Vodafone Idea Ltd.'s share price jumped over 18% as the government waived bank guarantee obligation for the spectrums acquired before 2022, which is expected to give relief to the company.

Cabinet has decided to waive off bank guarantee for telecom companies for deferred spectrum payments from 2012 onwards, government sources told NDTV Profit.

The relief will be extended to old spectrum holdings. Department of Telecommunications had proposed such a waiver to reduce financial strain on the telecom sector.

Vodafone Idea is expected to be the most benefitted among other industry players as it owes Rs 24,700 crore on bank guarantees, reports said.

Moneycontrol reported that Vodafone Idea has failed to pay its second bank guarantee approximately of Rs 350 crore, which was due on Nov 1, for spectrum acquired in 2012. The struggling telecom player has deferred payment of Rs 4,600 crore for a deal linked in 2016.

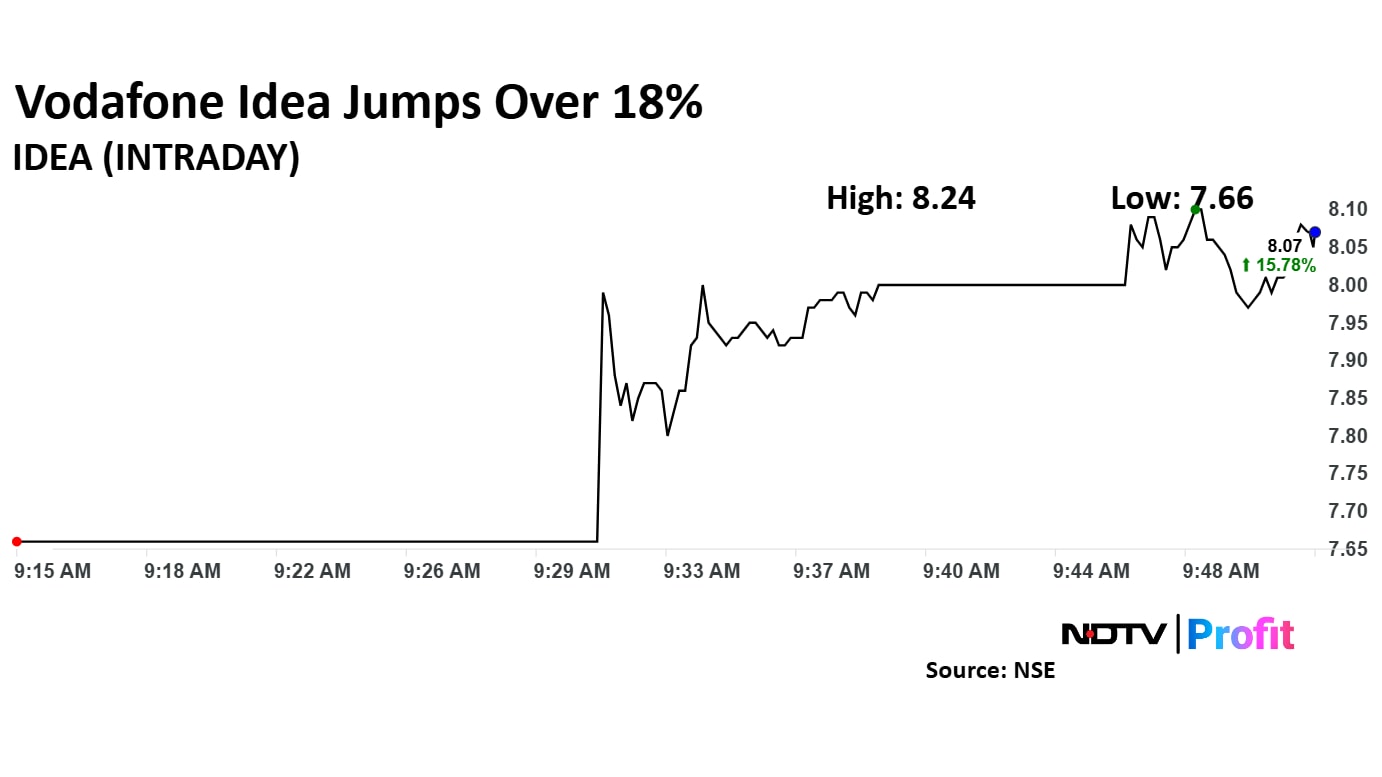

Vodafone Idea share price jumped 18.22% to Rs 8.24 apiece, the highest level since Nov 7. The stock hit the upper circuit shortly after opening. It pared gains to trade 15.35% higher at Rs. 8.06 apiece as of 09:48 a.m., as compared to 0.15% advance in the NSE Nifty 50 index.

Vodafone Idea extended gains to a second day. The stock declined 39.17% in 12 months, and 49.69% on a year to date basis. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 49.46.

Out of 22 analysts tracking the company, four maintain a 'buy' rating, five recommend a 'hold,' and 13 suggest 'sell', according to Bloomberg data.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.