(Bloomberg) --Times are tough in private markets. High borrowing costs are hurting returns, managers are struggling to exit investments, and regulators are circling. All that is bringing back an issue that has long haunted these opaque holdings: No one is quite sure how to actually measure their performance.

Barry Griffiths is one of a small group of quantitative analysts giving it a try. He's the driving force behind an alternative method for gauging unlisted investments that he says has the potential to demystify the world of private markets, from buyout funds to venture capital. The claim is it will help investors compare returns with those of other asset classes, as well as reveal the true value provided by managers in the business along the way.

That's a controversial prospect in an industry famous for grading its own homework in terms of performance and for awarding itself generous pay based on the results. Not to mention that successfully decoding such illiquid investments is fraught with pitfalls, as anyone modeling mortgage bonds and derivatives before the financial crisis would probably testify. Yet the rewards of success could be huge: Private equity commanded $10.6 trillion in 2023 and is expected to grow to $25.1 trillion by 2033, according to estimates from Bain & Co.

“It's not easy to understand the risks you're taking,” says Griffiths, the former head quant at private-asset giant Ares Management. The lack of transparency is one reason systematic investors and analysts like him remain few and far between in the industry, because the data they rely on is in short supply. But as competition grows and market pressures mount, quant ideas are gaining more traction—in particular “direct alpha,” the approach devised by Griffiths and his peers.

Alpha—a measure of a portfolio manager's returns on top of the broader market—is a familiar concept in finance. It's become a common tool in equities, where indexes such as the S&P 500 provide an obvious benchmark for performance. A huge amount of capital shifted into low-cost, passively managed funds at the expense of human stockpickers after it became clear that few managers consistently achieve alpha. It takes far fancier statistical footwork to do anything similar in private markets, where valuations are infrequent and largely decided by the managers of funds.

Private investments have cash flows that can be measured. But since every fund takes in money and pays it back at different times, it's hard to truly understand performance.

The direct alpha approach compares those cash flows—both contributions and distributions—with what the dollars would have been worth if they'd been invested in a public equity index in the same time period. That benchmark could be a broad one like the S&P 500 or perhaps a gauge of stocks in the same industry the fund invests in. The comparison should tell you how much you earned in excess of the market, or how much you lagged it. “Many times we found that somebody who had great absolute returns just happened to be invested in the right sector at the right time,” Griffiths says.

In one study published in 2023, he and co-authors Oleg Gredil at Tulane University and Ruediger Stucke, head of quant research at private equity firm Warburg Pincus, conducted a direct alpha analysis on a database of more than 2,400 funds specializing in buyouts. Their average reported internal rate of return (IRR)—the annual rate of growth based on a fund's cash flows—was 12.3%. But how does that compare with other investments? The researchers found that the funds' direct alpha was 3.1% using a broad market benchmark and 1.7% based on industry indexes.

Those are still good numbers, but for many investors it may be too little reward for locking up cash in illiquid and often leveraged assets for long periods. The average also obscures a notoriously wide range of outcomes. Meanwhile, venture capital funds fared even worse using this lens, with an average alpha of zero compared with similar listed stocks.

Direct alpha shares DNA with another well-known measure called the Kaplan-Schoar private markets equivalent, named after Steven Kaplan and Antoinette Schoar, the economists who developed it. The main difference is that direct alpha shows results as an annualized percentage figure, which is closer to how investors typically think about performance.

Griffiths published his first paper on direct alpha while working at Landmark Partners, an investor in secondary private stakes that was later acquired by Ares. He retired from the firm last year. His successor, Avi Turetsky, calls Griffiths “the godfather” of private-market quants. Now a small band of his protégés from Landmark is quietly spreading direct alpha further through the industry.

Among them is Ian Charles, managing partner at Arctos Partners, which runs a strategy offering capital solutions to private equity managers. (Arctos has tapped Griffiths as an adviser.) One manager came to Charles with the idea of launching a fund focused on an industry where it had posted stellar returns. “It turns out a lot of firms with pure-play products in that industry have great IRRs,” Charles says. But alpha analysis told a different story. The firm's actual alpha generation—the value it added—was “indistinguishable from zero” after adjusting for fees and broader industry performance, and its strength was actually elsewhere, he says.

