Shares of Vodafone Idea Ltd. hit a 1.5-year low on Thursday after Goldman Sachs reduced its revenue and Ebitda forecasts for the telecom operator by up to 5% and 13%, respectively, citing ongoing subscriber losses and weak operational performance.

The brokerage also revised its 12-month DCF target price for the company to Rs 2.4 from Rs 2.5, indicating a 67.3% downside.

Maintaining a 'sell' rating, Goldman Sachs noted that Vodafone Idea's balance sheet remains under pressure, despite the possibility of the government converting its dues into equity.

The firm highlighted that the telecom operator would need to increase its Average Revenue Per User by 160%, or Rs 280, to maintain positive free cash flow, a significant challenge given that the company only saw a 5.6% sequential ARPU increase in the July–September quarter, far short of the required growth.

On Thursday morning, Vodafone Idea saw a large trade with 6.06 crore shares exchanged in a bulk deal, with prices ranging from Rs 6.87 to Rs 7.17.

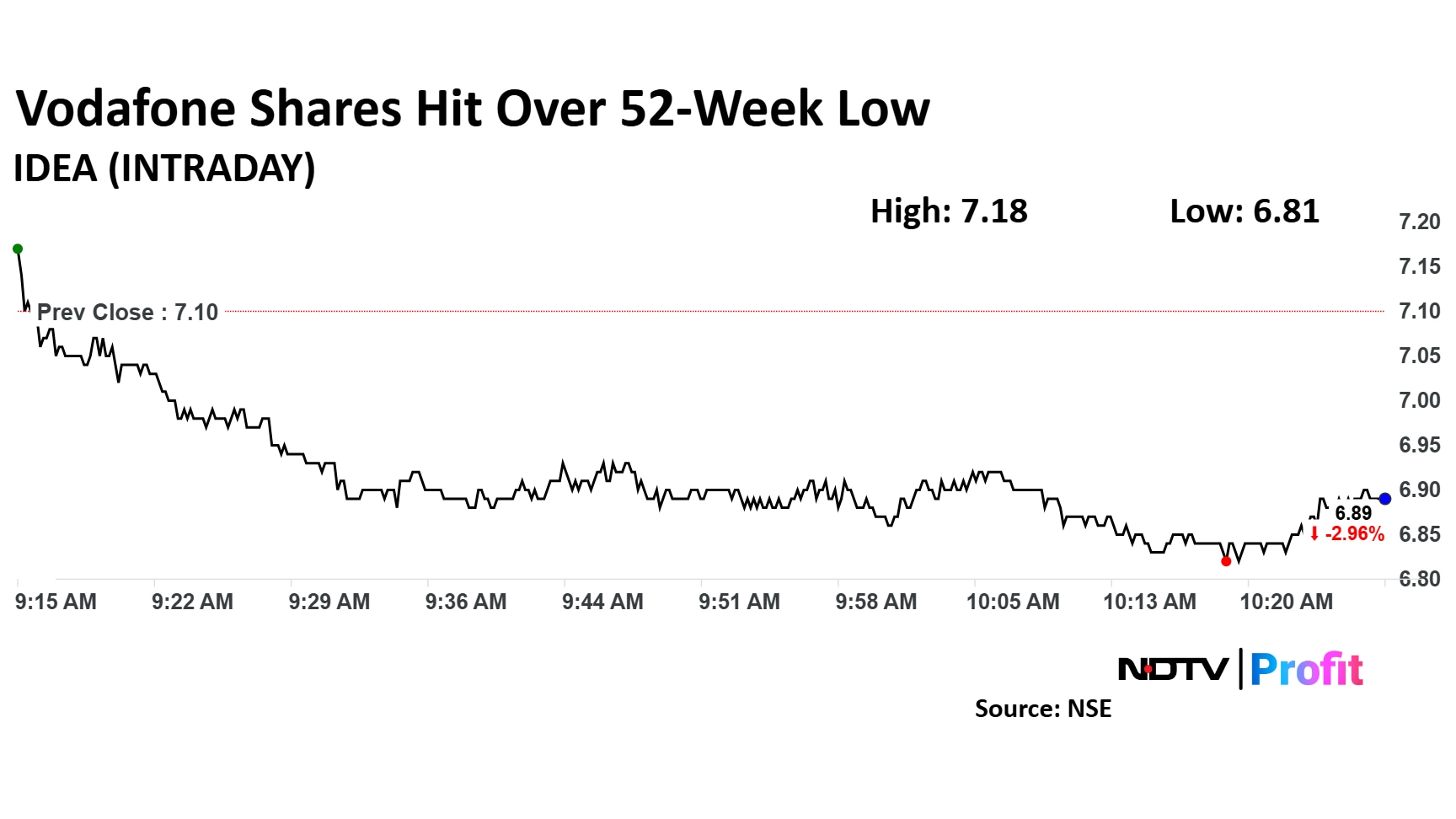

Vodafone Idea Share Price Today

Vodafone Idea share price fell as much as 4.08% to Rs 6.81 apiece, its lowest level since May 11, 2023. It pared losses to trade 3.52% lower at Rs 6.85 apiece, as of 10:23 a.m. This compares to a 0.84% decline in the NSE Nifty 50 Index.

It has fallen 56.94% on a year-to-date basis. Total traded volume so far in the day stood at 0.47 times its 30-day average. The relative strength index was at 26.02.

Out of 22 analysts tracking the company, four maintain a 'buy' rating, four recommend a 'hold,' and 14 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 24.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.