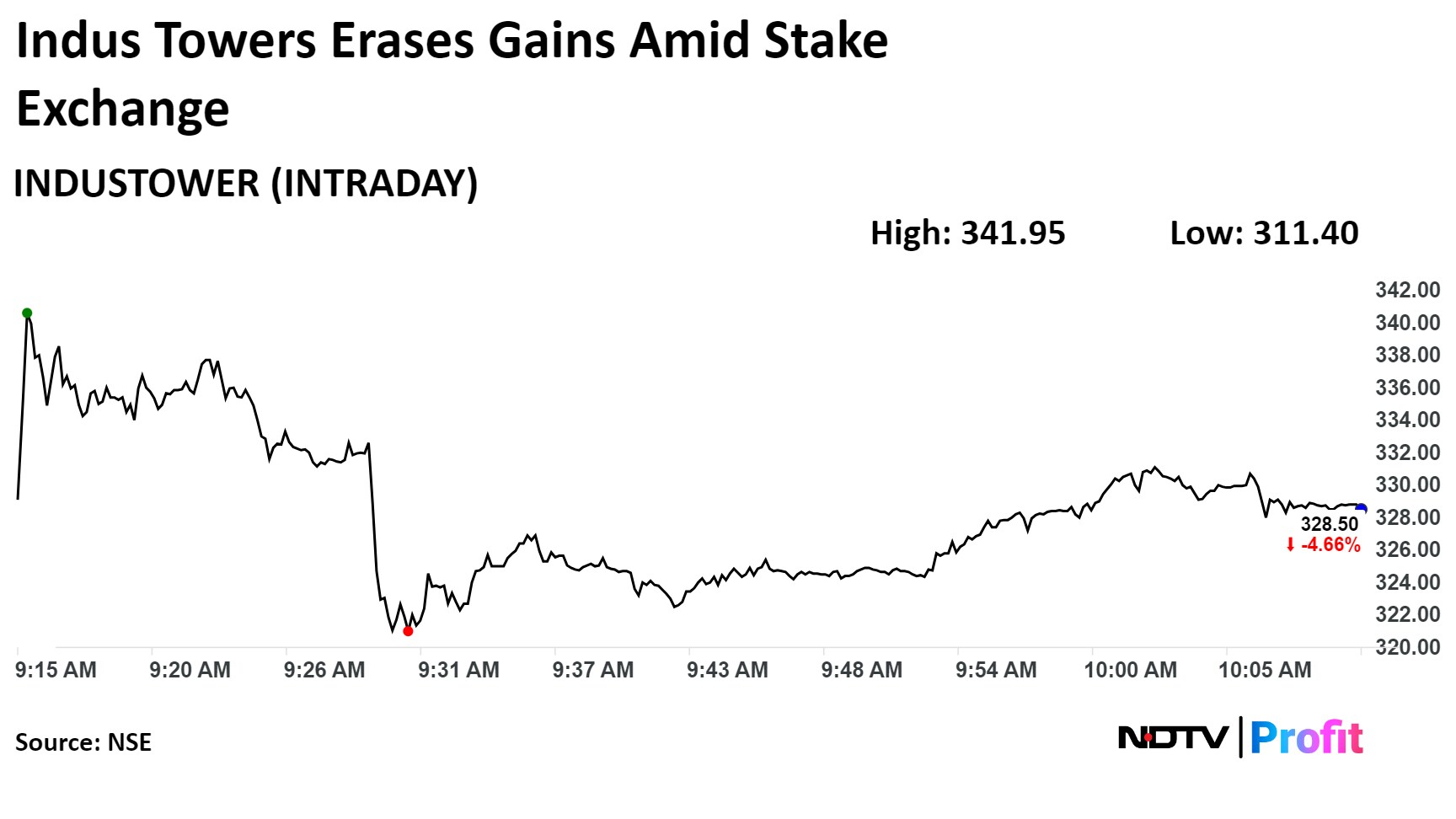

Shares of Indus Towers Ltd. tumbled nearly 10% on Wednesday after 19.15% stake in the company changed hands in multiple trades.

At least 51.6 crore shares of Indus Towers changed hands in 17 transactions as of 9:45 a.m. on Wednesday, according to Bloomberg. Buyers were not immediately known.

Bharti Airtel Ltd. acquired 2.69 crore shares worth 1% equity via an on-market transaction and increased its stake to 48.95%, an exchange filing said. It currently holds the largest stake in the company. Indus Towers has stopped dividend payouts since May 2022, but they are likely to resume after this cash flow. This move could benefit Bharti Airtel.

The cap on Vodafone Idea Ltd.'s dues to Indus Towers is Rs 6,500 crore. The stake sale, pledged against bank borrowings capped at Rs 4,500 crore, could potentially be settled post-sale. Rs 3,775 crore might be infused into the business, according to UBS.

Earlier, the Vodafone Group had increased its divestment of its stake in the telecom tower operator to 17.98%. The company was set to offload 48.47 crore shares, estimated to be worth Rs 16,528.3 crore, according to a fresh term sheet reviewed by Bloomberg. The shares were priced between Rs 310 and Rs 341 per share.

This revised plan came after the initial announcement where Vodafone intended to divest a 9.94% stake, equating to 26.8 crore shares valued at Rs 9,138.8 crore. The substantial increase in the share sale indicates a broader strategy by Vodafone to monetise its assets in Indus Towers.

The sellers include a consortium of entities such as Euro Pacific Securities Ltd., CCII (Mauritius) Ltd., Asian Telecommunication Investments (Mauritius) Ltd., Trans Crystal Ltd., Mobilvest, Prime Metals Ltd., Vodafone Telecommunications (India) Ltd., and AI-Amin Investments Ltd.

Vodafone Group currently holds a 21.05% stake in Indus Towers. While Bharti Airtel remained the largest shareholder with a 47.95% stake as of March 2024, This has now increased even further.

Morgan Stanley and BofA Securities Ltd. are the executive placement agents appointed to manage the sale, ensuring a smooth transaction process.

Shares of the company fell as much as 9.62%, the lowest level since April 4, before paring loss to trade 4.27% lower at Rs 328.95 apiece, as of 10:15 a.m. This compares to a 0.08% advance in the NSE Nifty 50.

The stock has risen 65.26% year-to-date and 164.70% in the last 12 months, according to NSE data. Total traded volume so far in the day stood at 41.18 times its 30-day average. The relative strength index was at 44.65.

Out of 20 analysts tracking the company, eight maintain a 'buy' rating, seven recommend a 'hold,' and five suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.