Two top research firms have contrasting views on Maruti Suzuki India Ltd.

Macquarie has a bearish stance on India's largest carmaker as it expects Maruti Suzuki's market share in the small segment to fall. For Citi, the stock is a top pick.

While Maruti continues to lead the small vehicle market, Macquarie said in a Feb. 22 note that an analysis of entry-level personal vehicles indicated a market-share loss for automaker in the Rs 4 lakh to Rs 7 lakh price range.

The brokerage expects the near-term demand for small cars to remain tepid due to the price hikes in the last couple of years. "While distribution and fuel efficiency remain MSIL's moat, micro-SUVs pose a risk to market share recovery."

Macquarie reiterated its 'neutral' stance on the company. The brokerage recently downgraded the auto major, citing a slow recovery in the entry-segment passenger vehicle space.

Citi, however, placed Maruti Suzuki in a 90-day positive catalyst. In the near term, the automaker's stock could see outperformance with a pick-up in monthly volumes and strong 4Q FY24 results, Citi said.

Citi maintained its target price of Rs 14,200 per share against the prevailing price of around Rs 11,618. The brokerage also made a minor upward revision to FY24 estimates reflecting better volumes.

Even Macquarie agrees that Maruti Suzuki's strong brand, distribution network, and fuel efficiency still remain key competitive advantages. "However, rising consumer preference for SUVs, wider model optionality with micro-SUVs, better safety ratings and superior product features translate into higher competitive intensity."

Tata Motors Ltd. and TVS Motor Ltd. remain Macquarie's top picks in the auto sector. Bajaj Auto Ltd. may benefit in the near term from premium motorcycles and its electric vehicle focus, apart from a recovery in exports, it said. "Ashok Leyland Ltd. and Eicher Motors Ltd. are our least preferred stocks."

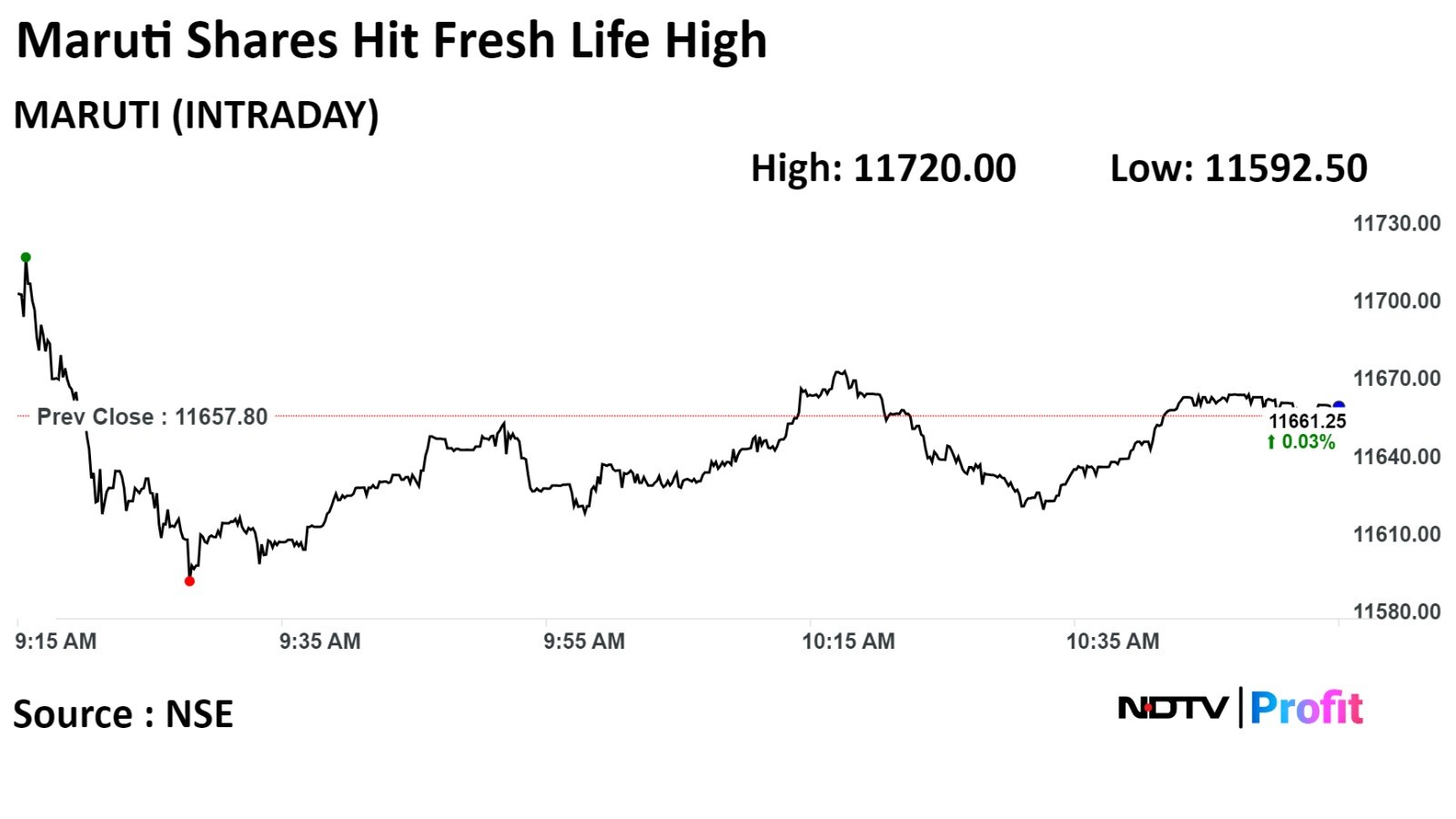

Maruti's stock rose as much as 0.53% during the day to hit an all-time high of Rs 11,720 apiece on the NSE. It was trading 0.15% lower at Rs 11,639.9 per share, compared to a 0.18% advance in the benchmark Nifty 50 as of 11:49 a.m.

It has risen 33.85% in the past 12 months. The relative strength index was at 76.5, .

Thirty-nine out of the 48 analysts tracking Maruti have a 'buy' rating on the stock, as many as six recommend a 'hold' and three suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 2.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.