Despite recent struggles in private equity, money keeps flowing in, with record levels of committed cash yet to be allocated to investments. There's a growing belief among many large institutional investors that private assets are an essential component of diversified portfolios. Against that backdrop, the added insight from direct alpha is winning over influential fans. Japan's $1.6 trillion Government Pension Investment Fund uses a version of it in combination with more established tools of analysis. Norges Bank Investment Management, which manages the $1.8 trillion Norwegian sovereign wealth fund, used the method as it weighed whether to enter the asset class.

It's unlikely everyone will be as enthusiastic about these new insights in a business where private-fund managers are typically compensated based on absolute performance (this year has seen a big gain in the payouts investment firms made to employees as their asset piles have grown). In a 2021 paper, Griffiths, Turetsky and other co-authors laid out a way to calculate private-market alpha in dollar terms. It would, they wrote, “enable performance compensation to be paid only for outperformance versus a public market benchmark.”

Direct alpha is “certainly not a standard way” of looking at performance, according to Hugh MacArthur, chairman of Bain's private equity practice. He says investors care about two things: the absolute return over time and whether it's repeatable. “People try to torture the data to try and say, ‘Well, the returns aren't really what you think they are,'” MacArthur says. But at the end of the day, “the cash goes in, and whatever cash comes back, I look at it and I measure it and it's more, so what am I going to do? Deny that it's more and not do the rational thing?”

Pretty much every attempt to bring statistical rigor to private markets—where the academic literature is packed with contradictory findings—is destined to be contentious. One common limitation is that every measure is only as good as the assumptions it needs to make. The choice of benchmark makes a huge difference to direct alpha results. A recent study by money management firm Dimensional Fund Advisors found that while an average buyout fund beats the S&P 500 across its lifetime, it actually loses to an index of small-cap value shares—which some might say look more like a typical private equity portfolio.

Private equity rates of return are also vulnerable to a manager's influence, because among other things they can control the timing of cash flows in and out of their funds. This can affect direct alpha calculations, though not as much as with absolute returns. “My group tended to do a lot of sensitivity analysis because we were aware that we were highly uncertain,” Griffiths says.

Big investors may even have an incentive not to look too carefully under the hood of returns. The apparent stability of prices in private markets—like in 2022 when the MSCI World Index of stocks lost 19% and an MSCI gauge of PE funds dropped only about half as much—can be advantageous for investors aiming to show their portfolios carry less risk. But some of the steadiness may be an illusion created by the fact that private assets aren't traded or priced as often as public stocks. Cliff Asness, co-founder of quant asset manager AQR Capital Management, considers this a deliberate ploy he dubs “volatility laundering.”

