Vodafone Idea Ltd. share price fell more than 9% to over one-year low on Monday. The stock dipped after a media report surfaced indicating that the Department of Telecommunications has issued a notice regarding the company's failure to provide necessary bank guarantees for past spectrum auction dues.

The notice, as reported by the Economic Times, highlights concerns over the telecom operator's compliance with regulatory financial requirements.

The DoT's action stems from Vodafone Idea's inability to submit the required bank guarantees on time for spectrum dues arising from auctions conducted prior to 2022. These guarantees are crucial for securing the funds needed to cover the company's outstanding obligations from these auctions, as per the ET report.

Vodafone Idea's moratorium on spectrum auction dues will expire in September 2025. This places additional pressure on the company to arrange for bank guarantees well in advance, as they must be submitted in phases for various auctions.

NSE has sought a clarification from Vodafone Idea following the report and subsequent drop in share price.

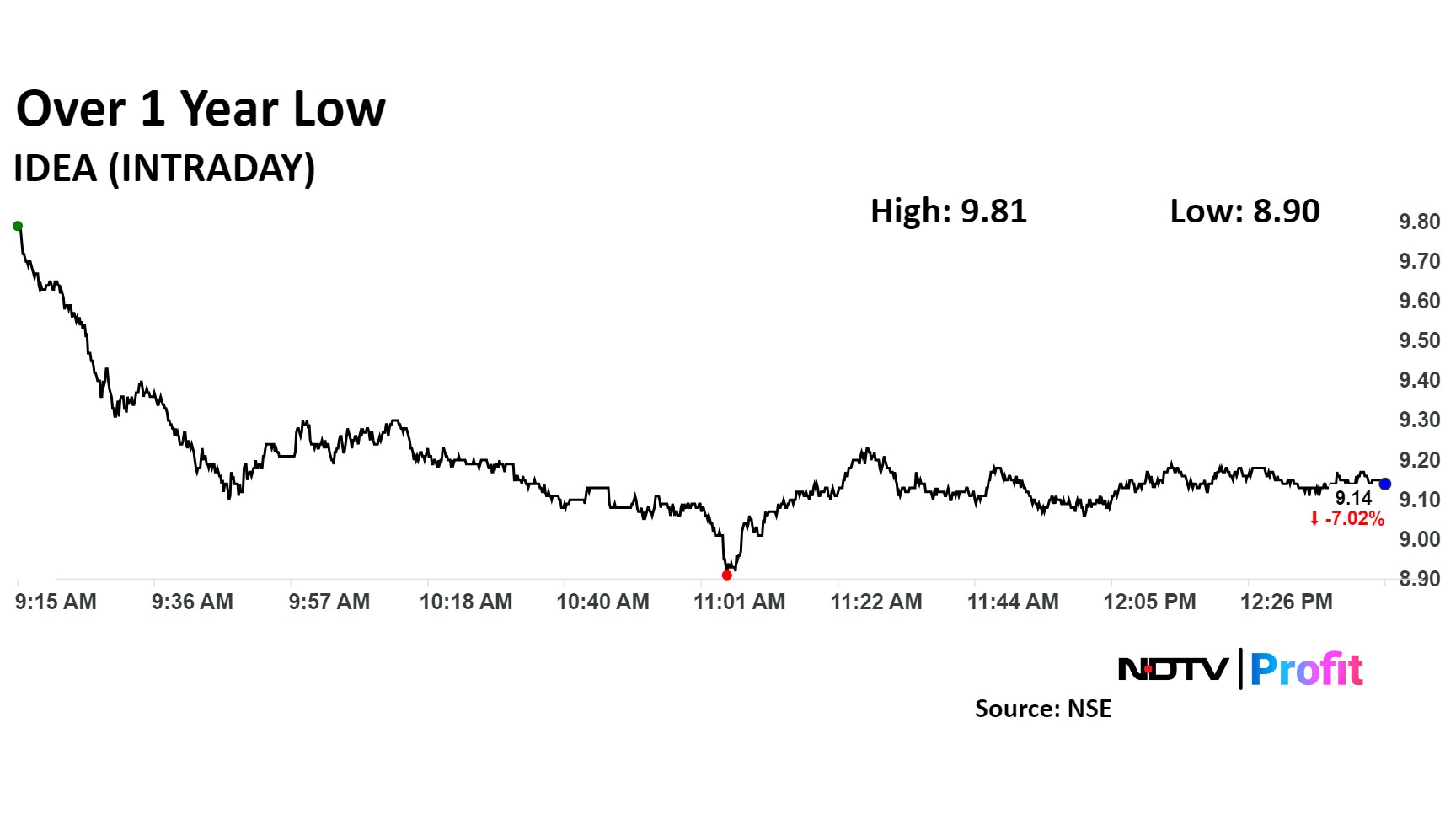

Shares of Vodafone Idea fell as much as 9.09% to Rs 8.09 apiece, a level last seen on Aug. 30 in 2023. It pared losses to trade 6.64% lower at Rs 9.14 apiece as of 12:41 p.m. This compares to a 0.53% decline in the NSE Nifty 50 Index.

The stock has fallen 16.15 % in the last 12 months. Total traded volume so far in the day stood at 1.3 times its 30-day average. The relative strength index was at 19.

Out of 22 analysts tracking the company, four maintain a 'buy' rating, three recommend a 'hold,' and 15 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 22.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.