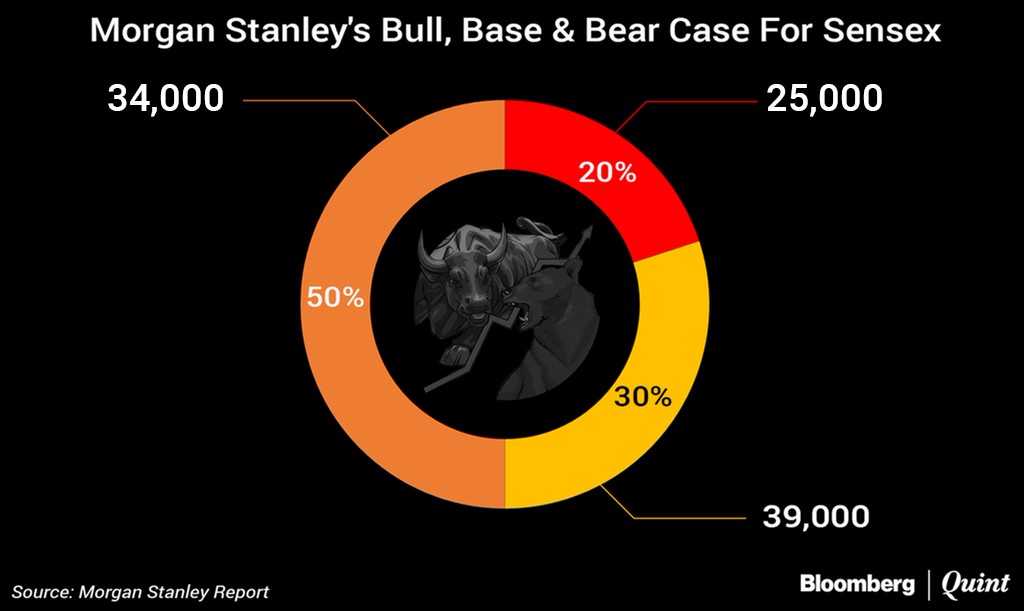

In Morgan Stanley's base case, the Sensex target for June 2018 is at 34,000 – the bear case pegs the index at 25,000 and the bull case at 39,000.

Earnings revisions will likely turn positive in the coming six months after six years in negative territory. Valuations are not yet stretched against history, other markets and bonds. Rising demand for equities from domestic households and a potential M&A activity could take multiples higher in coming months.Morgan Stanley Research

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.