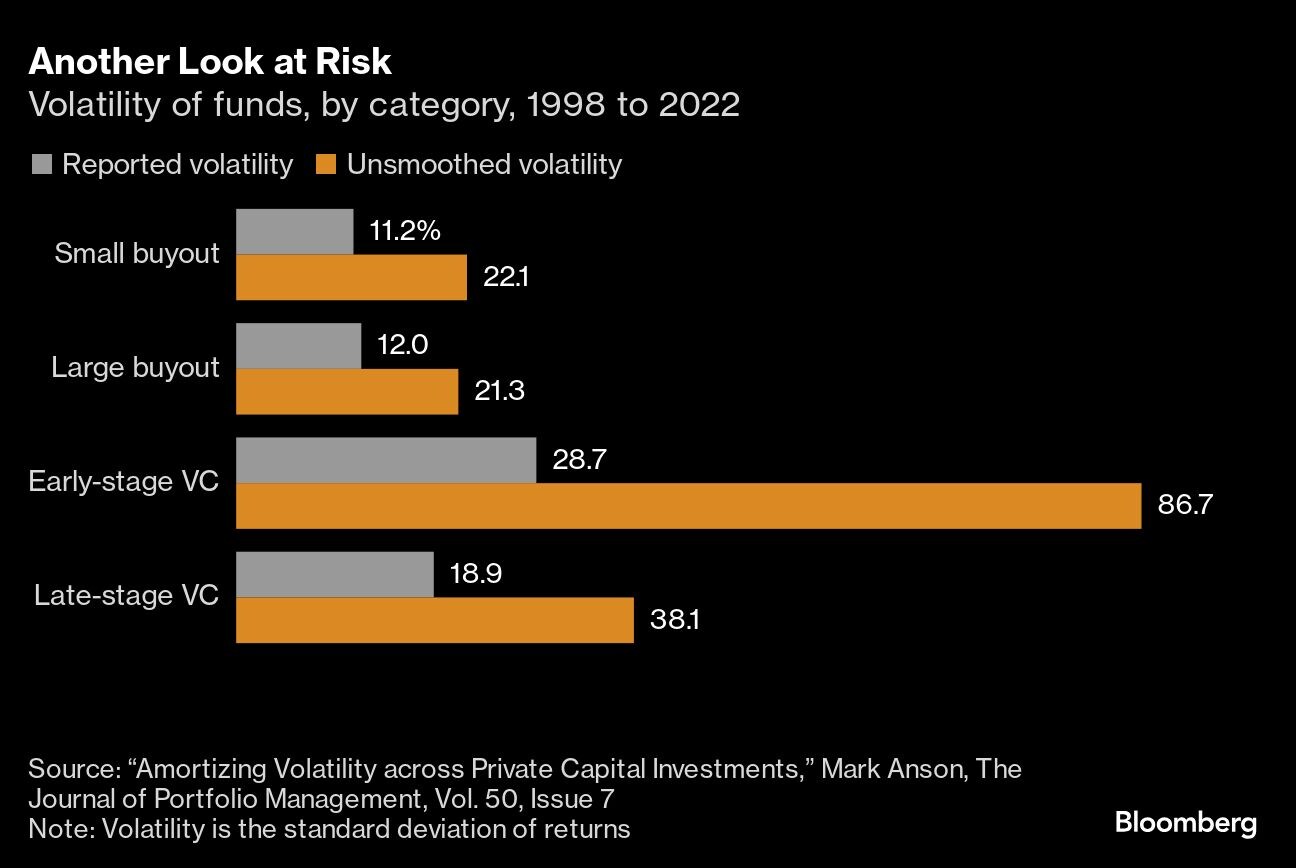

In a study this year, Mark Anson, chief investment officer of the $29 billion Commonfund, which invests money for nonprofits and others, found the volatility of large buyout funds almost doubles to 21%, far higher than the S&P 500, if you account for lags in the reporting of valuations. Traditional private-market reporting methods don't tell you “the true economic story,” he says. For Anson, who previously led the California Public Employees' Retirement System's push into private equity, unsmoothing returns and computing the alpha has allowed Commonfund to have a higher allocation, because it can be more certain of the risks it's taking.

It's a similar story at the $43.4 billion UPS Pension Plan, where Senior Portfolio Manager Alexander Dorf says using direct alpha has boosted the plan's private-asset performance and driven a shift from giant managers to smaller, more specialized ones. He figures these methods are catching on. As it becomes harder to ride rising markets, “you're going to see more of those debates around what is the purpose of PE,” he says. “Is it really just volatility dampening, or are there actual improvements?”

Meanwhile, some of Wall Street's biggest players are developing their own tools for assessing private markets. Asset management giant BlackRock Inc. is buying Preqin, an alternative-assets data provider, for $3.2 billion to help it index private markets. “There is a large gap in private-asset transparency relative to the public markets,” BlackRock Chief Operating Officer Rob Goldstein told analysts after announcing the deal. “If you can't properly analyze an investment, you don't understand it.”

Still, the road to fully explaining private-asset performance is likely to be long. The earliest stock market quants laid the academic foundations for alpha in equities in the 1960s, but index funds only really took off after the global financial crisis. “I would love to see more of the information getting into the hands of practitioners, and I think it's starting to,” Griffiths says. “It's just slow. Everything in private equity moves slowly, right?”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.