Voltas Ltd. shares surged to a record high during early trade on Monday after its profit more than doubled in the first quarter of financial year 2024-25. The household appliances-maker saw its bottom-line grow as demand for cooling products during the scorching summer months in India sparked a boom in sales.

The company reported a 160% rise in consolidated net profit to Rs 335 crore in the April-June quarter, compared to Rs 129 crore in the same period last year, according to an exchange filing on Monday.

Revenue from operations increased by 46.5% to Rs 4,921 crore during the quarter under review. Expenses rose from Rs 3,196 to Rs 4,520 crore, led by jump in inventory and material costs. Inventory cost surged from Rs 49.7 crore to Rs 517.8 crore.

Operating profit, or earnings before interest, tax, depreciation and amortisation, advanced 129% to Rs 424 crore, compared to Rs 185 crore last year. Operating margin expanded to 8.6% from 5.5%.

Segment Performance

The unitary cooling products business saw overall volume grew by 67%, while income increased by 51% to Rs 3,802 crore. India witnessed heatwaves during the peak summer months of April, May and June.

Electro-mechanical projects and services, which comprises both domestic and international projects businesses, reported a revenue growth of 40% at Rs 949 crore.

Income from engineering products and services for the quarter was higher at Rs 161 crore, as compared to Rs 142 crore in the corresponding quarter last year.

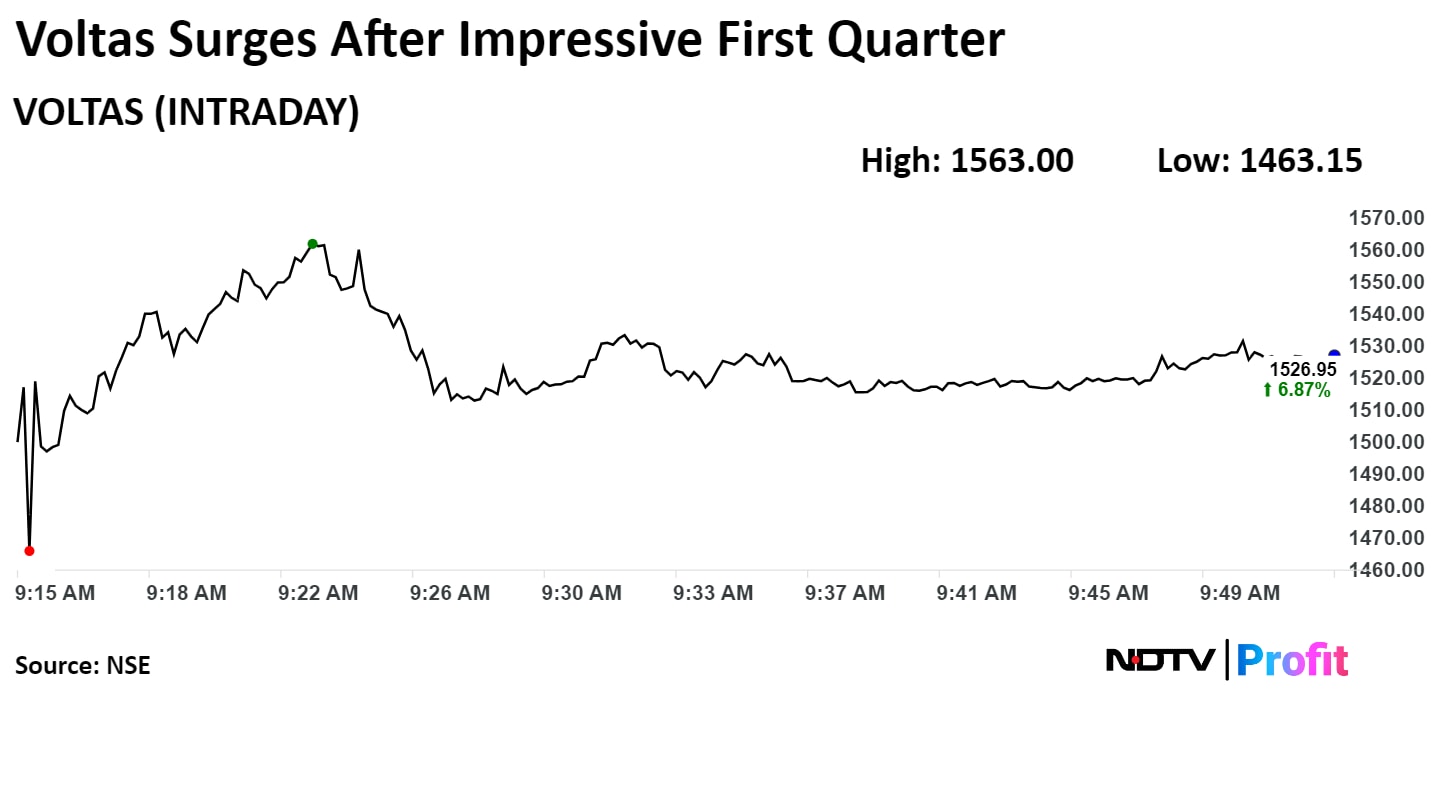

Shares of Voltas advanced 9.7% to an all time high of Rs 1,566.9 apiece, following the quarterly results, before cooling off to 1,553.65, or 8.7% higher, by 11:45 a.m. The benchmark NSE Nifty 50 was trading 0.26% higher.

The stock has risen 89% in the last 12 months and 57% on a year-to-date basis. The total traded volume so far in the day stood at 3.8 times its 30-day average. The relative strength index was at 61.

Seventeen out of the 40 analysts tracking Voltas have a 'buy' rating on the stock, 13 recommend a 'hold' and 10 suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 4.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.