Waaree Energies Ltd.'s share price fell over 6% on Tuesday despite positive results for the second quarter as the company's topline remained flat. The solar module manufacturer's revenue for the second quarter rose 1% on the year to Rs 3,754.38 crore from Rs 3,537.3 crore.

Meanwhile, Waaree Energies' consolidated net profit rose 17% on the year to Rs 375.66 crore for the second quarter ended in September. The net profit rose because the company deferred tax payment, which pulled down the total tax payable.

Waaree Energies' board has approved investment of Rs 600 crore to establish infrastructure to manufacture renewable power projects and bidding pipeline.

Waaree Energies focuses on Ebitda margins, which has been either stable or growing. Last year, on an average, margis was 13%, and this quarter and overall in first half so far, the Ebitda margin is about 15%, Chief Financial Officer Sonal Shrivastava said.

The focus is how Waaree Energies manages the cost to maintain the margin. "In this quarter as well, margin has come around 14%, which is quite robust," Shrivastava said.

In the coming quarter, Waaree Energies' US factories will go on stream. The company will be ramping up more capacities. "All in all, we do see a little coming in this quarter (October–December). But, we will watch that closely," Shrivastava said.

Waaree Energies Q2FY25 Highlights (Consolidated, YoY)

Revenue up 1% at Rs 3,754.38 crore versus Rs 3,537.3 crore.

Ebitda up 1.5% at Rs 524.85 crore versus Rs 517.26 crore.

Margin at 14.7% versus 14.6%.

Net profit up 17% at Rs 375.66 crore compared to Rs 320.12 crore.

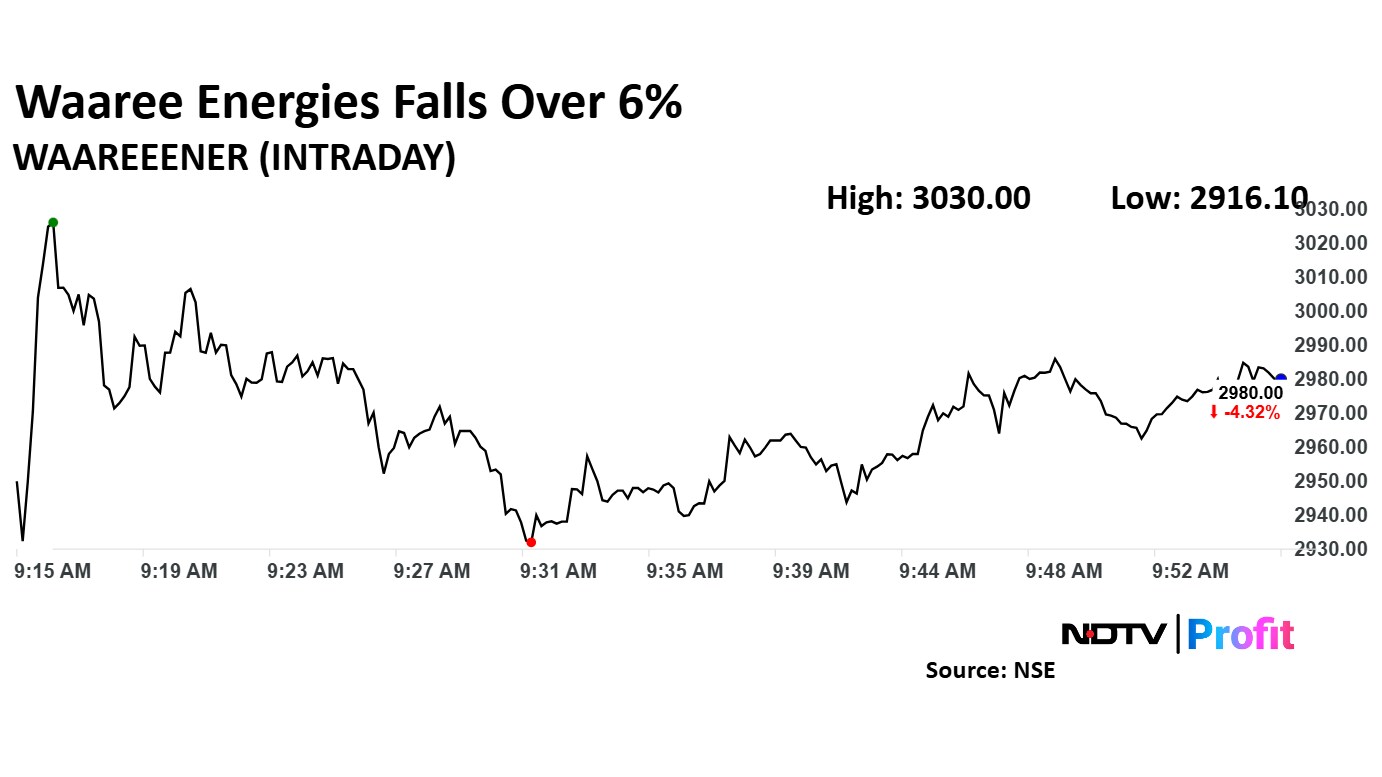

Waaree Energies share price declined 4.32% to Rs 2,980.00 apiece.

Waaree Energies Ltd. share price declined as much as 6.42% to Rs 2,914.60 apiece, the lowest level since Nov 14. It pared losses to trade 4.42% down at Rs 2,976.85 as of 09:50 a.m. as compared to 0.94% advance in the NSE Nifty 50 index.

The stock rose 98.06% since its listing on the bourses. Total traded volume so far in the day stood at 0.8 times its 30-day average. The relative strength index was at 71.88, which implied the stock is overbought.

Waaree Energies Ltd. debuted on the BSE and the NSE at a premium of 69.66% and 66.3%, respectively, on Oct 28.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.